|

Forex Forums | ForexLasers.com |

|

|||||||

|

|

|

LinkBack | Thread Tools | Search this Thread |

|

#441

|

||||

|

||||

|

EURUSD H4 Technical and Fundamental Analysis for 07.30.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis: Today’s EUR/USD analysis is framed by multiple Eurozone macroeconomic indicators due for release. With data on consumer spending, GDP, and retail sales scheduled, traders are closely watching for signs of economic resilience. A stronger-than-forecast reading would typically be bullish for the euro, especially from the INSEE and Destatis GDP reports. Meanwhile, the USD awaits impactful data later in the week, including ADP employment data and crude oil inventories, which may shift the Fed’s interest rate expectations. For now, mixed macro signals leave EUR/USD highly sensitive to incoming figures and central bank sentiment, particularly in light of persistent inflationary concerns across the Eurozone and potential Fed policy adjustments. Price Action: The EUR/USD pair on the H4 timeframe has initiated a sharp bearish correction from the 1.17300 peak, losing approximately -2.14% since the start of the week. After a strong downward move, price action found temporary support near the 23.6% Fibonacci retracement level at 1.15300. This has led to two green candles forming, suggesting a short-term rebound. However, the current downtrend structure remains dominant, with lower highs and lower lows evident. If the price fails to break through the resistance at the 38.2% (1.15820) or 50.0% (1.16250) retracement levels, a renewed decline could target the 0.0% Fibonacci level around 1.14500. Key Technical Indicators: Moving Averages: The 9-period EMA (blue) has decisively crossed below the 17-period EMA (orange), confirming the bearish shift in momentum on the EUR-USD H4 chart. This crossover early in the week has continued to guide price lower, acting as dynamic resistance during minor pullbacks. Parabolic SAR: The Parabolic SAR dots are firmly positioned above the recent H4 candles, affirming bearish momentum. The indicator has been consistent in signaling downward price action and will remain a key reference point until a reversal signal forms below price. MACD (Moving Average Convergence Divergence): The MACD histogram is strongly negative, with the MACD line at -0.004621 and the signal line at -0.002724. This widening gap suggests persistent downside pressure. However, traders should monitor for potential MACD convergence if upward corrective movement continues in the next few candles. Support and Resistance: Support: The key short-term support lies around the 1.15300 zone, coinciding with the 23.6% Fibonacci level. A break below this level could accelerate the move toward the 0.0% retracement near 1.14500. Resistance: Immediate resistance stands at 1.15820 (38.2% Fib level). A further upside correction could face resistance at 1.16250 (50.0% Fib), with the stronger bearish barrier remaining around the 1.16700 region. Conclusion and Consideration: The EUR/USD H4 chart technical analysis signals a prevailing bearish bias, reinforced by the moving averages crossover, downward MACD momentum, and Parabolic SAR positioning. Although the pair shows a temporary bounce from 1.15300 support, any upward retracement toward the 38.2% or 50.0% Fibonacci levels may encounter renewed selling pressure. From a fundamental standpoint, key EUR economic data today may introduce volatility, but until significant bullish catalysts emerge, bears remain in control. Caution is advised for long positions unless confirmed by reversal signals. Disclaimer: The analysis provided for EUR/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURUSD. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 07.30.2025 |

|

#442

|

||||

|

||||

|

USDJPY Daily Technical and Fundamental Analysis for 07.31.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis: The USD-JPY currency pair is likely to experience increased volatility today due to significant economic releases from both Japan and the United States. Japanese Industrial Production, Retail Sales, and Consumer Confidence data are scheduled, which will provide crucial insights into the economic health of Japan. Additionally, market participants will closely monitor the outcomes of the Bank of Japan's monetary policy statements and comments by the BOJ Governor for indications of future policy shifts. From the U.S. side, traders will pay close attention to the Core PCE Price Index and Unemployment Claims, which can significantly influence the USD valuation, as these metrics directly affect the Federal Reserve's monetary policy outlook. Price Action: The USD/JPY pair has transitioned into a bullish phase on the H4 chart, clearly evident after breaking the resistance line of its previous downtrend. Currently, the pair is trading within an ascending channel, consistently respecting its boundaries. After recently bouncing off the channel’s lower trendline, the price appears headed toward the upper boundary, setting a potential bullish target. The recent bullish candles reinforce the upward momentum, suggesting continued bullish sentiment in the short term. Key Technical Indicators: Parabolic SAR: The Parabolic SAR indicators have consistently formed below the last four candles, indicating a clear bullish momentum in the short-term price action of the USD JPY pair. Traders can interpret this as a potential continuation signal toward the upper channel boundary. RSI (Relative Strength Index): Currently, the RSI stands at 65.69, signaling robust bullish strength but still beneath the overbought threshold of 70. This indicates that while bullish momentum is strong, there is still room for further upside before becoming overextended. MACD (Moving Average Convergence Divergence): The MACD indicator presents values of 0.4017 and 0.3214, with the MACD line positioned above the signal line, supporting the bullish scenario. This positioning suggests continued buying momentum, albeit with caution for potential weakening if the MACD line converges toward the signal line in upcoming sessions. Support and Resistance: Support: Immediate support for the USD-JPY pair is found at approximately 147.435, aligning with the lower boundary of the ascending channel and recent swing lows. Resistance: Key resistance is expected near the upper boundary of the ascending channel around 149.640, coinciding with recent peaks that could challenge bullish momentum. Conclusion and Consideration: The USD-JPY H4 chart currently favors bullish continuation, supported by key technical indicators such as Parabolic SAR, RSI, and MACD, along with constructive price action within the ascending channel. However, market participants should remain cautious given today’s significant economic data and monetary policy announcements from both Japan and the United States, potentially increasing volatility. Monitoring key resistance and support levels will be essential to effectively manage trading positions. Disclaimer: The analysis provided for USD/JPY is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on USDJPY. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 07.31.2025 |

|

#443

|

||||

|

||||

|

EURGBP H4 Technical and Fundamental Analysis for 08.01.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis: Today, the EURGBP pair is likely to see moderate volatility as both the Euro (EUR) and British Pound (GBP) are influenced by several macroeconomic indicators. For the EUR, a flurry of economic releases including the Final and Flash PMIs, CPI (Consumer Price Index), and retail sales are scheduled. These are critical metrics for assessing economic health, particularly inflation and business activity across the Eurozone. Strong PMI or CPI figures could support a bullish case for the Euro if they exceed forecasts. On the GBP side, the focus is on the House Price Index and the S&P Global Manufacturing PMI. Any positive surprise from the UK housing or manufacturing data could boost the Pound, potentially applying downward pressure on EUR/GBP. Overall, the market could be reactive today, with traders adjusting their positions based on real-time data surprises from either side. Price Action: The EURGBP pair on the H4 chart has been moving in a clear bullish trend since early June, following a long-term ascending trendline. Recently, the price entered a short-term corrective phase, pulling back from the resistance area around 0.87600. However, after testing the strong support zone near 0.86100, the price action shows bullish rejection with consecutive green candles forming. Parabolic SAR dots have shifted below the candles, indicating a potential resumption of upward momentum. The EUR GBP price is currently attempting to retake lost ground and approach the resistance at 0.86800, a key barrier to further upside. Key Technical Indicators: Parabolic SAR: The Parabolic SAR has shifted from above to below the price for the past 5 spots, signaling a reversal of momentum back to the bullish side. This is often considered an early signal for a trend continuation, especially when paired with bullish candlestick patterns forming at major support levels. Moving Averages (MA9 Blue / MA17 Orange): Currently, the fast MA (9) is still below the slow MA (17), with both moving slightly downward. However, price action has pierced through the MA9, which is now starting to slope upward. If this short MA crosses above the long MA, it could trigger a bullish crossover, confirming further upside potential toward the 0.87600 resistance. MACD (12,26,9): The MACD histogram shows a bearish trend softening as it begins to rise back toward the zero line. The MACD line is at -0.001169 and the signal line at -0.001495, suggesting decreasing selling pressure. If momentum continues, a bullish crossover could occur in the next few sessions. RSI (14): The Relative Strength Index is at 46.51, recovering from near-oversold levels. This neutral-to-bullish positioning indicates the market has room to rise without being overbought, especially if supported by positive news or a breakout above key resistance. Support and Resistance: Support: The nearest key support level is seen around 0.86100, where the price recently bounced, aligning with historical price rejection zones and the lower bound of the bullish trend. Resistance: The next major resistance lies at 0.86800, a zone that may cap upward movement in the short term. A confirmed breakout above this level could open the path to 0.87600, the previous high. Conclusion and Consideration: In this EURGBP H4 technical and fundamental chart analysis, the pair remains within a broader upward trend, though it recently experienced a healthy pullback. The combination of technical signals—such as SAR shift, bullish price action at support, and a possible MACD reversal—suggests a potential continuation to the upside, especially if upcoming Eurozone data beats expectations. Caution remains warranted, however, as mixed fundamental results from either the Eurozone or the UK could shift short-term sentiment. Traders should monitor today's key macroeconomic releases closely to confirm price direction. Disclaimer: The analysis provided for EUR/GBP is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURGBP. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.01.2025 |

