|

Forex Forums | ForexLasers.com |

|

|||||||

|

|

|

LinkBack | Thread Tools | Search this Thread |

|

#1161

|

|||

|

|||

|

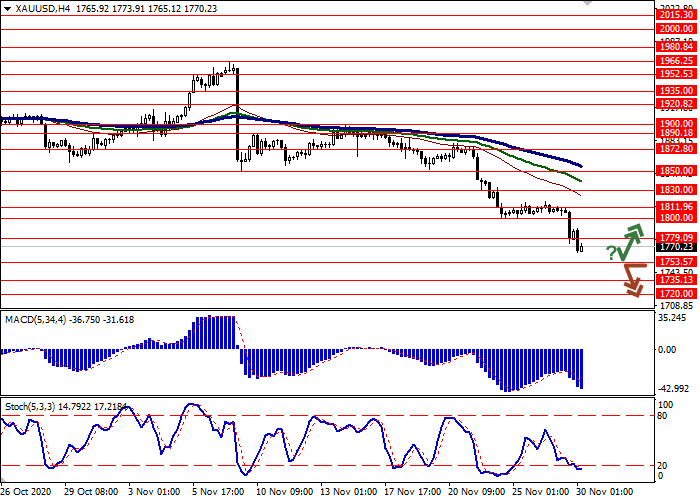

XAU/USD: five-month lows updated

Current trend Gold prices are showing a steady decline in today's trading, renewing their lows since July 2. The instrument got an opportunity to consolidate below the psychological level of 1800.00, responding to the growing positive sentiment regarding political and economic changes in the USA with the arrival of the Joe Biden administration. Pressure on safe gold is also coming from the growing prospect of tackling COVID-19 through the launch of a massive vaccination campaign, although it will certainly take a long time given the amount of vaccine needed and the rush to develop it. In turn, some support for gold is provided by the possible prospects for another easing of monetary policy by the world's leading regulators in December, especially from the Fed and the ECB. Support and resistance Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is expanding from below; however, it fails to catch the development of "bearish" trend at the moment. MACD is actively going down preserving a stable sell signal (located below the signal line). Stochastic, having reached its lows, reversed into the horizontal plane, indicating growing risks of corrective growth in the short and/or ultra-short term. To open new positions, it is necessary to wait for the trade signals to become clear. Existing short positions should be kept in the short term. Resistance levels: 1779.09, 1800.00, 1811.96, 1830.00. Support levels: 1753.57, 1735.13, 1720.00, 1700.00.

|

|

#1162

|

|||

|

|||

|

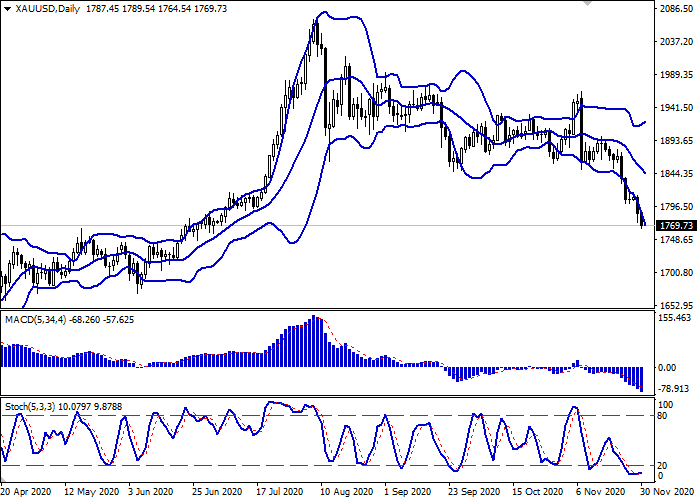

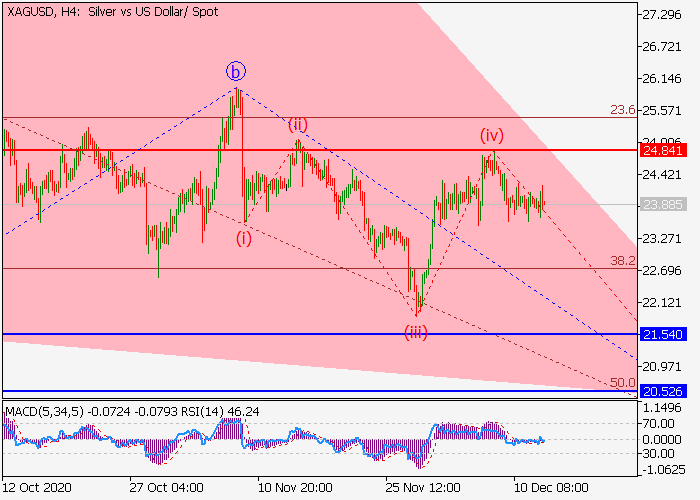

XAG/USD: wave analysis

The pair may fall. On the daily chart, the first wave of the higher level 1 of (3) formed, and a downward correction develops as the wave 2 of (3). Now, the wave a of 2 has formed, the wave b of 2 has developed, and of the wave c of 2 is forming. If the assumption is correct, the price will fall to the levels of 20.5218.28. In this scenario, critical stop loss level is 25.05.

|

|

#1163

|

|||

|

|||

|

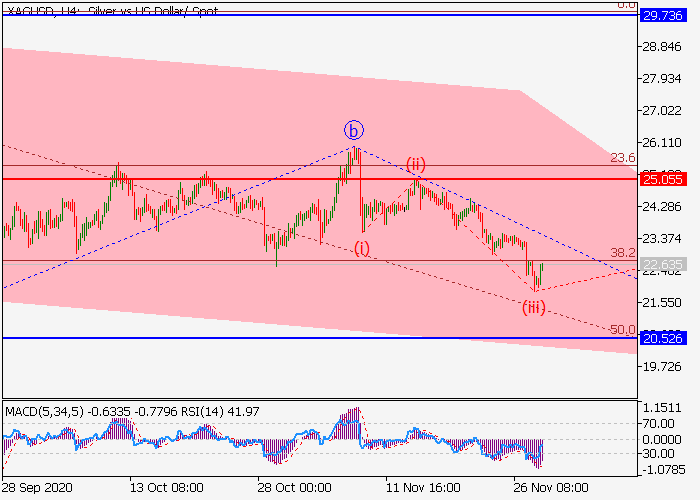

USD/CAD: USD remains under pressure

Current trend USD shows multidirectional trading against CAD in today's Asian session, slightly correcting after an active decline the day before, which returned the instrument to the area of local lows since October 2018. USD is under pressure from the worsening epidemiological situation, as well as not the most confident macroeconomic statistics on business activity in the US manufacturing sector. The reduction of the instrument the day before was also facilitated by the speech of the Fed Chair Jerome Powell in the Congress. Powell warned that the country will face several "difficult" months ahead, since it is not yet possible to count on a quick solution to the coronavirus issue, and the economy already needs additional support. In turn, Canadian data managed to support the market. Canada's annualized GDP in Q3 2020 grew by an impressive 40.5% QoQ after falling by 38.1% QoQ last month. However, the market forecasts assumed that the Canadian economy will grow by 47.6% QoQ. Markit Manufacturing PMI in Canada in November rose from 55.5 to 55.8 points, in line with the forecasts. Support and resistance Bollinger Bands in D1 chart demonstrate a moderate decrease. The price range is slightly widening from below but does not conform to the development of the "bearish" trend yet. MACD is going down preserving a moderate sell signal (located below the signal line). Stochastic, on the other hand, maintains a timid uptrend, signaling that USD is oversold in the ultra-short term. Resistance levels: 1.2950, 1.3000, 1.3050, 1.3100. Support levels: 1.2900, 1.2850, 1.2800.

|

|

#1164

|

|||

|

|||

|

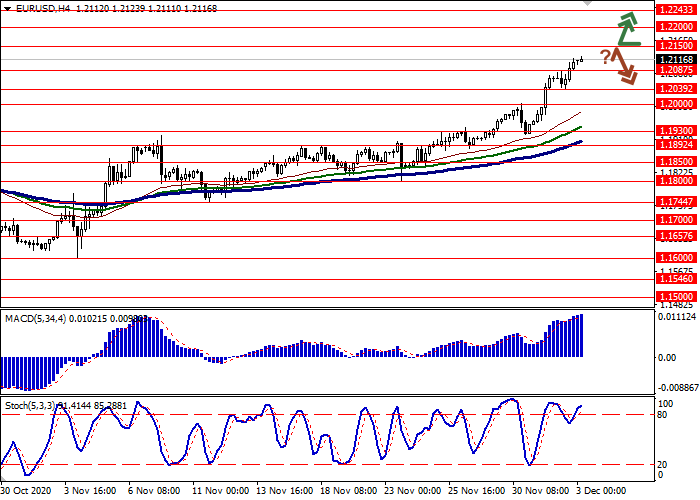

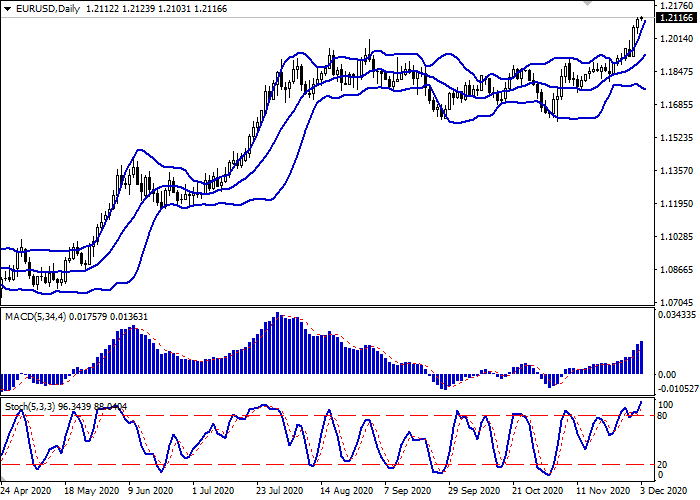

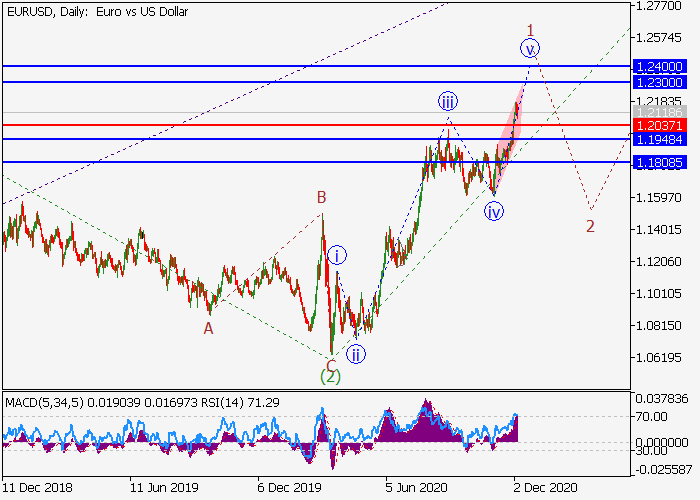

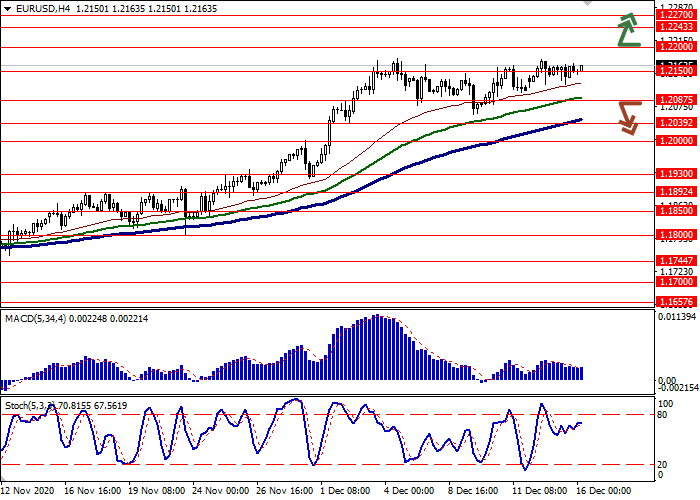

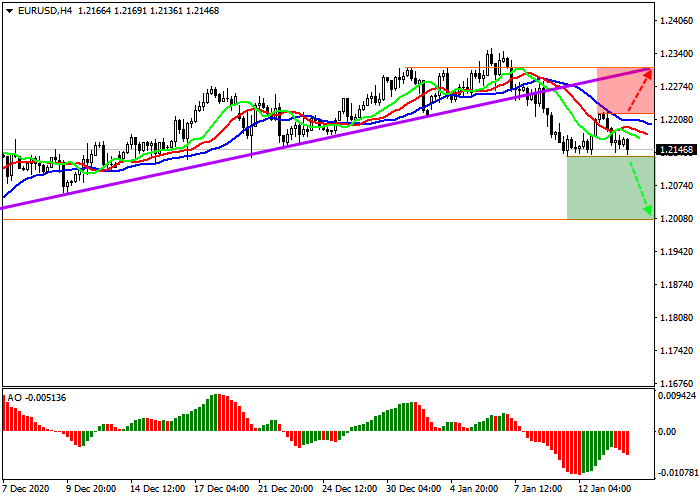

EUR/USD: updating record highs

Current trend EUR is trading ambiguously against USD during today's Asian session, consolidating near 1.2120 and all-time highs since April 2018. EUR maintains its "bullish" momentum, receiving support from a weak USD; however, technical factors and the coming weekend provoke traders to close some of their long positions. Macroeconomic statistics from Europe published yesterday turned out to be moderately optimistic. Investors were most pleased with data from Germany, which reflected a 2.6% MoM growth in October retail sales after a 2.2% MoM decline in the previous month. Analysts had expected growth of 1.2% MoM. In annual terms, sales added 8.2% YoY, which also turned out to be noticeably better than market forecasts at +5.9% YoY. Today, investors are focused on business activity statistics in the euro area for November. Support and resistance Bollinger Bands in D1 chart show stable growth. The price range is expanding; however, it fails to catch the development of "bullish" trend at the moment. MACD indicator is growing keeping a strong buy signal (located above the signal line). Stochastic retains its upward direction but is located near its highs, which indicates risks of overbought EUR in the ultra-short term. Technical indicators do not contradict the further development of the uptrend. Resistance levels: 1.2150, 1.2200, 1.2243. Support levels: 1.2087, 1.2039, 1.2000, 1.1930.

