|

Forex Forums | ForexLasers.com |

|

|||||||

|

|

|

LinkBack | Thread Tools | Search this Thread |

|

#1

|

||||

|

||||

|

Trading recommendations:

The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 192.20. A break of that target will move the pair further downwards to 191.95. The pivot point stands at 193.85. In case the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 194.55 and the second target at 191.95. Resistance levels: 194.55 194.95 195.30 Support levels: 192.20 191.95 191.35  |

|

#2

|

||||

|

||||

|

Overview

The GBP/JPY pair remains neutral for consolidation above a temporary low of 180.36. Further decline is expected as long as resistance at 187.36 holds. Below 180.36 will target the key support level of 174.86. However, a decisive breakout of 187.36 will shift the focus back to resistance of 195.26. A breakout of the mid-term trend line support is taken as a sign of trend reversal. This is supported by bearish divergence condition in the weekly MACD. Also, GBP/JPY came close to key cluster resistance of 61.8% retracement of 251.09 to 116.83 at 199.80, which is close to the psychological level of 200. A break of 174.86 will confirm trend reversal and result in a deeper fall to 38.2% retracement of 116.83 to 195.86 at 165.67

|

|

#3

|

||||

|

||||

|

Trading recommendations:

The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. As long as the price holds above its pivot point, long positions are recommended with the first target at 188.45 and the second target at 189. In the alternative scenario, short positions are recommended with the first target at 185.70 if the price moves below its pivot points. A break of this target is likely to push the pair further downwards, and one may expect the second target at 185.90. The pivot point is at 186.60. Resistance levels: 188.45 189 189.95 Support levels: 185.70 184.90 184.10  [IMG]www.instaforex.com[/IMG]

|

|

#4

|

||||

|

||||

|

GBP/JPY is expected to trade in a lower range as the pair is under pressure now. The pair is consolidating below its 20-period and 50-period MAs. A further decline is expected. The downside prevails, as long as the nearest key resistance at 184.15 holds on the upside. Furthermore, the intraday RSI is negative below its neutrality area of 50. Therefore, our next down targets are set at 182.60 and 182 (Fibonacci projection).

Trading recommendations: The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 182.60. A breakout of that target will move the pair further downwards to 182. The pivot point stands at 184.15. In case the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 184.95 and the second target at 186.  |

|

#5

|

||||

|

||||

|

GBP/JPY is expected to trade with a bullish bias. The pair posted strong rebound yesterday following the break above its key resistance at 183.25 (the upper boundary of its previous trading range). The upside room has been opened towards 184.85. Besides, the rising 20-period and 50-period MAs also confirmed a positive outlook. The intraday RSI shifted to bullish. In that case, as long as 183.25 is not broken, watch for further advance to 184.85 and 185.40.

Trading recommendations: The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. As long as the price holds above its pivot point, long positions are recommended with the first target at 184.85 and the second target at 185.40. In the alternative scenario, short positions are recommended with the first target at 182.70 if the price moves below its pivot points. A break of this target is likely to push the pair further downwards, and one may expect the second target at 182. The pivot point is at 183.25.  |

|

#6

|

||||

|

||||

|

GBP/USD is expected to trade with a bullish bias above 183. According to the chart, the pair stands firmly above its intraday support at 183. It is expected to post a new bounce to challenge 184.40. The RSI indicator is headed up jumping above its neutrality area of 50, which should confirm a positive bias. So, as long as 183 holds on the downside, a new rise to 184.40. and 184.85 seems to be on the cards.

Trading recommendations: The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. As long as the price holds above its pivot point, long positions are recommended with the first target at 184.30 and the second target at 184.85. In the alternative scenario, short positions are recommended with the first target at 182.30 if the price moves below its pivot points. A break of this target is likely to push the pair further downwards, and one may expect the second target at 181.80. The pivot point is at 183  |

|

#7

|

||||

|

||||

|

GBP/JPY is expected to trade with bullish bias. The pair is well supported by its rising 50-period intraday MA and remains on the upside. The 20-period MA also stays above the 50-period one, which confirms a bullish bias. The intraday RSI is above its 50% neutrality area. Further upside is therefore expected with the next horizontal resistance and overlap set at 184.60 at first. A break above this level would call for further advance towards 185.80 in extension.