|

#444

|

||||

|

||||

|

GOLDUSD H4 Technical and Fundamental Analysis for 08.04.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis: Gold prices (XAU/USD) today could experience increased volatility due to important upcoming USD news releases. The Census Bureau will release data on U.S. Factory Orders, a key indicator measuring the total value of new purchase orders placed with manufacturers. An actual value greater than forecasted typically strengthens the USD, putting downward pressure on gold prices. Additionally, insights from the Federal Reserve's quarterly lending report, indicating confidence in lending and spending, could impact USD strength. Traders should closely monitor these releases, as stronger-than-expected data may weigh on gold prices, while weaker data could provide support. Price Action: The GOLDUSD H4 chart indicates a clear ascending triangle pattern, following a strong bullish uptrend. Recently, price action has respected the triangle’s bottom trendline and is currently moving toward the upper boundary. The presence of strong bullish engulfing candles and positive market momentum suggests a greater probability of an upward breakout, potentially extending the bullish trend. Key Technical Indicators: Parabolic SAR: On the H4 timeframe, Parabolic SAR dots are situated below the price, indicating a bullish momentum and supporting the likelihood of upward movement. Bollinger Bands: Bollinger Bands are widening, indicating increased volatility. The current price has surpassed the upper band, signaling strong bullish momentum. Traders should be cautious of short-term pullbacks, but overall conditions favor continued bullish action. RSI (Relative Strength Index): The RSI stands at 65.71, suggesting bullish strength but still below the overbought threshold of 70. This indicates that gold prices (XAU/USD) have room to continue rising before becoming overextended. MACD (Moving Average Convergence Divergence): The MACD line currently reads -0.595, with the signal line at -10.837, indicating an emerging bullish crossover. Although still negative, upward momentum is strengthening, suggesting a continuation of bullish pressure. Support and Resistance: Support: Immediate support is identified at approximately 3297.50, aligning with the ascending triangle’s bottom line and recent price consolidation. Resistance: Immediate resistance is located near the upper boundary of the ascending triangle, around 3459.00, representing recent highs and a significant psychological level. Conclusion and Consideration: The XAU/USD H4 technical analysis reveals a predominantly bullish outlook, supported by strong price action, bullish indicators such as the Parabolic SAR and Bollinger Bands, and increasing bullish momentum reflected by MACD and RSI. The ascending triangle pattern suggests a high probability of upward breakout. Traders should closely monitor today’s USD economic news, as data strength will significantly influence price volatility and momentum direction. Disclaimer: The analysis provided for XAU/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on XAUUSD. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.04.2025 |

|

#445

|

||||

|

||||

|

GBPUSD H4 Technical and Fundamental Analysis for 08.05.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis: The GBPUSD pair is subject to notable volatility today, given the release of key economic indicators for both currencies. For the British Pound (GBP), traders are closely watching the UK's Services PMI from S&P Global and results from the Debt Management Office's 10-year bond auctions. These indicators could heavily influence the GBP’s strength, reflecting current market conditions and investors' outlook on UK economic health. For the US Dollar (USD), attention will be drawn towards the trade balance report from the Bureau of Economic Analysis, as well as the Services PMI from both S&P Global and the Institute for Supply Management (ISM). These indicators could lead to volatility in the USD, impacting GBPUSD trading conditions significantly. Price Action: GBPUSD price action on the H4 chart indicates a predominant bearish trend. After a short reversal, bearish momentum resumed with notable strength. Each drop in price has been accompanied by minor and flat corrective phases. The most recent correction is sharper, currently hovering between Fibonacci retracement levels of 23.6% and 38.2%. Should these levels fail to contain the correction, the next critical resistance area lies at 1.33902, historically a zone with significant price reactions. The RSI divergence pattern suggests a likely continuation of the bearish trend. Key Technical Indicators: MACD (Moving Average Convergence Divergence): The MACD line stands at -0.002930, with the histogram level at -0.001413, indicating that bearish momentum persists but is currently weaker. Traders should monitor for potential crossovers signaling either continued bearish momentum or a reversal. RSI (Relative Strength Index): The RSI indicator currently hovers around the 50.36 level, signifying a neutral market sentiment. Given the RSI divergence with higher highs compared to the lower highs in price, traders should anticipate potential bearish continuation. Parabolic SAR: The Parabolic SAR dots are placed below the current candles, signaling the potential continuation of the correction phase. This indicator reinforces the likelihood of upward continuation unless reversed by a clear downward move. Support and Resistance: Support: Immediate support lies at the recent low around the 1.31730 level, serving as a crucial psychological and technical floor. Resistance: Immediate resistance is marked at 1.33902, aligning with significant historical price reactions and the Fibonacci retracement levels. Conclusion and Consideration: The GBPUSD technical and fundamental analysis for the H4 timeframe underscores ongoing bearish sentiment, supported by RSI divergence, MACD weakening bearish momentum, and Parabolic SAR alignment. The upcoming economic news from the UK and the US could significantly affect volatility and market direction. Traders should remain cautious, factoring in these fundamental releases to refine their strategies. Disclaimer: The analysis provided for GBP/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on GBPUSD. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.05.2025 |