|

|

#1165

|

|||

|

|||

|

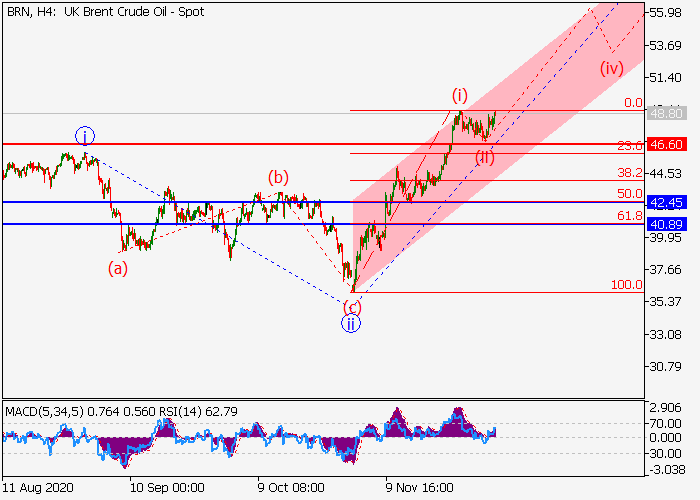

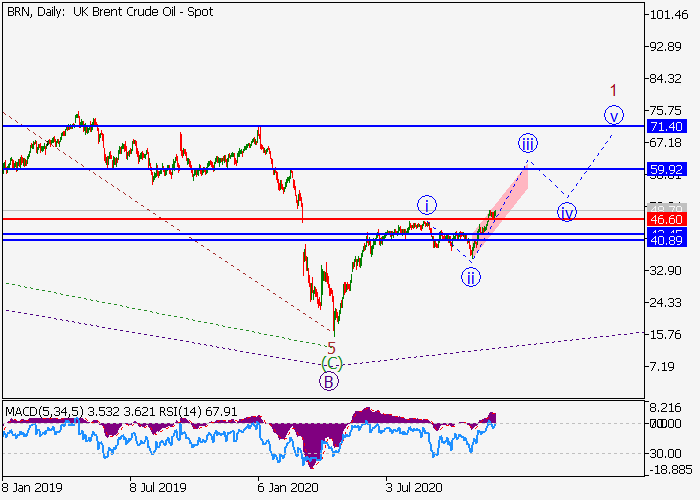

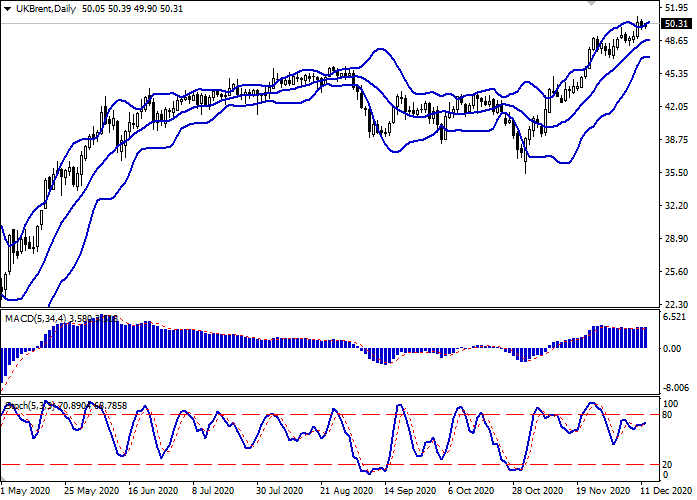

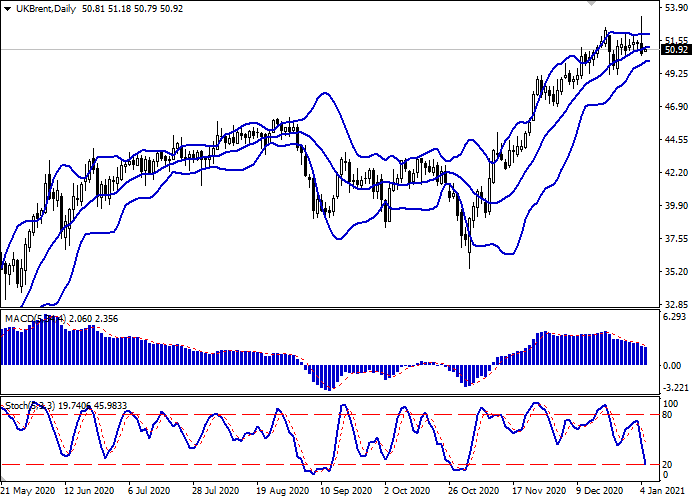

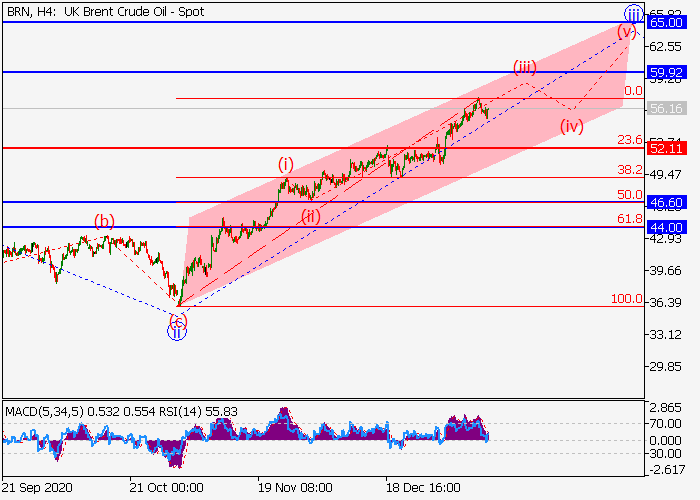

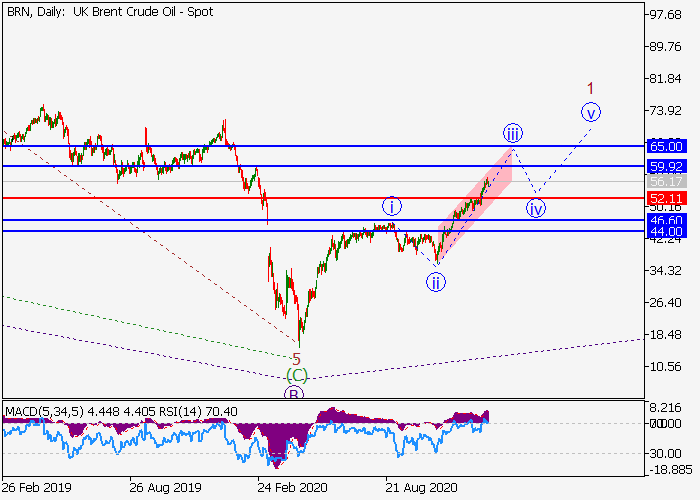

Brent Crude Oil: wave analysis

The price may grow. On the daily chart, a downward correction of the higher level developed as the wave B, and the formation of the upward wave C started, within which the first wave 1 of (1) of C develops. Now, the third wave of the lower level iii of 1 is forming, within which the wave (ii) of iii has ended. If the assumption is correct, the price will grow to the levels of 59.9271.40. In this scenario, critical stop loss level is 46.60.

|

|

#1166

|

|||

|

|||

|

Morning Market Review

EUR/USD EUR shows flat dynamics of trading against USD during today's Asian session, consolidating after an active decline of the instrument last Friday. EUR ended the session on December 4 in the red, responding to technical factors, while USD remained under pressure after the publication of weak data on employment in the country. The November labor market report reflected an increase in Nonfarm Payrolls by only 245K after an increase of 610K in October. Investors expected a slowdown in the dynamics of the indicator, but hoped for 469K new jobs. At the same time, the Unemployment Rate fell from 6.9% to 6.7%, and Average Hourly Earnings in November increased from +0.1% MoM to +0.3% MoM, which also turned out to be better than the neutral market forecasts. Today, traders expect publication of data on industrial production in Germany for October. Interesting statistics from the US will appear only on Thursday, and before that investors will actively discuss the prospects for further easing of monetary policy from the Fed in the light of the published report on the US labor market. GBP/USD GBP is showing ambiguous trading dynamics against USD in today's Asian session, consolidating near 1.3400. The instrument managed to update record highs since May 2018 last week; however, GBP failed to consolidate at new levels, since the technical factors of the correction were very strong. The trading of the new week starts quite carefully. Some support for GBP is provided by weak data from the US, which appeared at the end of last week, but there are still few fundamental growth factors. It became known on Saturday that the UK and the EU again failed to agree on a trade agreement within the framework of the Brexit transition period, and therefore the negotiators will continue joint meetings this week. Meanwhile, British Prime Minister Boris Johnson and the European Commission President Ursula von der Leyen announced significant progress in the negotiations; however, the market got used to these statements. NZD/USD NZD is trading ambiguously against USD in today's Asian session, preparing to test the level of 0.7000 for a breakdown again. The instrument showed an active decline last Friday, retreating from the record highs, updated the day before. The reason for the development of the "bearish" trend were technical factors, while the long-awaited report on the US labor market, released last Friday, disappointed investors with a slowdown in the growth of Nonfarm Payrolls (+245K against +610K in October). The Chinese statistics provide moderate support to the instrument today. China's Exports in November showed an impressive 21.1% YoY growth after rising only by 11.4% YoY in October. Forecasts suggested an increase of 12% YoY only. Imports over the same period, on the contrary, slowed down from +4.7% YoY to +4.5% YoY, which led to a noticeable increase in the trade surplus from USD 58.44B to 75.42B, which is significantly ahead of forecasts investors at USD 53.5B. USD/JPY USD is trading with a downtrend against JPY during today's Asian session, leveling the growth of the instrument last Friday, when the "bulls" still managed to recover, despite the publication of not very successful macroeconomic statistics from the US. At the beginning of the week, investors are returning to strategies that are still characterized by high demand for "safe" assets, given the tense epidemiological situation in the world. Japanese investors expect the publication of statistics from Japan tomorrow. Among other things, traders will be interested in the updated data on the dynamics of Japan's GDP for Q3 2020. In addition, Japan will release the dynamics of changes in Labor Cash Earnings and Household Spending for October. XAU/USD Gold prices are consolidating in today's Asian session, being located near the level of 1840.00 and local highs since November 23, updated at the end of the last trading week. Technical factors contributed to the decline in the instrument last Friday, while fundamentally USD remains under pressure after the publication of an uncertain report on the US labor market for November and in anticipation of new support measures for the American economy. In turn, the optimistic news regarding the development of vaccines against the coronavirus makes traders keep some of the risky positions, and the stock market is kept near record highs. Since December 7, Great Britain is one of the first in the world to begin a large-scale vaccination of the population (starting with risk groups) with a vaccine from Pfizer and BioNTech. |

