EUR/USD: Current dynamics

15/04/2019

The dollar fell by the end of last week. On Friday, the DXY dollar index closed with a 0.2% fall, at 96.97. According to the minutes of the March meeting of the American central bank, the Fed leaders are concerned about the slowdown in global economic growth, which threatens to worsen the situation in the US economy. It follows from the protocols that the leaders of the central bank do not see the conditions for a further increase in interest rates.

At the same time, US President Donald Trump reiterated his criticism of the Federal Reserve System, stating that "quantitative tightening was a murderer, the opposite should have been done". On Sunday, Trump tweeted that the economy and the stock market could have grown faster, "if the Fed had done its job properly".

On Monday, the dollar continues to decline, while DXY dollar index futures traded at the beginning of the European session near the 96.45 mark, 10 points lower than the opening price of the trading day.

On Monday, the publication of important macro data is not planned. Probably, trading in financial markets will be more relaxed than at the end of last week, which was full of important political and economic events.

Investors will also be less active on the eve of the Catholic Easter celebration this Sunday.

Meanwhile, the euro also remains under pressure after the ECB meeting last week. The ECB reported that the rate hikes before next year should not be expected, and the head of the European Central Bank, Mario Draghi, warned that the rate of economic growth in Europe this year will continue to decline. Mario Draghi last Wednesday signaled the possibility of implementing new measures to support the European economy in the event of a deterioration in its prospects.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Trading scenarios

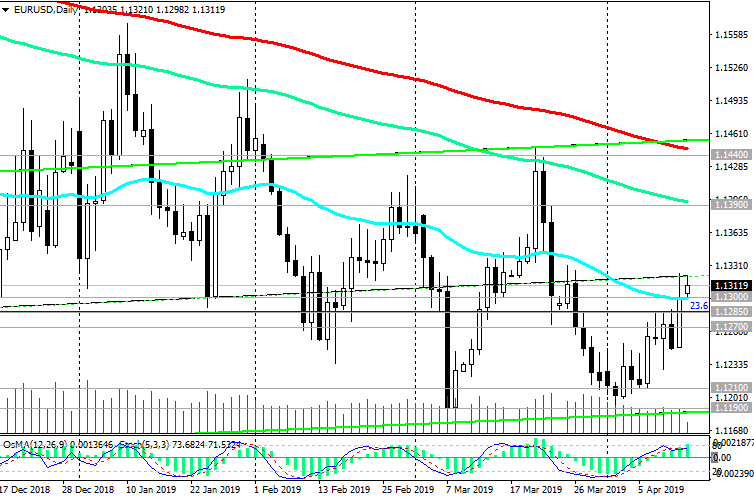

Against the background of the weakening dollar, the EUR / USD pair rose sharply last Friday, updating the 3-week high near the 1.1323 mark.

On Monday, the Eurodollar attempted to develop an upward movement, trading in the first half of the trading day above the support level of 1.1300 (EMA50 on the daily chart). Nevertheless, the Eurodollar failed to update the local and Friday maximum.

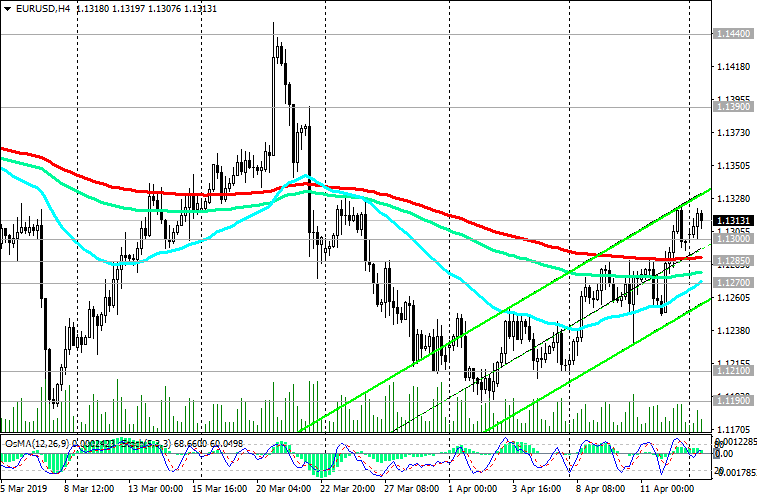

The OsMA and Stochastic indicators turned to short positions on the 4-hour and 1-hour charts.

Return under support level 1.1300 will be a signal for the resumption of short positions.

The breakdown of support levels of 1.1285 (Fibonacci level 23.6% of the correction to the fall from the level of 1.3900, which began in May 2014), 1.1270 (ЕМА200 per 1-hour chart) will confirm the scenario for the resumption of the EUR / USD decline.

The targets for reducing EUR / USD are at the support levels of 1.1210 (November lows), 1.1190 (March and year lows), 1.1120, 1.1000.

The growth scenario will be associated with the updating of the local maximum of 1.1323, which will create prerequisites for a stronger upward correction to the resistance levels of 1.1390 (EMA144), 1.1440 (EMA200 on the daily chart).

Support Levels: 1.1300, 1.1285, 1.1270, 1.1255, 1.1210, 1.1190, 1.1120, 1.1000

Resistance Levels: 1.1323, 1.1390, 1.1440

Trading recommendations

Sell in the market. Stop-Loss 1.1330. Take-Profit 1.1285, 1.1270, 1.1255, 1.1210, 1.1190, 1.1120, 1.1000

Buy Stop 1.1330. Stop Loss 1.1270. Take-Profit 1.1370, 1.1390, 1.1440

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com