|

#446

|

||||

|

||||

|

NZDUSD H4 Technical and Fundamental Analysis for 08.06.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis: Today's NZD/USD H4 technical and fundamental analysis is influenced by a significant wave of economic data from New Zealand and the United States. From the NZD side, market participants are closely watching employment figures, unemployment rates, and labor cost changes. These indicators are essential for understanding the health of New Zealand’s labor market, a crucial driver of consumer spending and inflation. While no releases are scheduled for today, anticipation builds for the next quarterly labor data in early November, potentially setting the tone for the NZD in the coming weeks. On the USD side, attention shifts to energy-related reports and monetary policy commentary. Crude Oil Inventory levels from the EIA, expected later this week, may impact overall risk sentiment and indirectly influence USD valuation. Moreover, FOMC members Lisa Cook and Susan Collins are scheduled to speak today. Their commentary could offer crucial insights into the Fed's monetary policy direction, influencing USD demand and NZD-USD exchange rates. Price Action: The NZD/USD price action on the H4 chart has shown a predominantly bearish trend. After a significant downward movement, the pair touched the 0.58565 support area, which coincides with the 0.0 Fibonacci retracement level. Following that, the price rebounded toward the 23.6% Fib level, struggling to establish a clear breakout. Despite forming three consecutive bullish (green) candles, the most recent candle has turned red, suggesting hesitation from the bulls at this critical resistance zone. The pair remains range-bound between the 0.58565 support and 0.58990 resistance, consolidating below the 38.2% Fibonacci retracement. Key Technical Indicators: Bollinger Bands: The NZD/USD price has been fluctuating between the lower and middle Bollinger Bands, indicating low volatility and range-bound behavior. After briefly touching the lower band, the price is attempting to break through the middle band, aligning with the 23.6% Fib level. However, the rejection shown by the red candle suggests resistance and potential consolidation unless a clear bullish breakout occurs. Parabolic SAR: The last four Parabolic SAR dots are aligned above the price candles, signaling a continuation of the bearish trend. Until the dots flip below the candles, momentum remains in favor of the bears, and traders may look for selling opportunities near resistance. RSI (Relative Strength Index): The RSI stands at 45.40, which is below the neutral 50 level, indicating slight bearish momentum. It is not in oversold territory, so there is still room for further downside before the market becomes technically oversold. MACD (Moving Average Convergence Divergence): The MACD line is at -0.000947, with the signal line at -0.001093, and the histogram is gradually turning positive. This could suggest that bearish momentum is weakening, and a potential crossover could occur soon. However, confirmation is required for a trend reversal signal. Support and Resistance: Support: Key support lies around 0.58565, which is aligned with the recent low and the 0.0 Fibonacci level, acting as a psychological and technical floor. Resistance: Immediate resistance is found at 0.59000, near the 23.6% Fibonacci retracement level and the middle Bollinger Band, forming a strong confluence area. Conclusion and Consideration: In today’s NZD/USD H4 chart forecast, the pair is attempting to recover from its recent lows but faces stiff resistance at the 23.6% Fibonacci retracement level. Technical indicators such as Bollinger Bands and Parabolic SAR suggest consolidation or potential downside continuation, while the RSI and MACD hint at possible bullish momentum buildup. Fundamental factors remain balanced, with upcoming U.S. central bank commentary and crude oil inventory data possibly tilting sentiment in favor of the USD. Traders should remain cautious and watch for a breakout from the current range to determine the next directional bias. Disclaimer: The analysis provided for NZD/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on NZDUSD. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.06.2025 |

|

#447

|

||||

|

||||

|

EURUSD H4 Technical and Fundamental Analysis for 08.07.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis: Today's EURUSD fundamental outlook shows significant market-moving events primarily from the USD side. Key releases include initial jobless claims from the Department of Labor, labor productivity and unit labor costs from the Bureau of Labor Statistics, and wholesale inventories from the Census Bureau. The market typically reacts positively to lower-than-expected initial jobless claims and labor productivity figures, as these signal economic strength. Additionally, Federal Reserve Bank of Atlanta President Raphael Bostic's fireside chat will draw close attention as investors look for insights into future monetary policy directions. For EUR, attention will focus primarily on upcoming trade balance and industrial output data from Destatis and economic bulletins from the ECB. Price Action: The EURUSD H4 price action demonstrates a strong bullish trend following a sharp reversal from previous bearish momentum. After an earlier consolidation phase, the EURUSD began another notable bullish impulse, breaking decisively above previous resistance levels. The latest candles, however, indicate a possible correction as traders secure profits, but based on Fibonacci retracement analysis, prices are likely to remain above the 23.6% retracement level before resuming bullish momentum. The key target for this bullish run is identified at 1.17682, a previously significant reactionary level. Key Technical Indicators: Williams %R: The indicator is hovering around the -9.10 level, suggesting the EURUSD H4 is currently in an overbought territory. Although this signals potential short-term pullbacks, the strong bullish momentum remains evident, and a slight correction is probable before further bullish moves. RSI (Relative Strength Index): The RSI indicator on the EURUSD H4 chart is currently hovering near 67.02, just below the overbought threshold of 70. This indicates that while bullish momentum remains robust, there's potential for minor consolidation or corrective moves to relieve bullish pressure before continuing upwards. Bollinger Bands: Bollinger Bands on EURUSD H4 have recently expanded, illustrating a strong bullish momentum and heightened volatility. Current price candles have reached the upper band, implying potential short-term retracement or sideways movement as the market consolidates gains before advancing further. Support and Resistance: Support: Immediate support aligns at the Fibonacci retracement level of 23.6% at around 1.15992, serving as a robust floor for potential retracement. Resistance: The primary resistance target stands firmly at 1.17682, reflecting historical price reaction significance. Conclusion and Consideration: EURUSD's H4 timeframe analysis indicates bullish dominance, supported by technical indicators like Williams %R, RSI, and Bollinger Bands. Short-term corrections are expected but likely limited above the 23.6% Fibonacci support. Traders should closely monitor today's USD economic releases and speeches from Fed representatives, as these could introduce volatility. EUR-specific data could provide additional directional cues. Disclaimer: The analysis provided for EUR/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURUSD. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.07.2025 |

|

#448

|

||||

|

||||

|

EURUSD H4 Technical and Fundamental Analysis for 08.07.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis: Today's EURUSD fundamental outlook shows significant market-moving events primarily from the USD side. Key releases include initial jobless claims from the Department of Labor, labor productivity and unit labor costs from the Bureau of Labor Statistics, and wholesale inventories from the Census Bureau. The market typically reacts positively to lower-than-expected initial jobless claims and labor productivity figures, as these signal economic strength. Additionally, Federal Reserve Bank of Atlanta President Raphael Bostic's fireside chat will draw close attention as investors look for insights into future monetary policy directions. For EUR, attention will focus primarily on upcoming trade balance and industrial output data from Destatis and economic bulletins from the ECB. Price Action: The EURUSD H4 price action demonstrates a strong bullish trend following a sharp reversal from previous bearish momentum. After an earlier consolidation phase, the EURUSD began another notable bullish impulse, breaking decisively above previous resistance levels. The latest candles, however, indicate a possible correction as traders secure profits, but based on Fibonacci retracement analysis, prices are likely to remain above the 23.6% retracement level before resuming bullish momentum. The key target for this bullish run is identified at 1.17682, a previously significant reactionary level. Key Technical Indicators: Williams %R: The indicator is hovering around the -9.10 level, suggesting the EURUSD H4 is currently in an overbought territory. Although this signals potential short-term pullbacks, the strong bullish momentum remains evident, and a slight correction is probable before further bullish moves. RSI (Relative Strength Index): The RSI indicator on the EURUSD H4 chart is currently hovering near 67.02, just below the overbought threshold of 70. This indicates that while bullish momentum remains robust, there's potential for minor consolidation or corrective moves to relieve bullish pressure before continuing upwards. Bollinger Bands: Bollinger Bands on EURUSD H4 have recently expanded, illustrating a strong bullish momentum and heightened volatility. Current price candles have reached the upper band, implying potential short-term retracement or sideways movement as the market consolidates gains before advancing further. Support and Resistance: Support: Immediate support aligns at the Fibonacci retracement level of 23.6% at around 1.15992, serving as a robust floor for potential retracement. Resistance: The primary resistance target stands firmly at 1.17682, reflecting historical price reaction significance. Conclusion and Consideration: EURUSD's H4 timeframe analysis indicates bullish dominance, supported by technical indicators like Williams %R, RSI, and Bollinger Bands. Short-term corrections are expected but likely limited above the 23.6% Fibonacci support. Traders should closely monitor today's USD economic releases and speeches from Fed representatives, as these could introduce volatility. EUR-specific data could provide additional directional cues. Disclaimer: The analysis provided for EUR/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURUSD. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.07.2025 |