|

#1167

|

|||

|

|||

|

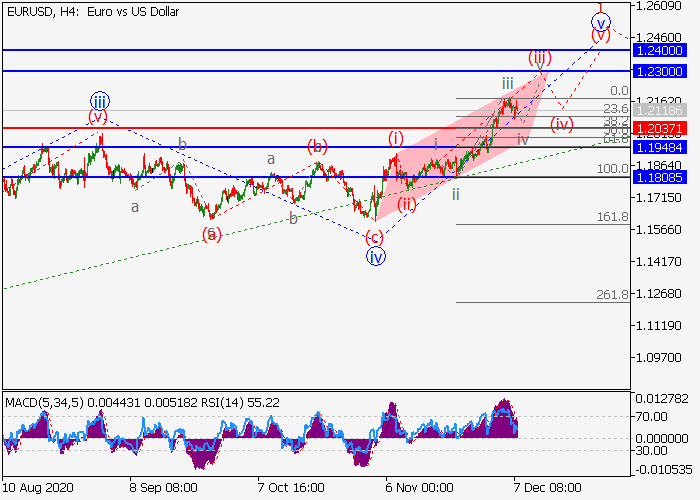

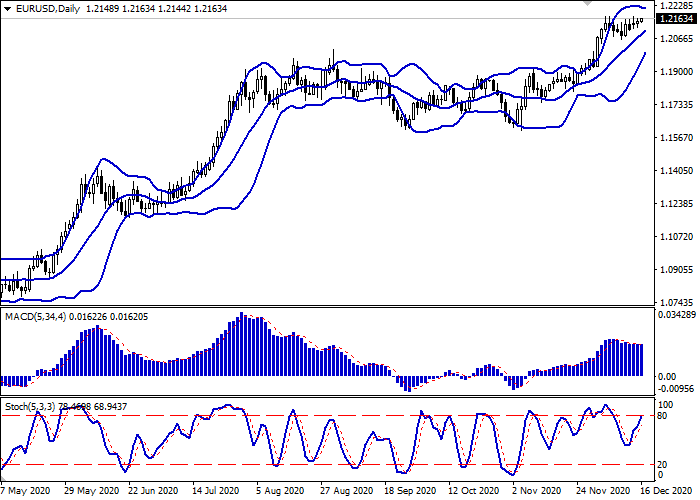

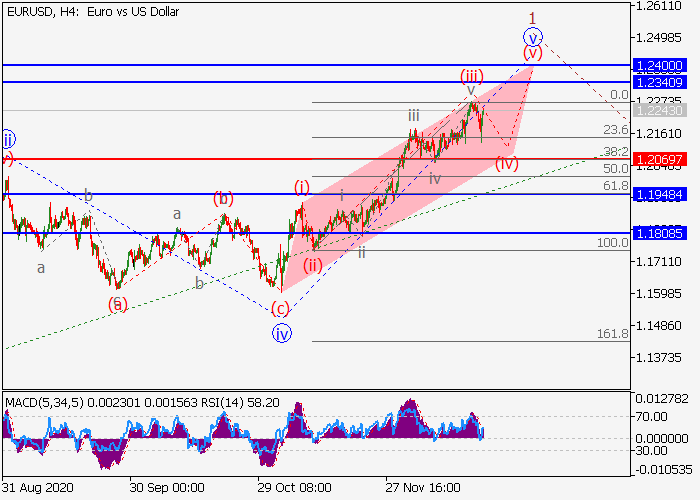

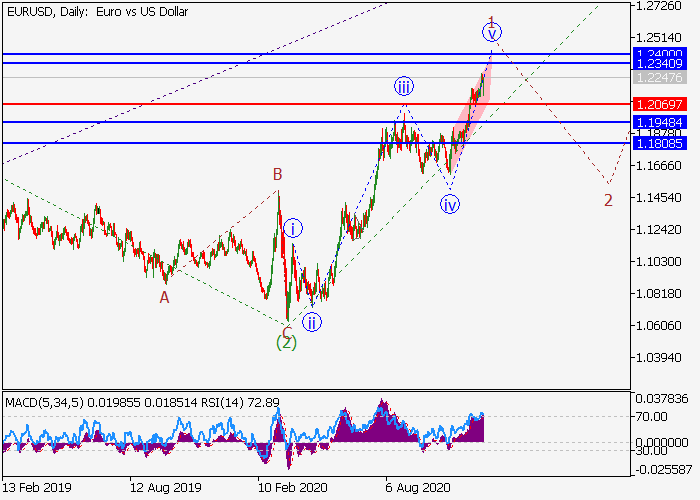

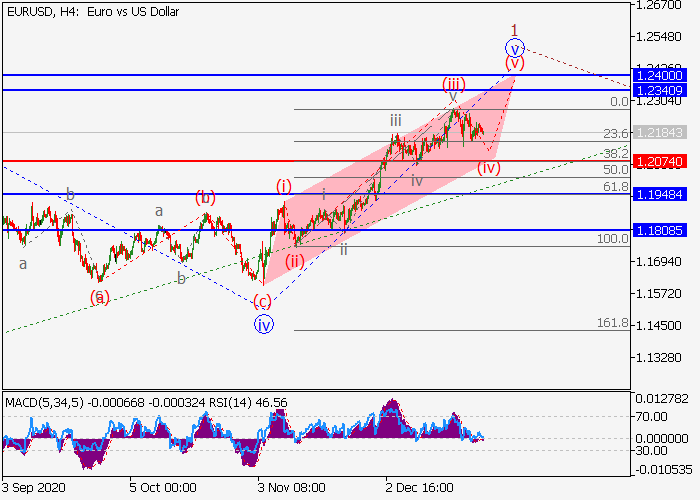

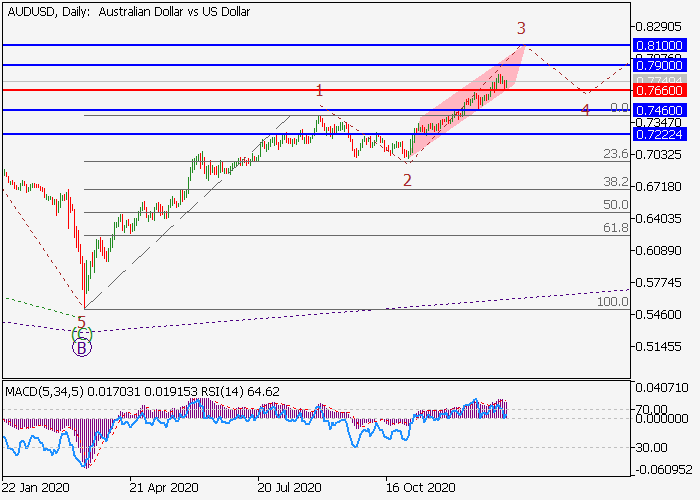

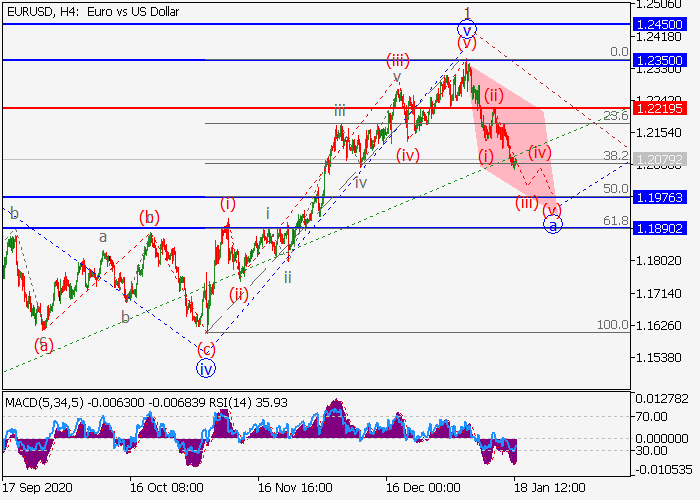

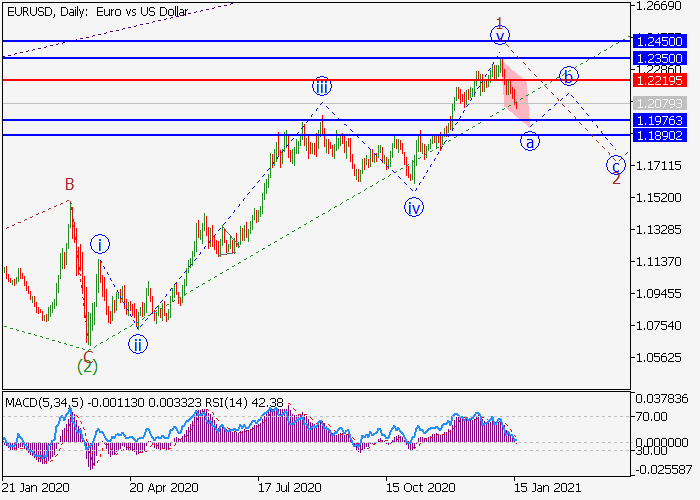

EUR/USD: wave analysis

The pair may grow. On the daily chart, the first wave of the higher level 1 of (3) develops, within which the wave v of 1 forms. Now, the third wave of the lower level (iii) of v is developing, within which the wave iii of (iii) is forming, and the local correction iv of (iii) is ending. If the assumption is correct, the pair will grow to the levels of 1.23001.2400. In this scenario, critical stop loss level is 1.2037.

|

|

#1168

|

|||

|

|||

|

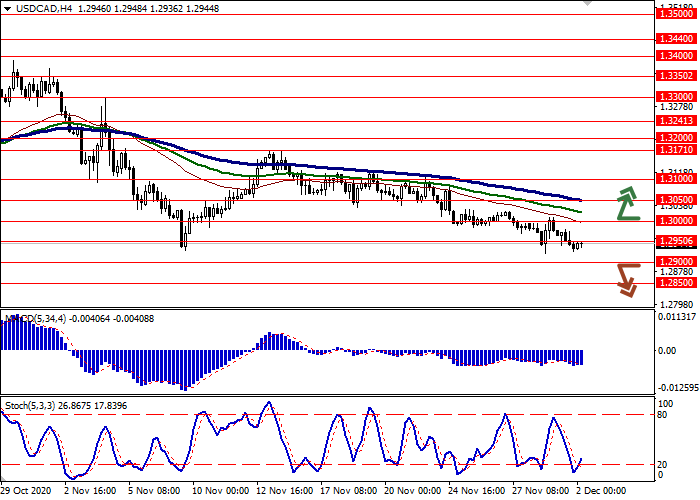

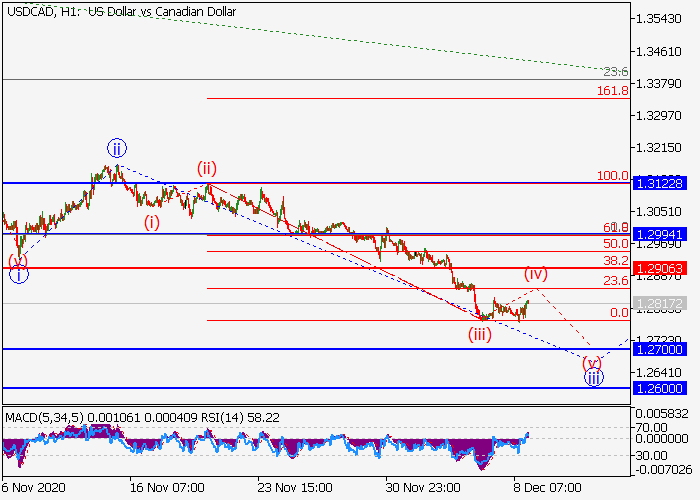

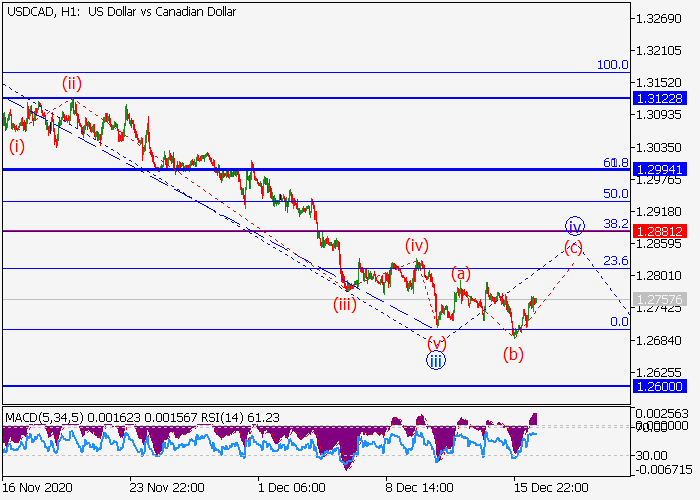

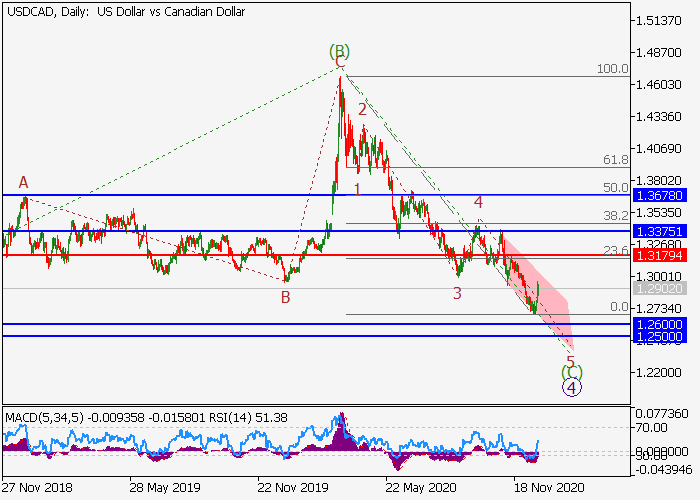

USD/CAD: wave analysis

The pair may fall. On the 4-hour chart, a correction of the higher level developed as the wave (2), and the formation of the downward wave (3) started. Now, the third wave of the lower level iii of 1 is developing, within which the wave (iii) of iii has formed, and the local correction (iv) of iii is developing. If the assumption is correct, after the end of the correction, the pair will fall to the levels of 1.27001.2600. In this scenario, critical stop loss level is 1.2906.

|

|

#1169

|

|||

|

|||

|

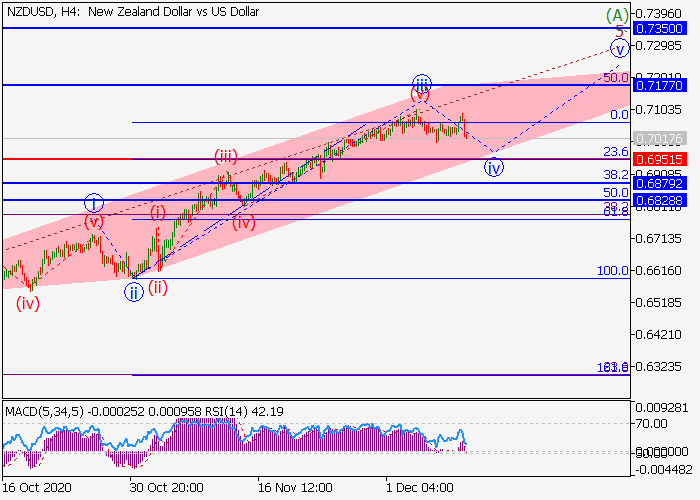

NZD/USD: wave analysis

The pair is in a correction and may grow. On the daily chart, the upward wave (А) of B develops as a momentum, within which the wave 5 of (A) forms. Now, the third wave of the lower level iii of 5 has formed, and a local correction is developing as the fourth wave iv of 5. If the assumption is correct, after the end of the correction, the pair will grow to the levels of 0.71770.7350. In this scenario, critical stop loss level is 0.6951.

|

|

#1170

|

|||

|

|||

|

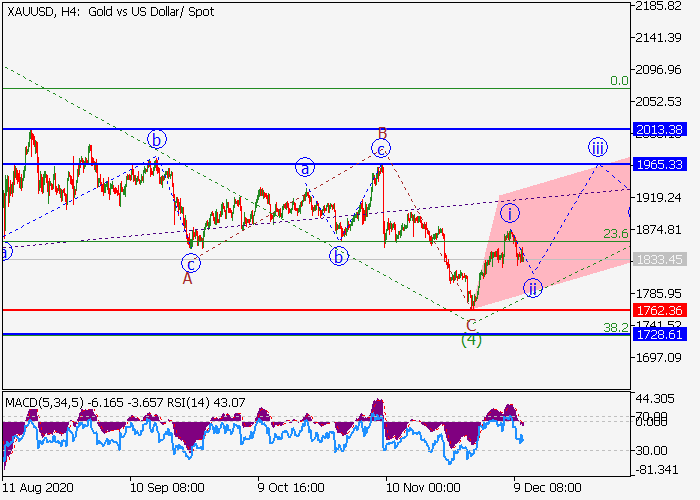

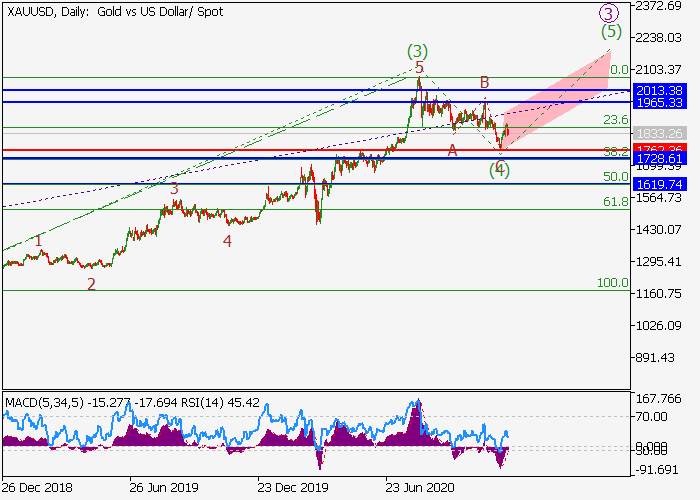

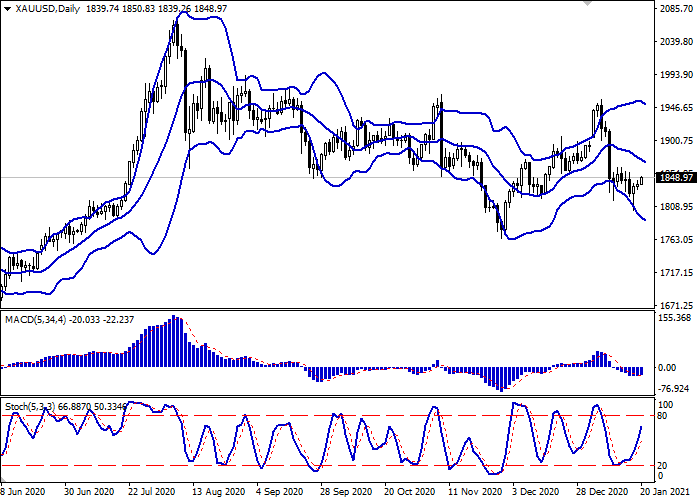

The pair may grow.

On the daily chart, the third wave of the higher level (3) formed, and a downward correction formed as the wave (4). Now, the development of the fifth wave (5) has started, within which the first entry wave of the lower level i of 1 of (5) has formed, and the wave ii of 1 is ending. If the assumption is correct, the pair will grow to the levels of 1965.332013.38. In this scenario, critical stop loss level is 1762.36.

|

|

#1171

|

|||

|

|||

|

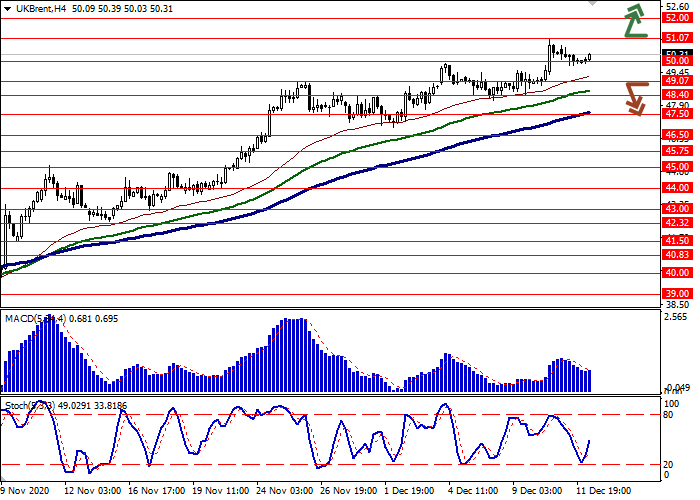

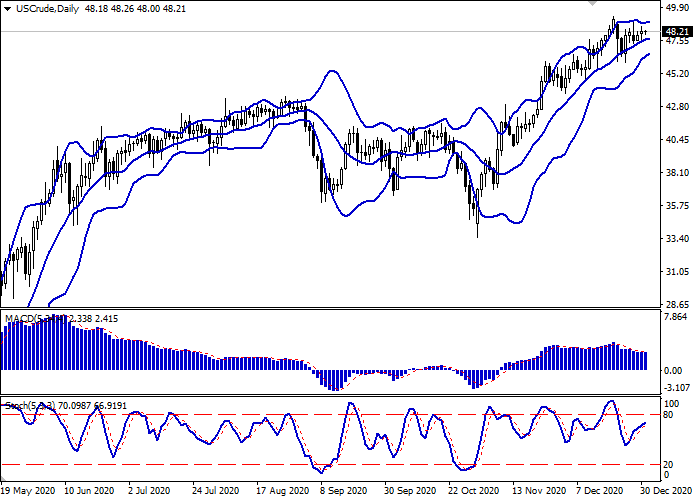

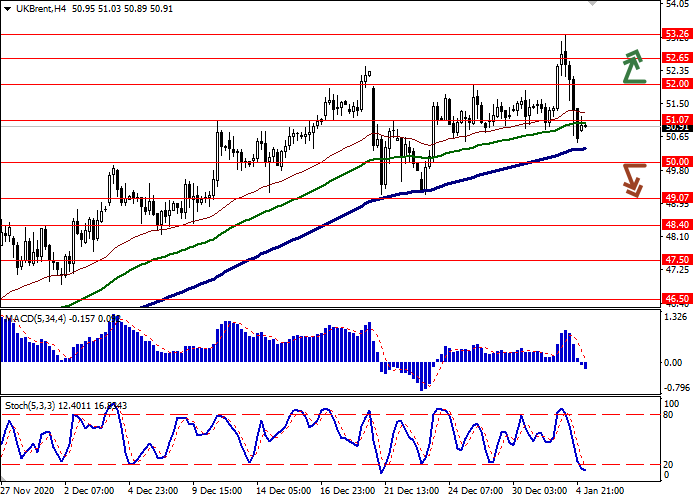

Brent Crude Oil: prices are recovering

Current trend Today, during the Asian session, oil prices are showing upward dynamics, trying to consolidate above the psychological level of $50 per barrel. The instrument dropped slightly at the end of the last trading week, however, it was caused by technical factors. The quotes are strongly supported by optimism regarding vaccines against COVID-19. Last weekend, it became known that the US Food and Drug Administration (FDA) noted the advantage of the vaccine from Pfizer and approved its use for the population over 16 years old. A vaccination campaign is expected to start soon in the US, which will strengthen the market's confidence that the next year can be survived without new lockdowns. Meanwhile, Baker Hughes' report on active oil platforms in the US, released on Friday, again reflected a solid increase from 246 to 258 units. Support and resistance On the daily chart, Bollinger Bands reverse into a horizontal plane. The price range is expanding from above but not as fast as the bullish dynamics develop. The MACD indicator is growing, maintaining a poor buy signal (the histogram is above the signal line). Stochastic, without reaching the overbought area, reversed into a horizontal plane near the level of 80, indicating the ambiguous nature of the last days' trading. The current readings of technical indicators do not contradict the further development of upward dynamics. Resistance levels: 51.07, 52.00, 53.00. Support levels: 50.00, 49.07, 48.40, 47.50.

|

|

#1172

|

|||

|

|||

|

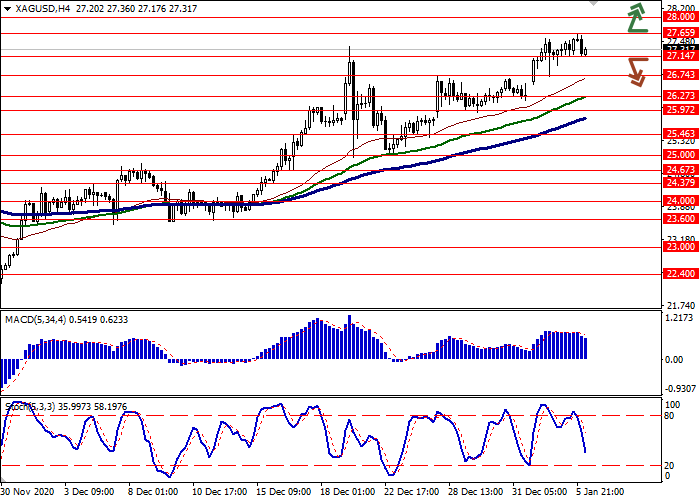

XAG/USD: wave analysis

The pair may fall. On the daily chart, the first wave of the higher level 1 of (3) formed, and a downward correction develops as the wave 2 of (3). Now, the wave c of 2 is forming, within which a local correction has ended as the fourth wave of the lower level (iv) of c, and the development of the wave (v) of c has started. If the assumption is correct, the price will fall to the levels of 21.5420.52. In this scenario, critical stop loss level is 24.84.

|

|

#1173

|

|||

|

|||

|

EUR/USD: euro is near record highs

Current trend Today during the Asian session, the EUR/USD pair is growing slightly, gradually returning to the previous record highs around 1.2174. USD weakens amid optimism about COVID-19 vaccinations, actively starting around the world. The process may begin in the US soon, as the Food and Drug Administration (FDA) recently approved the use of Pfizer and BioNTech vaccines. Yesterday, it became known that the FDA is preparing to publish the results of the third phase of clinical trials of the vaccine from Moderna, which can also be interpreted as the first step towards its approval for emergency use in the country. Meanwhile, the epidemiological situation in the US remains difficult. Earlier, the mayor of New York expressed the idea of returning the city to a full-fledged quarantine in response to a sharp increase in the case number. On Wednesday, European investors are focused on the block of macroeconomic statistics on business activity in Germany and the EU. Analysts predict the data to be poor, so there is no expectation of noticeable growth in the single currency. Support and resistance On the daily chart, Bollinger bands actively grow. The price range narrows, indicating the emergence of flat dynamics in the short term. MACD grows but keeps a sell signal (the histogram is below the signal line). Stochastic grows but rapidly approaches its highs, indicating that EUR may become overbought in the ultra-short term. Resistance levels: 1.2200, 1.2243, 1.2270, 1.2300. Support levels: 1.2150, 1.2087, 1.2039, 1.2000.