|

#449

|

||||

|

||||

|

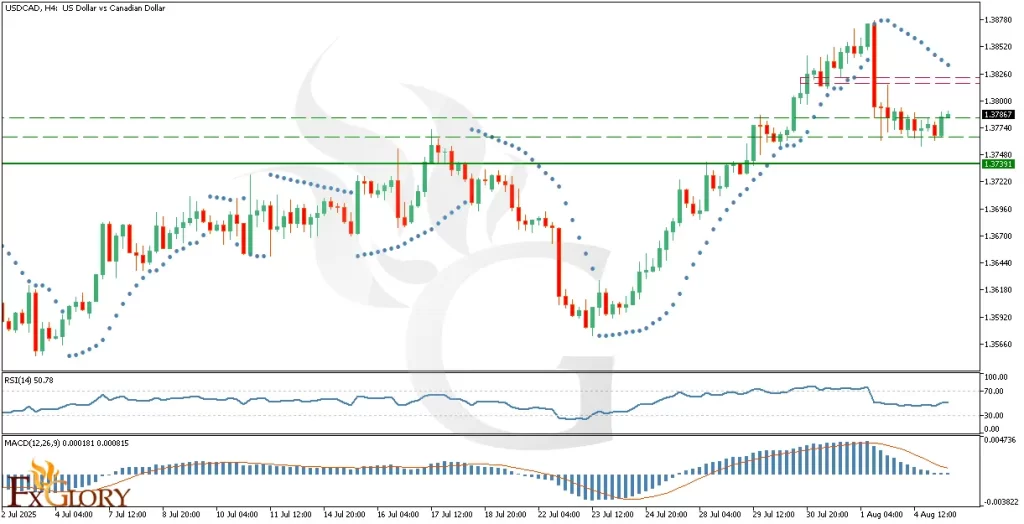

USDCAD H4 Technical and Fundamental Analysis for 08.08.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis: The USD/CAD currency pair could see increased volatility today as markets prepare for high-impact USD and CAD news releases. On the USD side, remarks from US President Donald Trump and Federal Reserve Bank of St. Louis President Alberto Musalem may influence expectations for fiscal policy and interest rate direction. Any hawkish language from the Fed could strengthen the USD. From the CAD side, key employment change and unemployment rate data will be released by Statistics Canada. Strong labor market results would likely boost the Canadian Dollar, putting downward pressure on USDCAD. Traders should monitor these events closely, as the combination of US political and monetary commentary with Canadian economic data could spark significant intraday moves. Price Action: After a sharp bullish rally, USDCAD broke its uptrend line with a strong bearish candle, pulling back into the previously broken zone near 1.37646. Price is currently consolidating around this level, signaling indecision between buyers and sellers. Given the recent momentum, the correction phase could be near completion. If buying pressure returns, the next upside target could be 1.38201, while further selling momentum could push the price toward 1.37391 as the next potential reversal point. Key Technical Indicators: Parabolic SAR: Last few dots are above the price, confirming the current bearish bias. However, the flatter alignment of recent dots suggests a slowdown in bearish momentum, which could pave the way for a bullish reversal if supported by fundamentals. RSI (14): The RSI is at 50.78, reflecting neutral conditions. The market is neither overbought nor oversold, leaving room for movement in either direction. MACD (12,26,9): With the MACD line at 0.000181 and the signal line at 0.000815, momentum appears to be weakening. The histogram is edging toward negative territory, aligning with the consolidation phase and hinting at potential bearish continuation unless buying volume increases. Support and Resistance: Support: Immediate support is located at 1.37646, which represents the current consolidation area and a previously broken level now acting as a test zone. Resistance: The nearest resistance level is at 1.38201, which aligns with recent highs and serves as the next upside target if bullish momentum resumes. Conclusion and Consideration: The USD-CAD H4 chart is showing a consolidation phase after breaking its bullish structure. Parabolic SAR remains bearish, RSI is neutral, and MACD indicates fading bullish momentum. With today’s US speeches and Canadian employment data ahead, traders should expect volatility spikes. A confirmed break above 1.38201 could signal a bullish continuation, while a drop below 1.37646 might open the way to 1.37391. Caution is advised, and confirmation from both technical and fundamental cues should guide trading decisions. Disclaimer: The analysis provided for USD/CAD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on USDCAD. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.08.2025 |

|

#450

|

||||

|

||||

|

ETH/USD H4 Technical and Fundamental Analysis for 08.11.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis Ethereum (ETHUSD) continues to show strong bullish sentiment, supported by the broader crypto market recovery and favorable macroeconomic conditions. Today, traders will closely watch the USD inflation expectations release from the Federal Reserve Bank of Cleveland. This quarterly survey gauges business managers' views on price changes over the next 12 months. If the actual figure surpasses forecasts, the US Dollar may strengthen, potentially adding short-term selling pressure on ETHUSD. However, Ethereum’s underlying fundamentals remain robust with sustained demand for decentralized applications (dApps) and Layer-2 scaling solutions, suggesting any dips could attract new buyers. Price Action After a prolonged consolidation phase, ETH-USD has surged aggressively, attacking its recent high near $4,140. The strong bullish impulse broke through previous resistance zones, with the price briefly touching $4,204 before pulling back slightly. This resistance level is significant, and although the first breakout attempt might face profit-taking, the momentum suggests that ETHUSD could eventually break above it and head toward its all-time high (ATH). The recent move is characterized by high volume and acceleration, indicating strong market participation from buyers. Key Technical Indicators Parabolic SAR: The last few Parabolic SAR dots are positioned well below the price, with the gap widening. This reflects strong bullish acceleration and sustained momentum, confirming the current uptrend in ETHUSD. RSI (14): Currently at 81.44, well above the overbought threshold of 70. This indicates strong buying pressure but also warns of a potential short-term correction before continuation. MACD (12,26,9): The MACD line at 105.099 is significantly above the signal line at 60.984, with widening histogram bars. This divergence between the two lines shows increasing bullish momentum and confirms the strength of the ongoing uptrend. Stochastic (5,3,3): With readings of 91 and 76, the Stochastic oscillator is in the overbought zone, signaling that while the bullish trend is strong, the market could be due for a short-term consolidation or minor pullback before another upward push. Support and Resistance: Support: Immediate support is located at 3,473.21, which aligns with the lower consolidation boundary and a previous price reaction zone. Resistance: The nearest resistance level is at 4,140.47, which coincides with the recent breakout point, followed by 4,204.37, marking the latest intraday high. Conclusion and Consideration The ETH-USD H4 chart shows a decisive breakout attempt from its recent consolidation, supported by strong bullish momentum across all major technical indicators. While the RSI and Stochastic suggest overbought conditions, the widening Parabolic SAR and bullish MACD divergence confirm the strength of the move. Traders should watch for a possible retest of $4,140 as support before another rally attempt toward $4,300–$4,400 and eventually the ATH. Given the upcoming USD inflation expectations release, short-term volatility is likely. A stronger USD may create temporary selling pressure, but Ethereum’s current trend and market structure remain bullish. Disclaimer: The analysis provided for ETH/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on ETHUSD. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.11.2025 Last edited by FXGLORY; 11-08-2025 at 02:54. |