|

|

#1174

|

|||

|

|||

|

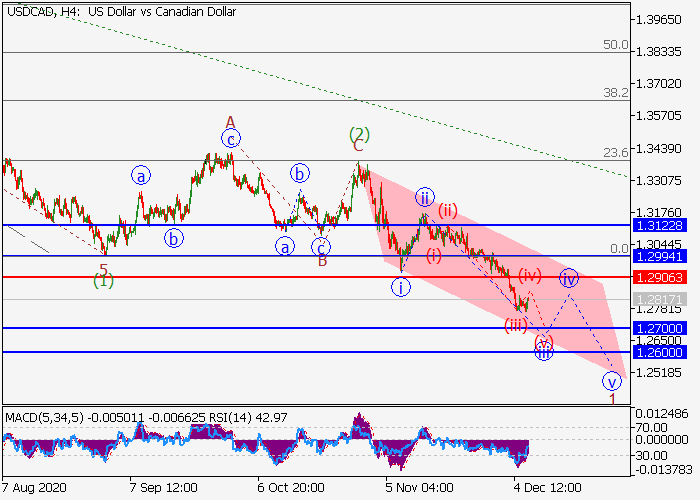

USD/CAD: wave analysis

The pair is in a correction, a fall is possible. On the 4-hour chart, a correction of the higher level developed as the wave (2), and the downward wave (3) forms, within which the wave 1 of (3) develops. Now, the third wave of the lower level iii of 1 has formed, and a local correction is developing as the wave iv of 1. If the assumption is correct, after the end of the correction, the pair will fall to the levels of 1.26001.2500. In this scenario, critical stop loss level is 1.2881.

|

|

#1175

|

|||

|

|||

|

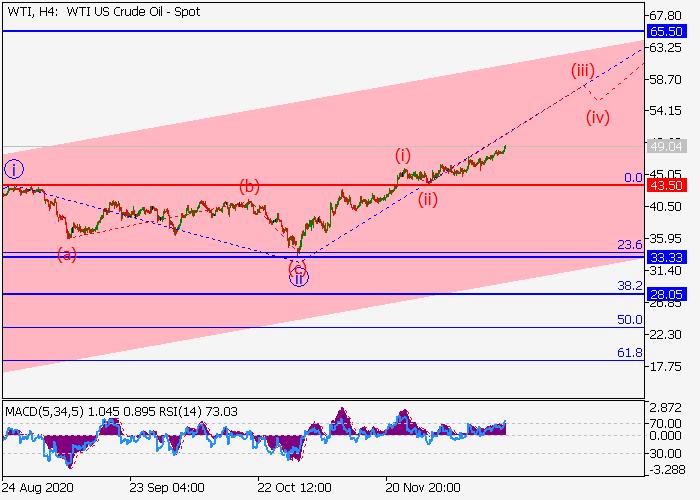

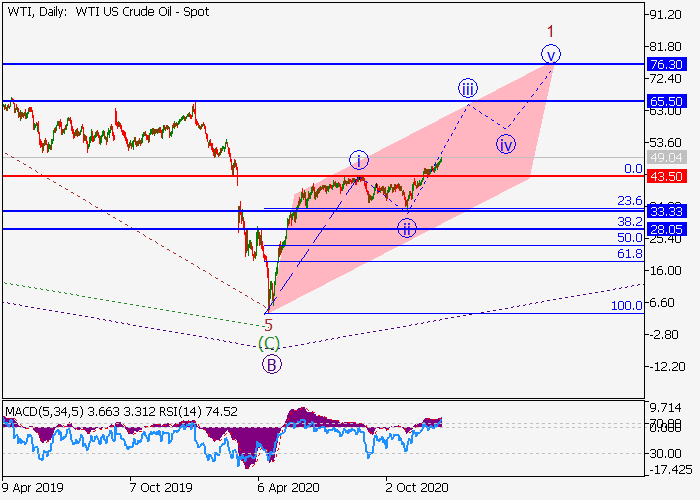

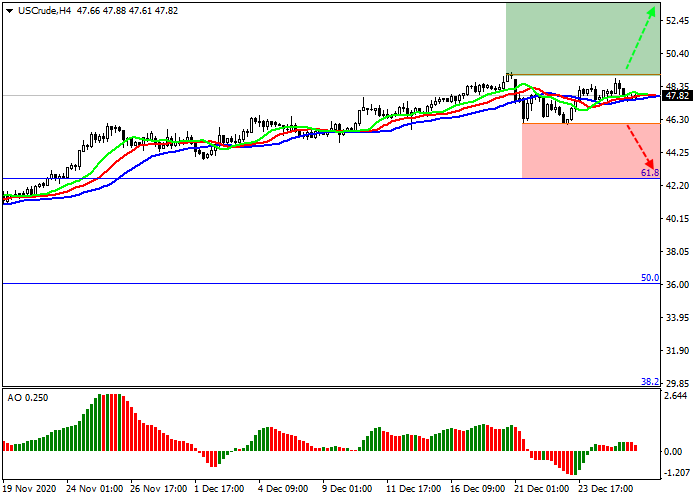

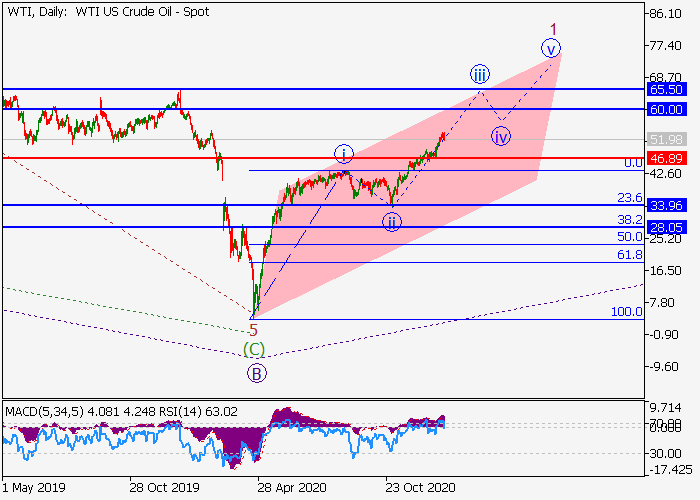

WTI Crude Oil: wave analysis

The price may grow. On the daily chart, a downward correction of the higher level developed as the wave B, and the formation of the upward wave C started, within which the first wave 1 of (1) of C develops. Now, the third wave of the lower level iii of 1 is forming, within which the wave (iii) of iii is developing. If the assumption is correct, the price will grow to the levels of 65.5076.30. In this scenario, critical stop loss level is 43.50.

|

|

#1176

|

|||

|

|||

|

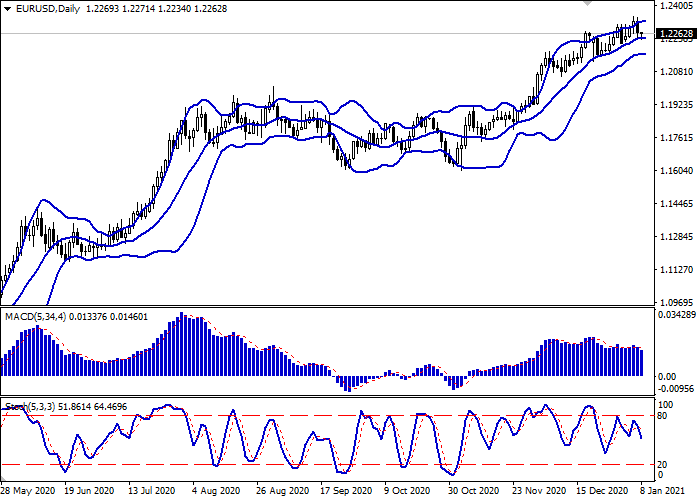

EUR/USD: wave analysis

The pair may grow. On the daily chart, the first wave of the higher level 1 of (3) develops, within which the wave v of 1 forms. Now, the third wave of the lower level (iii) of v of 1 has developed, and a local correction is forming as the wave (iv) of v of 1. If the assumption is correct, after the end of the correction, the pair will grow to the levels of 1.23401.2400. In this scenario, critical stop loss level is 1.2069.

|

|

#1177

|

|||

|

|||

|

USD/CAD: wave analysis

The pair is in a correction, a fall is possible. On the daily chart, the downward wave of the higher level (C) of 4 develops, within which the fifth wave 5 of (C) forms. Now, the third wave of the lower level iii of 5 is developing, within which the local correction (iv) of iii is ending. If the assumption is correct, after the end of the correction, the pair will fall to the levels of 1.26001.2500. In this scenario, critical stop loss level is 1.3179.

|

|

#1178

|

|||

|

|||

|

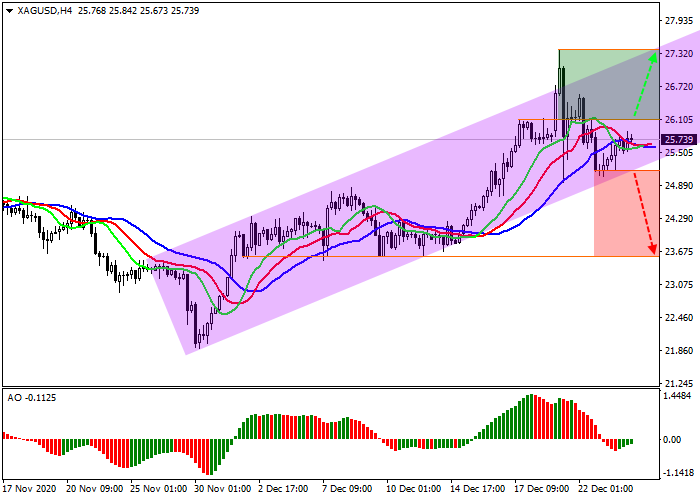

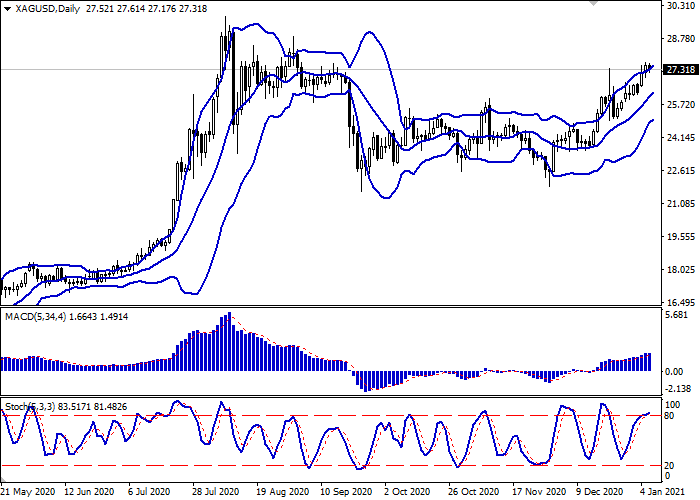

XAG/USD: silver rises again

Current trend Silver contract prices began to recover again, trading at $25.7 an ounce. In December, world prices for precious metals are quite stable and fully reflect the behavior of investors in the markets. In this regard, it is quite convenient to track the future possible movement of an asset by comparing it with the quotes of the VIX volatility index. Historically, as the VIX rises, tensions rise in the markets, and investors start to actively move into the assets of the metal group, using them as shelter assets. The VIX has been declining since last Friday but yesterday, there was a major reversal, and the index rose sharply from 22.37 points to the current level of 23.31 points. Accordingly, soon, the strengthening of silver quotes is expected, especially since the long weekend is coming. Support and resistance On the local chart of the asset, the price moves within the local ascending channel. Inside it, the instrument has reached the support line and is forming a reversal. Fast EMAs on the Alligator indicator crossed the signal one upwards, and the AO oscillator histogram is in the sell zone but very close to the transition level. Resistance levels: 26.10, 27.40. Support levels: 25.10, 23.60.

|

|

#1179

|

|||

|

|||

|

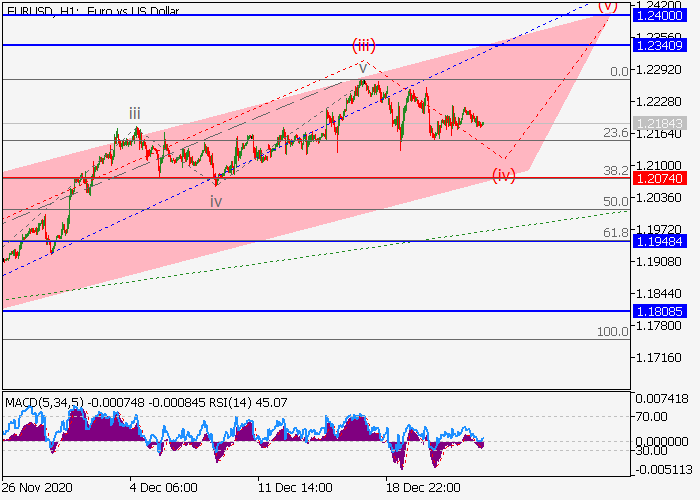

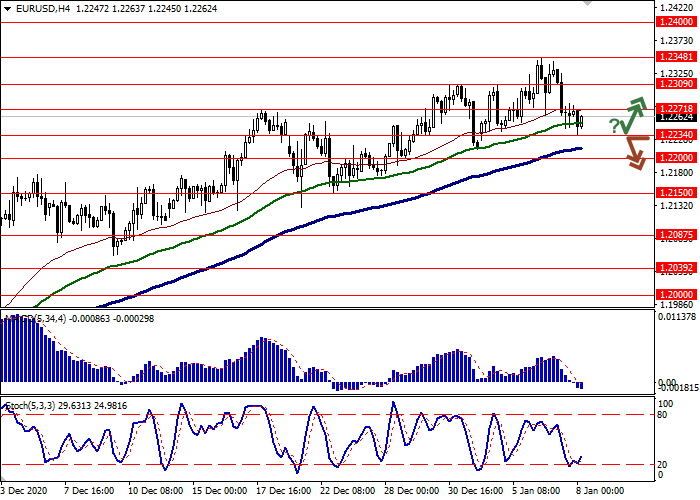

EUR/USD: wave analysis

The pair is in a correction and may grow. On the 4-hour chart, the first wave of the higher level 1 of (3) develops, within which a downward correction ended as the wave iv of 1, and the fifth wave v of 1 develops. Now, the third wave of the lower level (iii) of v has formed, and a local correction is developing as the fourth wave (iv) of v. If the assumption is correct, after the end of the correction, the pair will grow to the levels of 1.23401.2400. In this scenario, critical stop loss level is 1.2074.

|

|

#1180

|

|||

|

|||

|

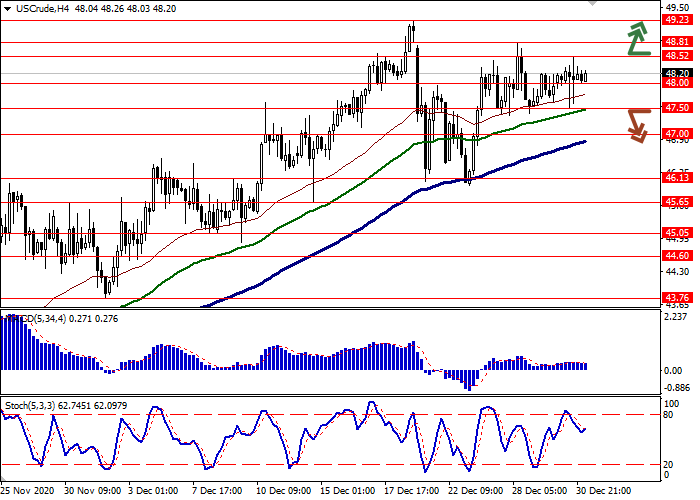

WTI Crude Oil: the price is consolidating

Current trend The price of WTI crude oil is trading sideways, being at the level of 47.82. Oil quotes are traded with increased volatility. The external information background has a significant impact on the choice of investors. Thus, the situation with the beginning of vaccination in many countries is undoubtedly a positive factor for the asset. However, the greatest expectations are associated with the OPEC+ meeting, which will be held on January 4. The cartel members plan to consider the possibility of increasing quotas for oil production by 500K barrels per day. The past week has confirmed the increased interest in contracts from investors. According to the Commodity Futures Trading Commission, the number of net speculative positions in crude oil for the first time since August reached 525.7K, which exceeds the 514.6K shown a week earlier. Support and resistance On the local chart of the asset, the price continues to trade within the upward channel and is currently consolidating near the key level of 48.00. Technical indicators are in a state of uncertainty. The fast EMAs of the Alligator indicator have crossed with the signal line, and the histogram of the AO oscillator is in the positive zone. Resistance levels: 49.00, 53.00. Support levels: 46.00, 42.50.

|

|

#1181

|

|||

|

|||

|

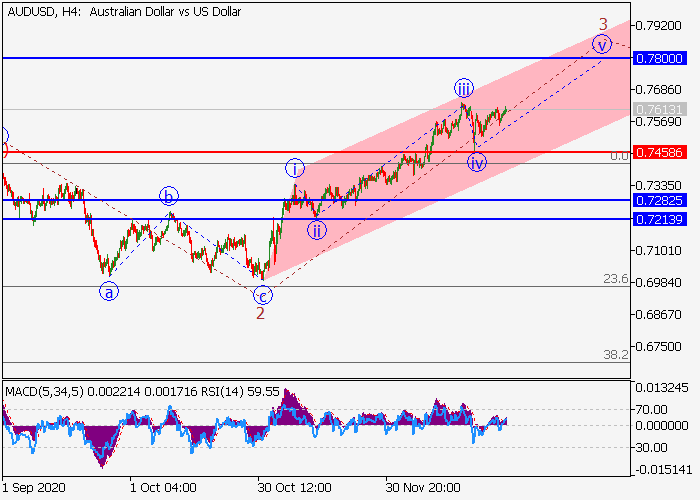

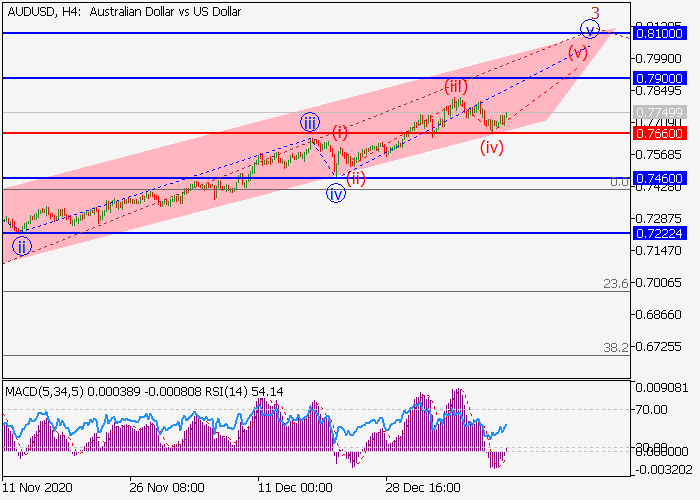

AUD/USD: wave analysis

The pair may grow. On the daily chart, the first wave of the higher level 1 of (1) formed, and a local correction developed as the second wave 2 of (1). Now, the third wave 3 of (1) is developing, within which the wave iii of 3 has formed, and a correction has ended as the wave iv of 3. If the assumption is correct, the pair will grow to the levels of 0.78000.8100. In this scenario, critical stop loss level is 0.7458.

|

|

#1182

|

|||

|

|||

|

WTI Crude Oil: waiting for new drivers

Current trend Today during the Asian session, oil prices move flat, trading near $48 per barrel. The price is moderately supported by the approval of new stimuli for the American economy by US President Donald Trump. They involve direct payments to citizens of $600. Earlier, Trump tried to insist on increasing this amount to $2,000, which was approved in the House of Representatives but the Senate majority blocked the initiative, deciding to put the issue in a separate bill. Yesterday, quotes were significantly supported by the US EIA report, which reflected a sharp decline in oil reserves for the week of December 25 by 6.1 million barrels after falling by 0.56 million barrels previously. Analysts expected further decrease but hoped for a fall of only 2.58 million barrels. However, the upcoming OPEC meeting, which will be held on January 4, remains a bearish factor. It is expected that the cartel will decide to increase oil production by 500K barrels per day. Support and resistance On the daily chart, Bollinger Bands grow moderately. The price range narrows from below, reflecting the ambiguous nature of trading in the short term. MACD falls, maintaining a poor sell signal (the histogram is below the signal line). Stochastic grows slightly, approaching the level of 80 and limiting the development of bullish sentiment in the ultra-short term. It is better to wait until the signals from technical indicators are clear. Resistance levels: 48.52, 48.81, 49.23. Support levels: 48.00, 47.50, 47.00, 46.13.

|

|

#1183

|

|||

|

|||

|

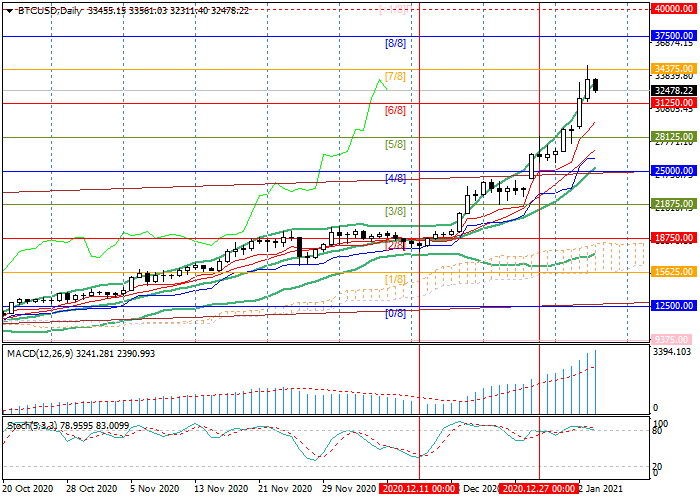

BTC/USD: technical analysis

Current trend Since mid-December, the BTC/USD pair has been moving in an uptrend, constantly renewing historical highs. Over the past week, the price added over 34% and rose above 34700.00. The asset remains popular with investors due to a difficult global economic situation and deterioration in relations between the United States and China, caused by the delisting of several Chinese companies from the New York Stock Exchange. Experts note that relations between the first two world economies are unlikely to significantly improve under the new American President Joe Biden, and therefore digital assets will remain attractive. Currently, quotes have slowed down, trading at 34375.00 (Murrey [7/8]), a breakout of which allows further growth to the levels of 37400.00 (Murrey [8/8]) and 40,000.00. The key bearish level is 31250.00 (Murrey [6/8]). If the price consolidates below it, a decline to the levels of 28125.00 (Murrey [5/8]) and 25000.00 (Murrey [4/8], the middle line of Bollinger bands) may follow. Technical indicators point to continued growth. Bollinger Bands are directed upwards. The MACD histogram is growing in the positive zone. Stochastic is in the overbought zone moving horizontally. Support and resistance Resistance levels: 34375.00, 37400.00, 40000.00. Support levels: 31250.00, 28125.00, 25000.00.

|

|

#1184

|

|||

|

|||

|

Brent Crude Oil: waiting for OPEC decision

Current trend Today, during the Asian session, oil prices grow slightly, testing the level of 51.00 for a breakout. Yesterday, quotes decreased steadily, responding to the complication of the epidemiological situation in Europe, which correlates poorly with the market's plans to gradually increase energy demand. Also, investors fear that OPEC+ will decide to start a gradual increase in oil production. However, yesterday's meeting of the cartel did not lead to any specific decision, and it was decided to continue negotiations on January 5. Most of the OPEC+ countries are in favor of maintaining the current restrictions on production, while the UAE and Russia believe that oil production should be gradually increased. On Tuesday, investors await the publication of a report from the American Petroleum Institute (API) on oil reserves for the week of January 1. The previous report showed a steady decline in inventories by 4.875 million barrels. Support and resistance On the daily chart, Bollinger Bands reverse into a horizontal plane. The price range narrows, reflecting the ambiguous trading in the short term. MACD falls, maintaining a relatively strong sell signal (the histogram is below the signal line). Stochastic falls but is rapidly approaching the lows, signaling that the instrument may become oversold in the super short term. It is better to keep the current short positions until the signals from technical indicators are clarified. Resistance levels: 51.07, 52.00, 52.65, 53.26. Support levels: 50.00, 49.07, 48.40, 47.50.

|

|

#1185

|

|||

|

|||

|

XAG/USD: the prices are consolidated

Current trend Silver prices are showing a moderate decline on Wednesday, retreating from local highs, updated the day before. The instrument is still supported by the weak USD, which is waiting for new drivers at the market. US investors are watching Georgia's second round of Senate elections. If at least one Republican candidate wins, the Senate will remain with Mitch McConnell, which will allow Republicans to block the controversial initiatives of Democrat Joe Biden in the next two years. If both positions go to the Democrats, then the final word will remain with US Vice President Kamala Harris. In turn, the demand for silver is supported against the background of a worsening epidemiological situation in Europe, which threatens with new restrictions. The UK has recently decided on a third full quarantine, since for several weeks the incidence statistics have been setting new records. The speed with which a new strain of coronavirus is being detected in countries around the world is also worrying. Support and resistance Bollinger Bands in D1 chart show stable growth. The price range is narrowing, pointing at the ambiguous nature of trading in the ultra-short term. MACD indicator is growing preserving a rather stable buy signal (located above the signal line). Stochastic keeps an upward direction but is approaching its highs, which reflects the overbought silver in the ultra-short term. Existing long positions should be kept until technical indicators are clarified. Resistance levels: 27.65, 28.00, 28.50. Support levels: 27.14, 26.74, 26.27, 25.97.