|

#451

|

||||

|

||||

|

AUDUSD H4 Technical and Fundamental Analysis 08.12.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis The AUD-USD currency pair is currently influenced by mixed signals from both the Australian and US economic fronts. Today’s key upcoming AUD-related releases include the National Australia Bank (NAB) Business Confidence report, a leading indicator of business sentiment that can foreshadow future economic activity such as hiring and investment. Additionally, traders are awaiting further clarity from the Reserve Bank of Australia (RBA) regarding its interest rate outlook ahead of the September 30 meeting. From the US side, market focus will shift to the NFIB Small Business Index and later this week, the Consumer Price Index (CPI), which remains a major driver for Federal Reserve rate expectations. Speeches from Fed officials Thomas Barkin and Jeffrey Schmid could add volatility to USD pairs as traders seek clues on the next monetary policy steps. Price Action On the H4 chart, AUD USD has been trading within a long-term ascending trend channel following a recovery from its March low. Price is now locked in a sideways daily range within this upward channel, with the current battle occurring around the mid-line of the daily channel. The pair is showing hesitation, with momentum not strong enough to convincingly break above the mid-range resistance. If the bulls fail to secure this breakout, a retracement toward the lower trendline of the channel—and potentially the lower boundary of the sideways range—is likely. Conversely, a successful breakout could open the path toward the upper band of the daily range. Key Technical Indicators Bollinger Bands: The Bollinger Bands are narrowing, signaling a potential volatility squeeze. The price is currently testing the middle line of the Bands, which aligns with the mid-range resistance of the sideways channel. This compression suggests that a breakout move—either up or down—may occur soon, but given the weaker bullish momentum, the downside risk appears slightly higher. RSI (28): The Relative Strength Index is at 51.69, reflecting a neutral momentum state. This position shows neither overbought nor oversold conditions, which supports the case for potential range-bound trading in the near term. The RSI does not currently show strong bullish divergence, reinforcing the risk of a corrective move. MACD (24,52,12): The MACD main line (0.000523) is marginally above the signal line (0.000426), and the histogram has recently crossed above the zero line. While this suggests a mild bullish bias, the histogram’s low amplitude indicates that momentum is still weak and susceptible to reversal. A bearish crossover here could accelerate a drop toward support. Support and Resistance: Support: Immediate support is located at 0.6440, which aligns with the lower boundary of the short-term ascending channel and recent price consolidation area. Resistance: The nearest resistance level is at 0.6529, which coincides with the mid-line of the sideways daily channel and recent highs. Conclusion and Consideration The AUD/USD H4 chart shows a market at a critical juncture, trading at the mid-line resistance of a sideways daily channel within an ascending trend structure. While the narrowing Bollinger Bands point toward an upcoming breakout, the combination of a neutral RSI and a weak MACD histogram suggests the upside lacks conviction. This makes a downward correction toward 0.6440 more probable unless strong bullish momentum emerges. Traders should closely monitor today’s NAB Business Confidence report and speeches from US Fed officials for potential catalysts. Disclaimer: The analysis provided for AUD/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on AUDUSD. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.12.2025 |

|

#452

|

||||

|

||||

|

EURCAD H4 Technical and Fundamental Analysis for 08.13.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis: The EUR/CAD currency pair reflects the exchange rate between the Euro (EUR) and the Canadian Dollar (CAD). Today, the Euro’s performance is influenced by key German economic releases, including the Consumer Price Index (CPI) and Wholesale Price Index (WPI), which serve as leading inflation indicators. Higher-than-expected results could strengthen the Euro by reinforcing expectations for tighter European Central Bank policy. Additionally, the Bund Auction provides insight into investor sentiment toward Eurozone bonds. On the Canadian side, the market awaits the Bank of Canada (BOC) Minutes, which could reveal the central bank’s economic outlook and potential shifts in interest rate policy. Any hawkish tone may boost the CAD, creating increased volatility in EURCAD price action. Price Action: On the H4 chart, EURCAD is in a clear bullish trend, trading within a rising wedge pattern. The pair recently broke above short-term resistance, approaching the upper boundary near 1.61100. Price action shows strong upward momentum with the last three Parabolic SAR dots positioned below the candles, supporting the bullish bias. The short-term ascending trendline is acting as immediate support, while the longer-term trendline remains intact below the candles, confirming a broader bullish structure. Candles are riding along the upper Bollinger Band, which has started to expand, signaling increasing volatility and strong buying pressure. Key Technical Indicators: Bollinger Bands: EUR-CAD price is moving along the upper Bollinger Band, with bands widening, indicating rising volatility and a potential continuation of the bullish move. Sustained trading above the midline suggests ongoing buying interest. Parabolic SAR: The last three Parabolic SAR dots are positioned below the candles, confirming the current bullish trend. As long as price remains above these dots, upward momentum is expected to hold. Williams %R: The Williams %R is at -9.19, placing the market in overbought territory. This reflects strong bullish pressure but also signals that a short-term pullback or consolidation could occur. RSI (Relative Strength Index): The RSI stands at 65.64, below the overbought level of 70, indicating there is still room for further upward movement before market exhaustion. The RSI supports continued bullish price action but warrants caution for potential overextension. Support and Resistance: Support: Immediate support is seen at 1.60000, aligned with the short-term ascending trendline. Resistance: Key resistance is at 1.61100, with long-term resistance projected near 1.61490 at the wedge’s upper boundary. Conclusion and Consideration: The EUR CAD H4 analysis shows strong bullish momentum supported by technical indicators such as the Bollinger Bands, Parabolic SAR, Williams %R, and RSI. While the overall trend remains upward, overbought conditions suggest the potential for short-term retracement before any continued rally. Traders should closely monitor today’s Eurozone CPI, WPI, Bund Auction results, and the Bank of Canada Minutes for possible volatility spikes. Disclaimer: The analysis provided for EUR/CAD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURCAD. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.13.2025 |

|

#453

|

||||

|

||||

|

GBPUSD H4 Technical and Fundamental Analysis for 14.08.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis The GBPUSD currency pair is currently driven by anticipation of key economic data from both the UK and the US. For the Pound, traders are awaiting the RICS Housing Price Balance, a leading indicator of housing market trends, which could influence GBP sentiment if it beats or misses expectations. Later this week, UK GDP, Trade Balance, Industrial Production, and Manufacturing Production will be released, all of which could shape medium-term price direction. On the US side, the focus is on PPI inflation data and weekly jobless claims. Hawkish FOMC commentary could lift the USD, while softer data may encourage further GBP strength. Given the economic calendar, volatility in GBPUSD is expected to rise. Price Action The GBPUSD H4 chart shows a strong rebound from the broken support level at 1.31726, with price action trending higher toward the long-term uptrend line. If buyers succeed in breaking above this trendline, the next target is the 1.37820 resistance level. The Parabolic SAR remains firmly bullish, showing widening gaps below the price, which indicates accelerating buying pressure. However, with momentum oscillators in extreme overbought conditions, there is potential for a short-term pause before the next rally attempt. Key Technical Indicators Parabolic SAR: The dots are positioned below the current price and the gap between the dots and the candles has widened. This indicates that the bullish momentum is strengthening, supporting the possibility of further upside if resistance levels are broken. RSI (Relative Strength Index): The RSI is at 78.05, above the overbought threshold of 70. While this highlights strong bullish momentum, it also signals that the market could be overextended, increasing the likelihood of a pullback or consolidation. Stochastic Oscillator (5,3,3): The %K and %D readings are at 90.38 and 87.77, respectively, confirming extreme overbought conditions. This aligns with RSI warnings and suggests that while buyers are in control, short-term corrective moves cannot be ruled out. Support and Resistance Support: Immediate support is at 1.31726, which was previously a resistance zone and aligns with a recent price breakout area. Resistance: The nearest resistance is at 1.37820, which coincides with a key swing high and projected upside target if the uptrend line breaks. Conclusion and Consideration The GBPUSD H4 analysis suggests sustained bullish momentum, backed by strong price action and supportive technical indicators. However, with both RSI and Stochastic in overbought territory, the probability of short-term consolidation or retracement before testing 1.37820 is high. Traders should monitor today’s UK housing data and US inflation numbers closely, as these releases could be the catalysts for either a breakout continuation or a pullback toward support. Disclaimer: The analysis provided for GBP/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on GBPUSD. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.14.2025 |