|

|

#1186

|

|||

|

|||

|

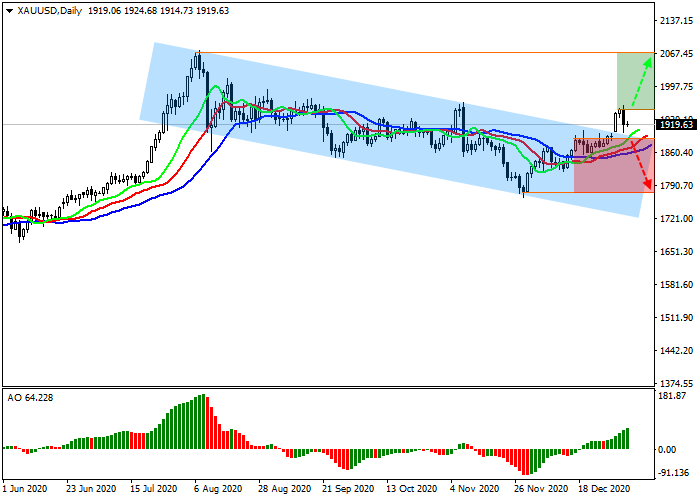

XAU/USD: gold quotes are correcting

Current trend Gold quotes are consolidating around 1919.00. As expected by most experts, the price of the precious metal has shown significant growth since the beginning of the year, and despite yesterday's decline, it remains fairly high. Undoubtedly, the strengthening of quotes is directly related to the situation around the coronavirus pandemic: the recent introduction of additional restrictions in a number of countries have pushed investors to avert risk and seek "safe havens". However, the transition to gold was not that significant. Since mid-December, the precious metal has a new competitor, Bitcoin. It was cryptocurrency that some institutional investors began to consider as a more reliable means of fighting inflation. Bitcoin is growing, and not only preserves assets but also brings very high profitability, which makes some investors, who have always kept their funds in gold, to make a short-term choice in favor of cryptocurrency. Support and resistance Quotes, which left the global descending channel yesterday, attempted to test the resistance line, after which growth may continue. Technical indicators continue to show a buy signal. Fast EMAs on the Alligator indicator are higher than the signal line, and the AO oscillator histogram is trading in the positive zone. Resistance levels: 1951.0, 2067.0 Support levels: 1886.0, 1774.0.

|

|

#1187

|

|||

|

|||

|

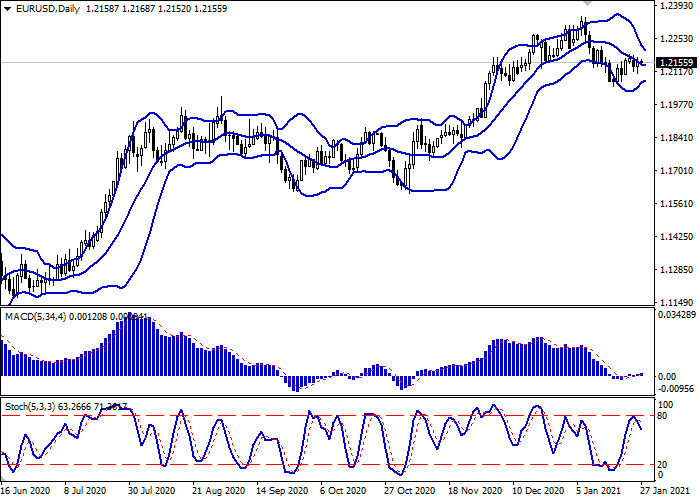

EUR/USD: EUR is corrected

Current trend EUR is declining insignificantly against USD today, developing the "bearish" signal that formed the day before. Noticeable pressure on EUR was exerted yesterday by macroeconomic statistics from the eurozone, which came out worse than expected. The volume of Retail Sales in November fell by 6.1% MoM after rising by 1.4% MoM in the previous month. Analysts had expected negative dynamics, but counted on a decrease by 3.4% MoM. On an annualized basis, sales fell by 2.9% YoY, while the forecasts were for an increase by 0.8% YoY. The data on consumer inflation were also negative. In December, the Consumer Price Index fell by 0.3% YoY, repeating November dynamics. Analysts had expected a slight improvement in the indicator to 0.2% YoY. Today, European investors are focused on the statistics on Industrial Production from Germany for November, as well as on the Unemployment Rate in the eurozone for the same period. Support and resistance In the D1 chart, Bollinger Bands are reversing horizontally. The price range is trying to consolidate, while remaining spacious enough for the current activity level in the market. MACD is going down having formed a new sell signal (located below the signal line). Stochastic is showing similar dynamics, signaling the presence of significant "bearish" potential in the ultra-short term. Existing short positions should be kept in the short and/or ultra-short term until the signals from technical indicators clear up. Resistance levels: 1.2271, 1.2309, 1.2348, 1.2400. Support levels: 1.2234, 1.2200, 1.2150, 1.2087.

|

|

#1188

|

|||

|

|||

|

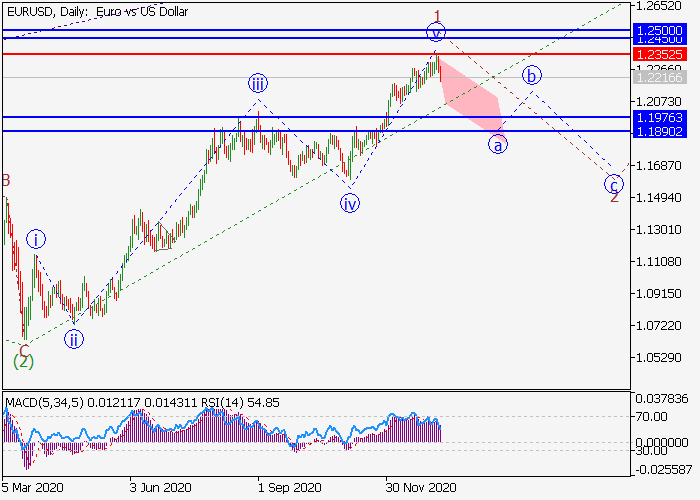

EUR/USD: wave analysis

The price may fall. On the daily chart, the first wave of the higher level 1 of (3) developed, within which the fifth wave v of 1 formed. Now, a downward correction is starting to develop as the second wave 2 of (3), within which the wave a of 2 is forming. If the assumption is correct, the pair will fall to the levels of 1.19761.1890. In this scenario, critical stop loss level is 1.2352.

|

|

#1189

|

|||

|

|||

|

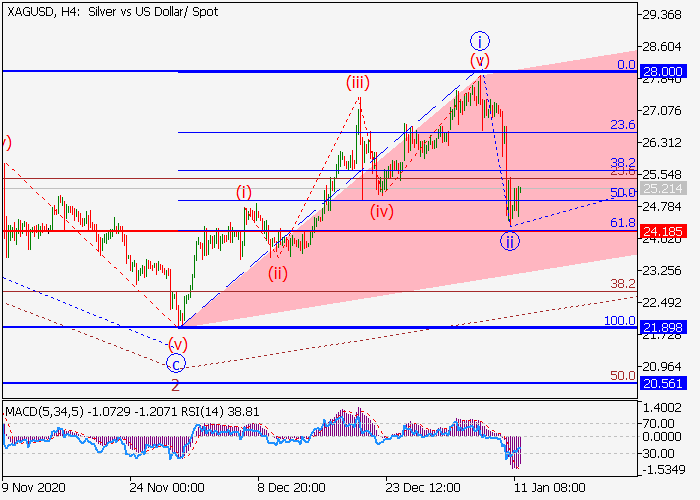

XAG/USD: wave analysis

The pair may grow. On the daily chart, the first wave of the higher level 1 of (3) formed, a downward correction developed as the wave 2 of (3), and the formation of the wave 3 of (3) started. Now, the first entry wave of the lower level i of 3 has formed, and the local correction has ended as the wave ii of 3. If the assumption is correct, the pair will grow to the levels of 28.0029.73. In this scenario, critical stop loss level is 24.18.

|

|

#1190

|

|||

|

|||

|

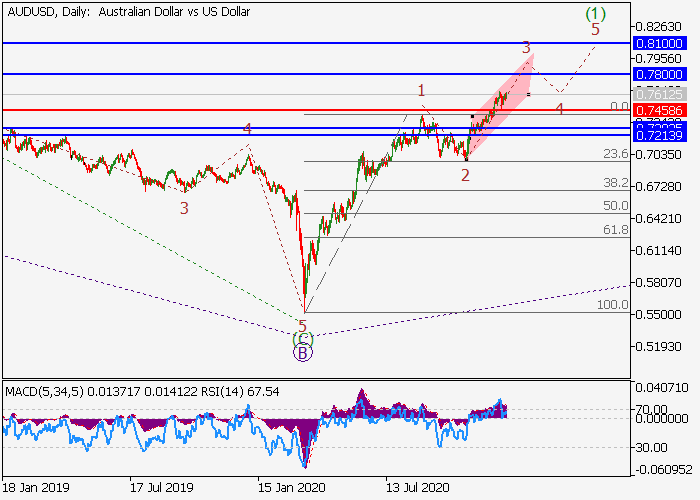

AUD/USD: wave analysis

The pair may grow. On the daily chart, the wave C of the higher level develops, within which the first wave (1) of C forms. Now, the third wave of the lower level 3 of (1) is developing, within which the wave iii of 3 has formed, the local correction iv of 3 has ended, and the fifth wave v of 3 is developing. If the assumption is correct, the pair will grow to the levels of 0.79000.8100. In this scenario, critical stop loss level is 0.7660.

|

|

#1191

|

|||

|

|||

|

EUR/USD: the pair declines again

Current trend The EUR/USD pair declines, trading around the level of 1.2146. Yesterday, the European currency strengthened against its main competitors after the publication of macroeconomic statistics. The volume of industrial production in the EU for November rose by 2.5% MoM against the expected growth of 0.2% and adjusted to 0.6% YoY against the background of forecasts of 3.3%. The volume of industrial production in Italy for the same period remained rather low and amounted to 4.2% YoY, which is still better than the forecast of 4.3%. After a slight downward correction, the American currency returned to the upward dynamics, which determined the instrument's trend. Although the main news is the possible impeachment of US President Donald Trump, experts call the likelihood of this event almost zero since the Senate, most likely, will not take this responsibility. Support and resistance Locally, the price left the uptrend, breaking the support line. After a short correction, it is ready to go below the local minimum. Technical indicators maintain a stable sell signal. The fluctuation range of the EMA on the Alligator indicator is expanding, and the histogram of the AO oscillator is trading in the negative zone. Resistance levels: 1.2218, 1.2310. Support levels: 1.2130, 1.2000.

|

|

#1192

|

|||

|

|||

|

Brent Crude Oil: wave analysis

The price may grow. On the daily chart, a downward correction of the higher level developed as the wave B, and the upward wave C started to form, within which the first wave 1 of (1) of C develops. Now, the third wave of the lower level iii of 1 is forming, within which the wave (iii) of iii is developing. If the assumption is correct, the price will grow to the levels of 59.9265.00. In this scenario, critical stop loss level is 52.11.

|

|

#1193

|

|||

|

|||

|

WTI Crude Oil: wave analysis

The price may grow. On the daily chart, a downward correction of the higher level developed as the wave B, and the formation of the upward wave C started, within which the first wave 1 of (1) of C develops. Now, the third wave of the lower level iii of 1 is forming, within which the wave (iii) of iii is developing. If the assumption is correct, the price will grow to the levels of 60.0065.50. In this scenario, critical stop loss level is 46.89.

|

|

#1194

|

|||

|

|||

|

EUR/USD: wave analysis

The pair may fall. On the daily chart, the first wave of the higher level 1 of (3) developed, within which the fifth wave v of 1 formed. Now, a downward correction is developing as the second wave 2 of (3), within which the wave a of 2 is forming. If the assumption is correct, the pair will fall to the levels of 1.19761.1890. In this scenario, critical stop loss level is 1.2219.

|

|

#1195

|

|||

|

|||

|

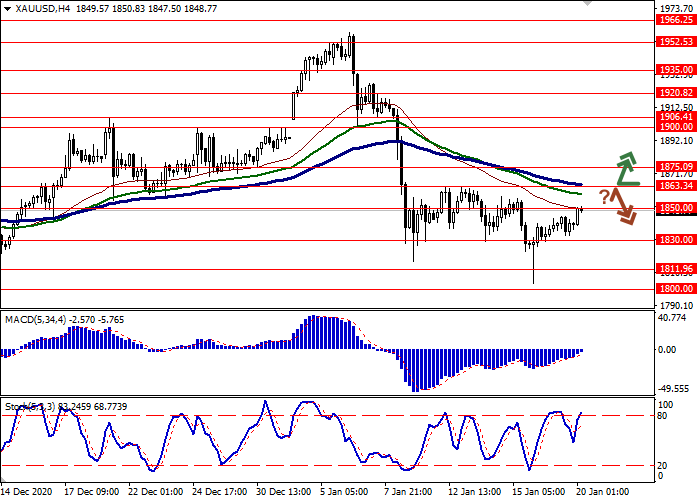

XAU/USD: gold is in demand again

Current trend Gold prices are rising significantly during today's Asian session, updating local highs of January 15. The instrument is testing the level of 1850.00 for a breakout. Noticeable pressure on USD was exerted by the speech of the candidate for the post of the US Treasury Secretary Janet Yellen, who spoke in favor of a gradual return of the "strong dollar policy". In any case, it seems that the Joe Biden administration will not engage in artificial weakening of the national currency, as well as prosecute other countries for such actions. In addition, investors are looking forward to Biden's inauguration today, and also expect quick decisions on the announced USD 2 trillion support package for the US economy. Support and resistance Bollinger Bands in D1 chart demonstrate a stable decrease. The price range expands from below, weakly reacting to the appearance of ambiguous trading dynamics in the nearest future. MACD is reversing to growth forming a new buy signal (located above the signal line). Stochastic keeps its upward direction but is rapidly approaching its highs, which reflects the risks of overbought instrument in the ultra-short term. Technical indicators do not contradict the further development of the uptrend in the short and/or ultra-short term. Resistance levels: 1850.00, 1863.34, 1875.09, 1900.00. Support levels: 1830.00, 1811.96, 1800.00.