|

#454

|

||||

|

||||

|

USDJPY H4 Technical and Fundamental Analysis for 08.15.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis The USD/JPY currency pair is currently influenced by a packed economic calendar for both the United States and Japan. For the JPY, traders are watching today’s GDP Deflator, Real GDP, and Industrial Production data from the Cabinet Office and METI. Stronger-than-expected Japanese growth or production figures may bolster the Yen by raising the prospect of tighter Bank of Japan policy. On the USD side, key data releases include Retail Sales, Core Retail Sales, Empire State Manufacturing Index, Import Price Index, Capacity Utilization, Industrial Production, and University of Michigan Consumer Sentiment. Positive results across these indicators would strengthen the USD by supporting a hawkish Federal Reserve stance, while weaker outcomes could dampen dollar demand. Given the heavy data flow, volatility in USDJPY is likely to remain elevated throughout the session. Price Action On the H4 timeframe, USD-JPY has been trending upward since mid-June 2025, respecting a strong ascending trendline. The pair recently tested this dynamic support at 146.70 and bounced higher, signaling renewed bullish pressure. This rebound keeps the sequence of higher highs and higher lows intact, pointing toward a possible move toward 151.60 in the medium term. The recent pullback appears corrective in nature, and the recovery suggests bullish continuation remains the dominant scenario. Key Technical Indicators Parabolic SAR: The most recent Parabolic SAR dots have flipped above the price and are widening, indicating that the prior bearish momentum is losing steam and that a bullish reversal is taking shape as the market reclaims the trendline. RSI (14): Currently at 54.04, the RSI has broken above the neutral 50 level from below, reflecting improving bullish momentum. This position still leaves room before reaching the overbought threshold (70), which supports the potential for further upside. MACD (24,52,12): The MACD line at -0.1612 and the signal line at -0.1022 remain in negative territory but are converging. This narrowing gap suggests weakening bearish momentum, and a bullish crossover could confirm the next leg higher toward the 151.60 resistance. Support and Resistance Support: Immediate support is located at 146.700, which aligns with the ascending trendline and a recent price rebound zone. A deeper correction could find the next support at 145.750, matching a previous consolidation area. Resistance: The nearest resistance level is at 149.450, which coincides with the last swing high before the recent retracement. A sustained breakout above this level could open the way toward 151.600, a key long-term resistance zone and previous peak. Conclusion and Consideration The USDJPY H4 chart remains structurally bullish, with price respecting the ascending trendline and indicators signaling potential momentum recovery. RSI’s move above 50, the Parabolic SAR shift, and MACD’s potential bullish crossover all align with the possibility of an advance toward 149.45 and, if broken, the 151.60 resistance. However, today’s multiple high-impact data releases from both the US and Japan could trigger sharp intraday swings. Traders should manage positions carefully and consider volatility when setting stop-loss and take-profit levels. Disclaimer: The analysis provided for USD/JPY is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on USDJPY. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.15.2025 |

|

#455

|

||||

|

||||

|

EURUSD H4 Technical and Fundamental Analysis for 08.18.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis The EUR-USD exchange rate remains sensitive to macroeconomic releases for both the Euro and the US. Today’s calendar shows the Eurostat Trade Balance for the eurozone and the NAHB Housing Market Index for the US as the closest scheduled items — Eurostat’s trade balance printed stronger-than-expected would be bullish for EURUSD, while a surprise upside in the NAHB index would favor the USD and could weigh on EURUSD. Overall, absent large surprises, these releases usually generate muted moves on the H4 timeframe, but an outsized surprise can amplify intraday volatility. Traders using fundamental analysis EURUSD should monitor these prints alongside market positioning and rate-expectation commentary to judge the next directional impulse. Price Action The EURUSD H4 price action shows a renewed bullish structure after a deep correction: the pair has formed higher lows and is now approaching the prior double-top area around 1.18000. Recent candles demonstrate controlled bullish pressure rather than explosive breakouts, suggesting accumulation and a tactical long bias while respecting resistance. The key short-term battle is at the double-top: a clean rejection increases the chance of a retracement to 1.16116, whereas a decisive breakout above 1.1800 with follow-through would validate continuation toward the longer-term monthly resistance near 1.20400. This price action EURUSD H4 view supports selective long entries on pullbacks into proven support, with stops placed beyond the H4 invalidation levels. Key Technical Indicators Parabolic SAR: The latest Parabolic SAR dot is below the price, indicating the current H4 trend is bullish. The PSAR confirms upside momentum and can be used as a trailing stop; a flip of the dots above price would be an early sign of trend exhaustion or a deeper pullback. RSI (14): RSI sits at ~61.8, showing bullish bias with room before classical overbought (70). The upward slope supports continuation, but traders should watch for RSI stalling or bearish divergence as a warning of weakening momentum in the EURUSD H4 technical analysis. Stochastic (5,3,3): Stochastic readings are ~86.37 / 87.60, clearly in overbought territory. This increases the likelihood of a near-term consolidation or pullback even in an uptrend. A bearish %K/%D crossover on the H4 stochastic would be a useful timing signal for short-term sellers or for traders to scale out of longs. Support and Resistance Support: Immediate support is located at 1.16116, which aligns with the recent H4 consolidation area and short-term swing lows; secondary support sits near 1.13850, corresponding to the lower H4 swing and deeper correction zone. Resistance: The nearest resistance level is at 1.18000, which coincides with the prior double-top zone and the last two highs; the next major resistance / monthly target is around 1.20400, aligning with the longer-term monthly resistance line. Conclusion and Consideration EUR/USD on the H4 chart shows a bullish structural trend supported by Parabolic SAR and RSI, while Stochastic’s overbought reading cautions about short-term retracements. The immediate tactical plan: favor buy-on-dip entries toward the 1.16116 support with targets into 1.18000; if price breaks and holds above 1.18000, consider the path open toward the 1.20400 monthly resistance. Conversely, a decisive break below 1.16116 would signal a deeper correction and shift the bias lower toward the 1.13850 zone. Always combine this technical and fundamental chart daily analysis with the incoming Eurostat and NAHB headlines, watch for order flow confirmation, and size positions conservatively given potential news-driven spikes. Disclaimer: The analysis provided for EUR/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURUSD. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.18.2025 |

|

#456

|

||||

|

||||

|

NZDUSD H4 Technical and Fundamental Analysis for 08.19.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis The NZDUSD pair remains sensitive to both New Zealand domestic data and US macro/newsflow. On the NZD side, upcoming Producer Price Index (PPI) releases and the twice-monthly GlobalDairyTrade (GDT) auction are relevant — stronger-than-expected PPI or higher dairy auction prices would support the NZD via inflation and export-income channels. For the USD, headline events this week include monthly Residential Building Permits and Housing Starts (Census Bureau), Federal Reserve Governor Michelle Bowman speaking (possible hawkish cues), and weekly API/EIA energy reports; stronger housing or hawkish Fed commentary typically strengthens the USD and can push NZD-USD lower. Overall, the macro backdrop currently favours risk-off/skittish flows into the USD if US prints surprise to the upside, while NZD remains vulnerable to commodity and PPI surprises. Price Action The H4 price action shows the pair entrenched in a long-term downtrend with a clear sequence of lower highs and lower lows. Recently the market has been consolidating between the nearest support area around 0.58934 and short-term resistance near 0.59547, forming a shallow range after a bearish impulse. Candles are trading below the moving average line, which is acting as dynamic resistance; failed attempts to close above 0.59547 point to sellers defending the earlier resistance line. Given the structure, any upward retracement would first test 0.59547 and then the long-term descending resistance near 0.61180, while renewed selling pressure risks a drop back to 0.58934 and ultimately the historical support zone around 0.56602. Key Technical Indicators Moving Average (9): Price is trading below the H4 moving average, which is sloping downward and acting as dynamic resistance, rallies have been capped at the MA. Until price closes convincingly above the MA, expect sellers to remain in control and treat rallies as shorting opportunities. RSI (14): Momentum is mildly bearish but not extreme, sitting around 43.78, which is below the 50 midpoint yet far from oversold. This leaves room for further downside while still allowing for a retracement if RSI moves back above 50. MACD (12,26,9): Momentum is weak with the MACD and signal lines nearly overlapping (MACD ≈ -0.000558, Signal ≈ -0.000541), yielding a small negative histogram. Wait for a clear crossover or histogram expansion aligned with price structure before taking directional trades. Support and Resistance Support: Near-term support sits at 0.58934, the recent swing low and short-term demand zone where buyers previously defended prices, with a deeper structural floor at 0.56602 that would act as the next major support if selling intensifies. Resistance: Immediate resistance is at 0.59547, a congestion zone and the first upside hurdle for any retracement, while the long-term descending trendline around 0.61180 represents the larger supply area that must be cleared to shift the bearish bias. Conclusion and Consideration NZD/USD on the H4 timeframe remains in a structural downtrend; technical indicators (MA, RSI, MACD) all lean mildly bearish to neutral and the pair is consolidating under the moving average. Shorter intraday traders can look for reliable setups near the 0.58934 support for counter-trend scalps with tight stops, but trend-following traders should favour short opportunities on rallies toward 0.59547 or the dynamic MA, targeting a move back toward 0.58934 and, if momentum accelerates, 0.56602. Fundamental catalysts (US Building Permits/Housing Starts, Fed Gov. Bowman remarks, NZ PPI and GDT dairy results) could spark volatility — plan entries around confirmed price action signals and prioritize risk management. Disclaimer: The analysis provided for NZD/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on NZDUSD. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.19.2025 |

|

#457

|

||||

|

||||

|

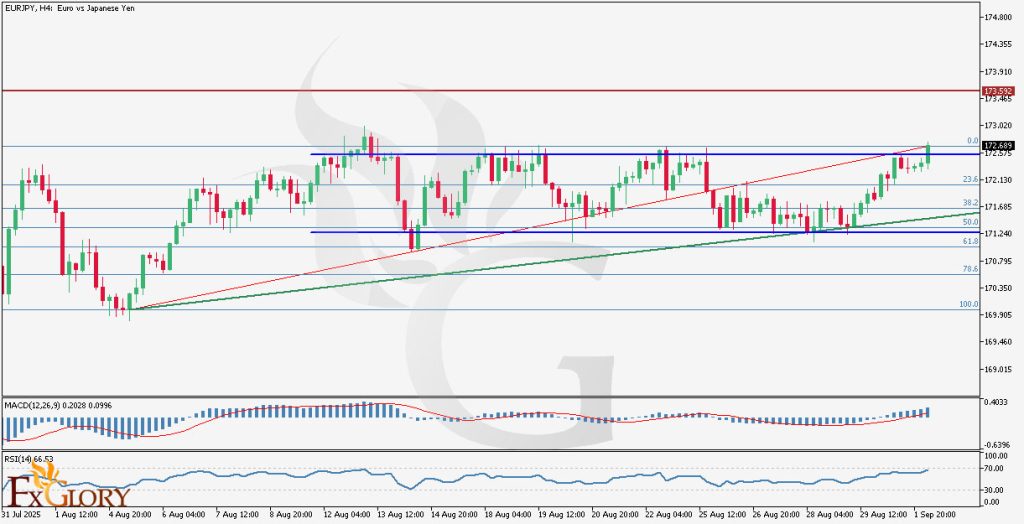

EURGBP H4 Technical and Fundamental Analysis for 08.20.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis: The EUR-GBP exchange rate remains highly reactive to inflation prints and central bank communication on both sides. Today’s focus is on the UK Consumer Price Index release from the Office for National Statistics and the scheduled speech by ECB President Christine Lagarde. A stronger-than-expected CPI reading would be bullish for the pound, potentially weighing on EURGBP, while any hawkish tone from Lagarde regarding Eurozone inflation and rates could support the euro and lift the cross. Historically, UK CPI tends to generate more immediate volatility than ECB speeches on the H4 timeframe, though sharp policy hints from Lagarde can create outsized swings. Traders analyzing EURGBP through fundamentals should watch these events closely, as they may shape near-term rate expectations and directional momentum. Price Action The EURGBP H4 chart shows signs of a completed bullish phase, with price failing to sustain the prior highs near 0.87200 and instead breaking lower into the 0.86200–0.86500 support zone. Recent candles reflect sideways consolidation with limited upside momentum, suggesting exhaustion of the earlier bullish trend. The immediate structure indicates that 0.86540 acts as key resistance, where repeated rejections highlight sellers defending the level. A sustained rejection here could reinforce downside continuation toward 0.86200, while only a decisive breakout above 0.86540 with follow-through would reopen the path toward 0.87200. Overall, this H4 price action favors cautious short setups below resistance, with stops placed above the recent rejection zone. Key Technical Indicators MACD (24,52,12): The MACD histogram is still in negative territory, though showing early signs of contraction as the bars turn less negative. This suggests bearish momentum is slowing but not yet reversed. A bullish crossover of the signal line would confirm momentum shifting, while continued weakness would reinforce downside bias. RSI (14): RSI currently sits near 50.5, reflecting neutral momentum after the prior down-leg. This midpoint reading signals indecision, with neither buyers nor sellers in control. A break above 60 would tilt bias bullish toward recovery, while a drop under 40 would favor continuation of the bearish structure. Support and Resistance Support: Immediate support is at 0.86230, aligning with the recent H4 swing low; secondary support lies near 0.85830, marking the lower correction zone. Resistance: The nearest resistance is 0.86540, defined by multiple recent rejections; the next level is 0.86760, coinciding with the upper H4 range. Conclusion and Consideration In summary, EURGBP on the H4 timeframe is currently caught between key fundamental catalysts and a technically vulnerable structure. With the pair consolidating below 0.86540 resistance and showing signs of bullish exhaustion, the bias leans slightly bearish unless buyers can force a decisive breakout above this level. The upcoming UK CPI release and ECB President Lagarde’s speech will likely provide the volatility needed for a clearer directional move. Until then, traders may favor cautious short positions below resistance while monitoring fundamental developments for potential momentum shifts. Overall, the balance of risks suggests a watchful stance, with downside continuation more probable unless strong Euro-driven catalysts emerge. Disclaimer: The analysis provided for EUR/GBP is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURGBP. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.20.2025 |