|

|

#1196

|

|||

|

|||

|

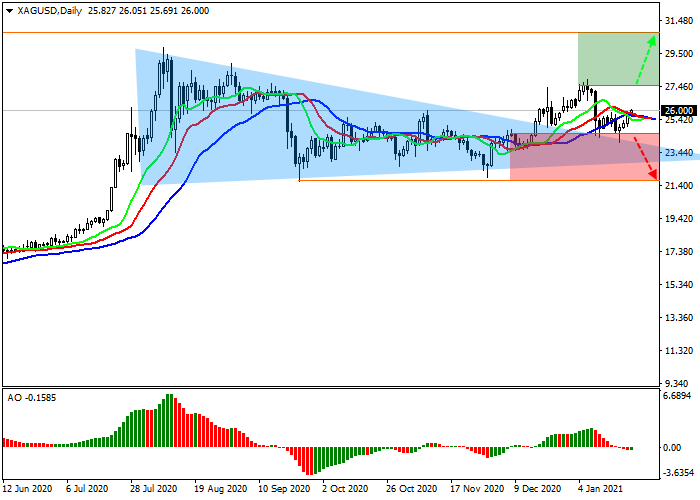

XAG/USD: silver returns to global growth

Current trend Silver contracts are correcting upwards, trading at $26 an ounce. Of all the assets of the metal group, silver has the highest chances of further growth. The asset is not as dependent on fluctuations in global capital as gold, and due to its much smaller money capacity, responds more quickly to fluctuations in the US dollar. The recent decline in the USD has led to the current strengthening of silver. In the future, the instrument can be supported by stability in the Chinese economy, the main importer of the metal. Yesterday, several key data were published, such as the rate of the People's Bank of China, which remained at 3.85%, and the volume of industrial production which increased by 7.3%. Thus, despite a new outbreak of coronavirus in some provinces, economic activity and demand in the PRC are strengthening, supporting silver. Support and resistance On the global chart of the asset, the price, after a rather significant downward impulse, is correcting upwards again, reversed from the resistance line of the global triangle pattern. Technical indicators are uncertain. The fluctuation range of the EMA on the Alligator indicator is narrowed, and the histogram of the AO oscillator is in the sell zone. Resistance levels: 27.54, 30.00. Support levels: 24.60, 21.76.

|

|

#1197

|

|||

|

|||

|

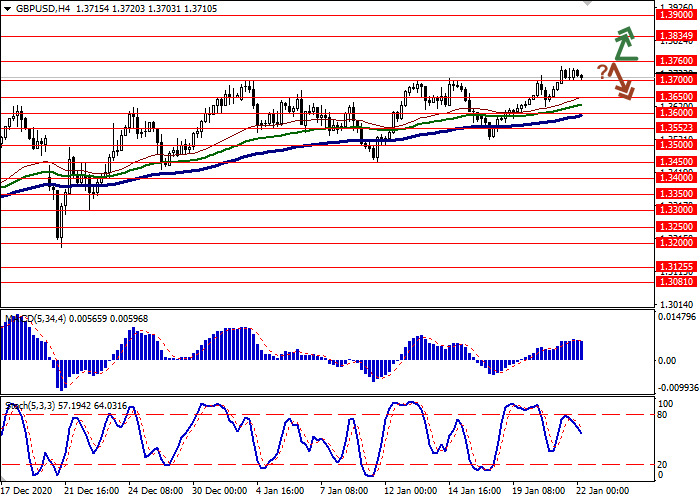

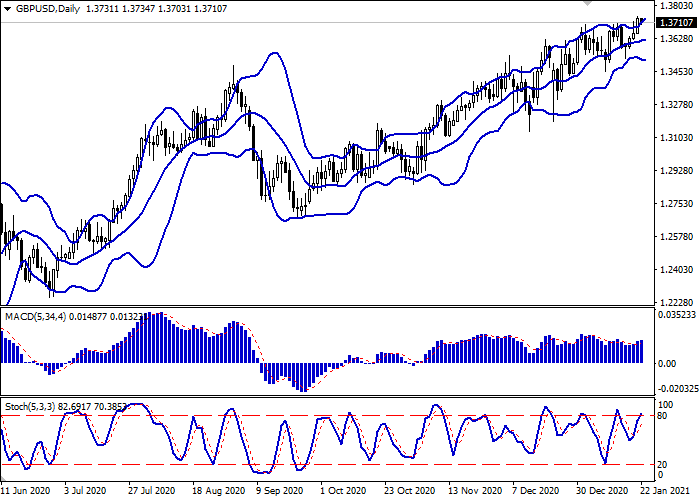

GBP/USD: consolidating at record highs

Current trend GBP is trading down against USD during today's morning session, correcting slightly after yesterday's renewing record highs since May 2018. The decline in the instrument is largely due to technical factors, while fundamentally the picture changes only slightly. Moderate support for USD is provided by rather positive macroeconomic statistics from the US, which entered the market on Thursday. The number of initial jobless claims for the week ending January 15 fell from 926K to 900K, while investors expected a decrease in the figure to 910K. Continuing Jobless Claims were revised down from 5.181M to 5.054M with the forecast for growth to 5.4M. In turn, GBP is under slight pressure on Friday after the publication of GfK Consumer Confidence. In January, the index fell from 26 to 28 points, while the market expected a decline to 29 points. Support and resistance The Bollinger Bands in D1 chart show moderate growth. The price range is expanding but it fails to conform to the development of "bullish" sentiments at the moment. MACD indicator is growing preserving a buy signal (located above the signal line). Stochastic keeps its upward direction but is rapidly approaching its highs, which reflects the risks of overbought instrument in the ultra-short term. Resistance levels: 1.3760, 1.3834, 1.3900. Support levels: 1.3700, 1.3650, 1.3600, 1.3552.

|

|

#1198

|

|||

|

|||

|

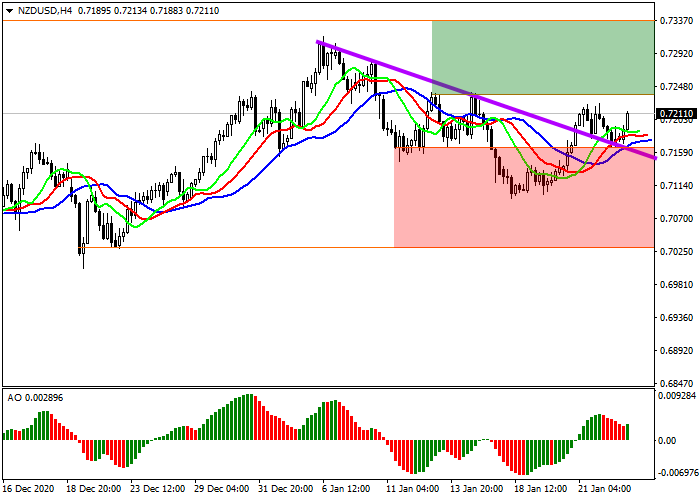

NZD/USD: a movement to the local high

Current trend The NZD/USD pair shows a steady upward trend, trading near the level of 0.7211. The positive momentum continues after the publication of the New Zealand CPI on Friday. The Q4 figure quarter was 0.5%, significantly surpassing the skeptical forecasts of analysts at the level of 0.1%. Manufacturing PMI for December fell but remained above the stability level, amounting to 48.7 points. The USD Index is declining, despite the positive Friday statistics, and moves around 90.100. Investors are waiting for the start of active actions by Joe Biden as president and are in no hurry to make a choice. Sales in the secondary housing market for December rose again and reached 6.76 million against the background of the forecast of 6.55 million. Manufacturing PMI for January reached 59.1 points, which is better than 57.1 in the previous period. Support and resistance After the breakout of the local resistance line, the formation and subsequent development of the Inverted Head and Shoulders pattern is possible. Technical indicators are in a local buying state and are ready to strengthen their readings. The fluctuation range of the EMA on the Alligator indicator began to expand, and the histogram of the AO oscillator, trading in the positive zone, forms upward bars. Resistance levels: 0.7236, 0.7340. Support levels: 0.7165, 0.7032.

|

|

#1199

|

|||

|

|||

|

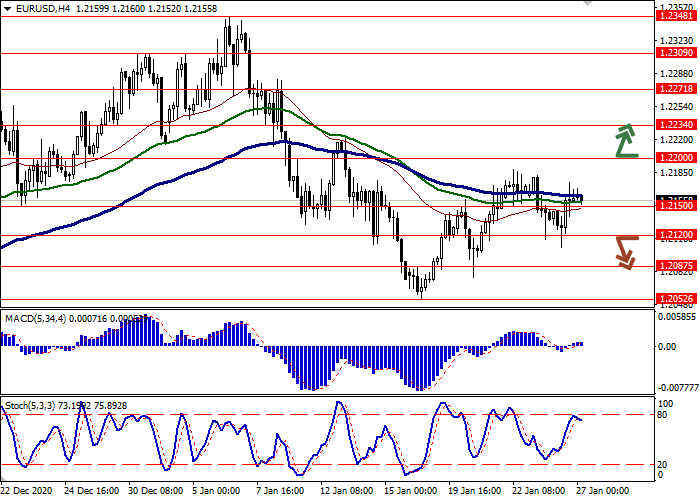

EUR/USD: ambiguous dynamics

Current trend EUR shows flat dynamics of trading against USD during today's Asian session, consolidating near the level of 1.2150. Investors do not open new trading positions yet, waiting for the Fed's monetary policy comments to be released tonight. The markets were a little wary after Joe Biden's statements that he is ready to adjust the previously announced USD 1.9 trillion stimulus plan for the US economy. Today, European investors expect the publication of macroeconomic statistics from Germany and France on the level of consumer confidence in February and January, respectively. In addition, attention will be drawn to the speech of the ECB Chief Economist Philip Lane, who can comment on the recent statements by Christine Lagarde about a possible double recession in the eurozone. Support and resistance In the D1 chart, Bollinger Bands are reversing horizontally. The price range is narrowing, reflecting ambiguous dynamics of trading in the short term. MACD indicator is growing preserving a weak buy signal (located above the signal line). The indicator line is also trying to consolidate above the zero level. Stochastic, having reached the level of "80" reversed downwards and does not react to yesterday's resumption of growth of the instrument. To open new positions, it is necessary to wait for the trade signals to become clear. Resistance levels: 1.2200, 1.2234, 1.2271, 1.2309. Support levels: 1.2150, 1.2120, 1.2087, 1.2052.

|

|

#1200

|

|||

|

|||

|

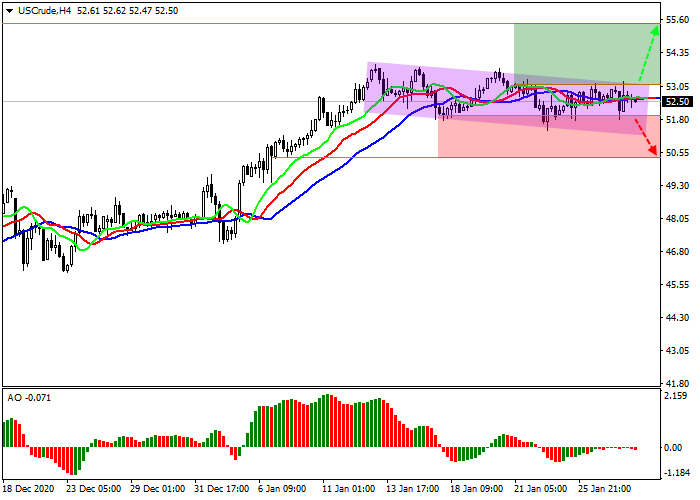

WTI Crude Oil: oil is preparing to renew the local high

Current trend The oil price is moving sideways, trading at the level of 52.50. Quotes reacted to the data on energy reserves very sharply. According to the API Institute, the amount of oil in American vaults fell by 5.272 million barrels against the expected increase of 0.603 million barrels. According to the report of the US EIA, the reduction was more significant. The indicator fell by 9.910 million barrels against the expected increase of 0.430 million barrels. However, such a tangible decrease in stocks gave the instrument only a temporary upward impetus, and the growth was offset by the subsequent news of the suspension of arms supplies from the United States to the UAE and Saudi Arabia. Although the ban is temporary, experts fear that relations between the countries will deteriorate, which will add additional uncertainty to the energy market. Support and resistance On the local chart of the asset, the price moves within the downwards channel, which can transform into a Flag pattern of the trend continuation. Technical indicators are uncertain. Fast EMAs of the Alligator indicator intertwined with the signal one and the histogram of the AO oscillator is approaching the positive zone. Resistance levels: 53.10, 55.00. Support levels: 52.00, 50.30.

|

|

|

|

Similar Threads

Similar Threads

|

||||

| Thread | Thread Starter | Forum | Replies | Last Post |

| Best News Analysis Platform | fxindicator | News trading | 6 | 27-12-2023 19:55 |

| Forex Analysis by LiteForex | LiteFXnews | Forex Analysis | 0 | 12-11-2015 07:38 |

| Hotforex.com - Market Analysis and News. | HFblogNews | Forex Analysis | 0 | 05-06-2015 10:47 |

| OctaFX.Com - Financial News and Analysis | farid | News trading | 341 | 27-01-2014 15:44 |