|

#458

|

||||

|

||||

|

GBPUSD Technical and Fundamental Analysis for 08.21.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis The GBPUSD currency pair is anticipating significant volatility due to today's scheduled economic events. For GBP, investors will closely monitor the public sector net borrowing data from the Office for National Statistics, which will indicate fiscal stability. Furthermore, the manufacturing and services PMI figures from S&P Global and the CBI Industrial Trends Survey are critical for assessing the UK's economic outlook. For the USD, traders will focus on Federal Reserve Bank of Atlanta President Raphael Bostic's speech and key economic indicators such as Initial Jobless Claims, Manufacturing and Services PMI, Philadelphia Fed Manufacturing Index, and Existing Home Sales. These events collectively could induce notable volatility in GBPUSD, guiding future monetary policy expectations. Price Action Analyzing GBPUSD in the H4 timeframe reveals a persistent bullish trend since 2022. Recently, the price successfully breached the resistance line of the most recent correction and is currently testing a significant support zone around 1.34568. The price action indicates potential bullish momentum towards the recent high at 1.37600. The proximity of RSI to oversold levels (near 30) further supports expectations for a reversal and continuation of the bullish trend. Key Technical Indicators RSI (14): Currently at 36.39, RSI is approaching oversold territory, suggesting that GBPUSD may soon experience a bullish reversal. Traders should be prepared for potential buying opportunities as the RSI crosses upward from the 30 level. MACD: The MACD is currently showing readings of -0.001429 and -0.000760. Although still negative, the narrowing gap between the MACD line and the signal line suggests weakening bearish momentum, setting the stage for a potential bullish crossover. Stochastic Oscillator: Stochastic values at 17.72 and 31.81 indicate the currency pair is significantly oversold. Such conditions typically precede a bullish reversal, highlighting favorable conditions for GBPUSD longs. Support and Resistance Levels Support: Immediate strong support is observed at the current price level of approximately 1.34568. Below this, the next critical support lies around the 1.34100 zone. Resistance: The nearest resistance levels are found at 1.35820, followed by the significant psychological barrier at 1.37600, representing the recent major high. Conclusion and Consideration The technical analysis of GBPUSD in the H4 timeframe indicates favorable conditions for a bullish reversal from the current support zone. Key technical indicators like RSI, MACD, and Stochastics reinforce the bullish outlook, especially as price nears oversold conditions. However, traders must remain cautious given the potential market volatility from today's key economic data releases affecting both GBP and USD. It's advisable to await confirmed bullish signals before committing to long positions. Disclaimer: The analysis provided for GBP/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on GBPUSD. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.21.2025 |

|

#459

|

||||

|

||||

|

GOLDUSD H4 Technical and Fundamental Analysis for 08.22.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis: The gold market is currently influenced by ongoing USD strength expectations, driven by scheduled speeches from key Federal Reserve officials including Jerome Powell, Susan Collins, and Beth Hammack. Hawkish statements on monetary policy and economic outlook from these FOMC members could support USD appreciation, placing downward pressure on gold prices in the short term. Moreover, global inflation concerns and safe-haven demand for gold continue to influence the XAU/USD market, making it sensitive to both USD fluctuations and geopolitical risks. Traders should closely monitor these speeches for indications of interest rate changes that may impact gold’s price action on H4 and daily charts. Price Action: On the H4 chart, gold is showing a short-term bearish trend after testing the upper Bollinger Band and the 50% Fibonacci retracement level, which acted as strong resistance. The price has since moved toward the middle Bollinger Band and the 38.2% Fibonacci retracement level, indicating consolidation within the current range. The market is forming a symmetrical triangle pattern, with higher lows and lower highs, suggesting that a breakout from these trendlines could define the next directional move. Currently, gold is reacting to established support and resistance levels, and traders should observe whether the upper or lower trendline breaks. Key Technical Indicators: Bollinger Bands: Gold’s price recently reached the upper Bollinger Band and retraced toward the middle band, signaling short-term bearish momentum. The bands are moderately wide, indicating average volatility in the H4 timeframe. The price respecting both the upper and middle bands confirms the relevance of these levels in guiding intraday trades. MACD (Moving Average Convergence Divergence): The MACD line is at -0.673 and the signal line at -2.501, indicating bearish momentum in the short term. The histogram suggests a slight recovery but the overall trend remains negative, supporting a cautious approach for potential short trades. RSI (Relative Strength Index): The RSI is currently at 49.87, moving horizontally near the neutral zone. This indicates neither overbought nor oversold conditions, suggesting the market is consolidating and could respond sharply once a breakout from the triangle pattern occurs. Support and Resistance Support: Immediate support is near 3333.00, aligning with the 38.2% Fibonacci retracement level, with secondary support around 3330.00, marking a key area of prior consolidation. Resistance: The nearest resistance zone is between 3350.00 and 3355.00, coinciding with the 50% Fibonacci retracement level and the upper Bollinger Band, providing strong potential selling pressure. Conclusion and Consideration: Gold on the H4 chart is currently in a consolidation phase within a symmetrical triangle pattern. Short-term bearish momentum is observed, supported by the retracement from the upper Bollinger Band and MACD readings. Traders should watch key trendline breaks and upcoming USD-related news for directional confirmation. A break above 3355 could signal bullish momentum, while a drop below 3320 could accelerate the bearish trend. Market participants must remain cautious given the high volatility potential from upcoming speeches by Federal Reserve officials. Disclaimer: The analysis provided for GOLD/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on GOLDUSD. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.22.2025 |

|

#460

|

||||

|

||||

|

USDCAD Daily Technical and Fundamental Analysis for 08.26.2025

Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis The USD-CAD pair reflects the exchange rate between the US Dollar (USD) and the Canadian Dollar (CAD). Today, significant volatility can be expected in USD-related pairs due to multiple key events. Federal Reserve Bank of New York President John Williams and Richmond President Thomas Barkin are scheduled to speak, potentially impacting monetary policy sentiment. Data on Durable Goods Orders excluding transportation items will be closely watched as they serve as leading indicators for manufacturing activity. Additionally, Bank of Canada Governor Tiff Macklem's speech on flexible inflation targeting at the Bank of Mexico Centennial Conference could induce CAD volatility. Traders should remain cautious and alert to sudden market moves. Price Action The USD/CAD pair has shown a clear bullish price action on the H4 timeframe. After maintaining an overall uptrend since mid-2021, the recent correction to Fibonacci retracement levels between 38.2% and 50% appears to have completed. Price has rebounded decisively, signaling a continuation of the bullish momentum. The market is currently aiming at the 23.6% Fibonacci retracement level, but the psychological resistance zone at 1.40000 remains a critical test ahead. Traders should closely monitor candlestick patterns around this key resistance for potential reversals or continuations. Key Technical Indicators RSI (28): Currently at 53.4, the RSI indicates balanced market conditions, with neither overbought nor oversold levels present. This mid-level position allows ample room for the price to move higher, supporting the potential continuation of the bullish trend in USD CAD. MACD (24,52,12): With values of 0.001697 and 0.002648, the MACD indicator shows bullish momentum, as the MACD line remains above the signal line. The positive histogram further confirms sustained bullish pressure. Traders should monitor the MACD closely for any divergence signs that might indicate a weakening trend. Support and Resistance Support: Immediate support stands at the 1.3750 Fibonacci level, aligned with recent swing lows and the previous correction bottom. Resistance: Key resistance is located at the psychological 1.4000 level, a major barrier that could potentially halt or slow down bullish momentum before price reaches the Fibonacci 23.6% retracement. Conclusion and Consideration The USD VS. CAD H4 chart analysis suggests a bullish outlook supported by current fundamental factors, recent price action, and technical indicators. Price action has returned to its broader uptrend after a healthy Fibonacci correction, with indicators pointing towards further bullish potential. However, traders must exercise caution due to today's high-impact speeches and durable goods data, potentially introducing market volatility. Disclaimer: The analysis provided for USD/CAD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on USDCAD. Market conditions can change quickly, so staying informed with the latest data is essential. FXGlory 08.26.2025 |

|

#461

|

||||

|

||||

|

GBPUSD H4 Technical and Fundamental Analysis for 08.27.2025