Trading recommendations: The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. As long as the price holds above its pivot point, long positions are recommended with the first target at 185.80 and the second target at 185.80. In the alternative scenario, short positions are recommended with the first target at 184.05 if the price moves below its pivot points. A break of this target is likely to push the pair further downwards, and one may expect the second target at 183.60. The pivot point is at 184.60.  |

|

#8

|

||||

|

||||

|

GBP/JPY is expected to trade in a lower pressure. The pair stays below its key resistance at 183.50 and remains under pressure. The 20-period moving average has crossed below the 50-period one. Meanwhile, the relative strength index lacks upward momentum. The first target to the downside is seen at the horizontal support overlapping at 182.10. A breakout below this level would open the way to further weakness toward 181.70.

Trading recommendations: The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 182.10. A break of that target will move the pair further downwards to 181.70. The pivot point stands at 183.50. In case the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 184.10 and the second target at 184.50.  |

|

#9

|

||||

|

||||

|

The GBP/JPY pair is under pressure. The pair stays below its key resistance at 182.45 and is capped by its descending 20-period moving average. Meanwhile, the relative strength index lacks upward momentum. The first target to the downside is set at the horizontal support and overlap at 181.05. A breakout below this level would open the way to further weakness toward 180.20.

Trading recommendations: The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 181.05. A break of that target will move the pair further downwards to 180.20. The pivot point stands at 182.45. In case the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 183.15 and the second target at 183.75.  |

|

#10

|

||||

|

||||

|

The GBP/JPY pair stays above its key support at 161.85 and remains choppy. Meanwhile, the relative strength index is mixed to bullish. The first target is set at the horizontal resistance and overlaps at 164.80. A breakout above this level would open the way to further rise towards 165.90.

Trading Recommendations: The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 164.80 and the second one at 165.90. In the alternative scenario, short positions are recommended with the first target at 161 if the price moves below its pivot points. A breakout of this target is likely to push the pair further downwards, and one may expect the second target at 159.80. The pivot point is set at 161.85.  |

|

#11

|

||||

|

||||

|

GBP/JPY is set to a further advance. The pair validated an intraday "V"-bottom pattern, and is now heading upward. The 20-period moving average turned up, and also crossed above the 50-period one, which should be a strong positive signal. Moreover, the relative strength index is bullish above its neutrality area at 50. Looking ahead, as long as 160.30 remains support, look for a new rise to 162.45 and 163.25 in extension.

Trading Recommendations: The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 162.45 and the second one at 163.25. In the alternative scenario, short positions are recommended with the first target at 159.80 if the price moves below its pivot points. A break of this target is likely to push the pair further downwards, and one may expect the second target at 159.35. The pivot point is at 160.30.  |

|

#12

|

||||

|

||||

|

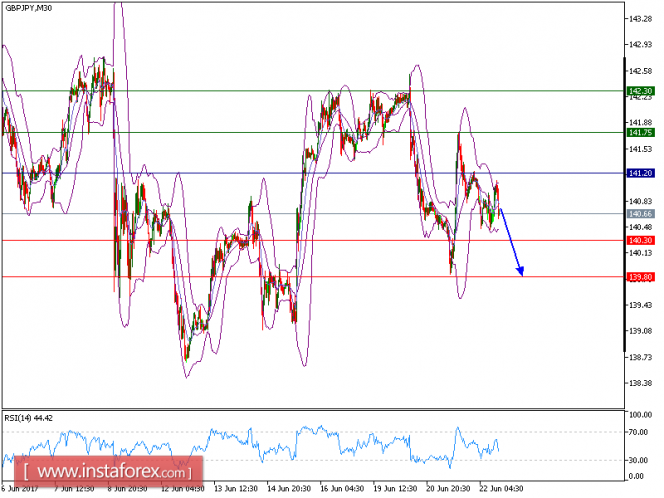

GBP/JPY is expected to trade in a higher range. The pair is holding on the upside after it has broken above a bearish trend line. Meanwhile, the relative strength index is bullish above its neutrality area at 50 and calls for further advance. Both the 20-period and 50-period moving averages are heading upward and act as support. To sum up, as long as 139.90 holds on the downside, look for further rise to 142.45 and even 143.25 in extension.

The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 142.45 and the second one, at 43.25. In the alternative scenario, short positions are recommended with the first target at 39.30, if the price moves below its pivot points. A break of this target is likely to push the pair further downwards, and one may expect the second target at 138.30. The pivot point is at 139.90.  |

|

#13

|

||||

|

||||

|

Overview

The GBP/JPY pair showed more sideways trading consolidating around 127.25 levels yesterday due to a lack of negative momentum until this moment. The bearish scenario depends on stability of the 129.60 resistance. We expect the price to gather the required negative momentum and start recording targets at 123.15 followed by 120.90. Note that an attempt to breach the mentioned resistance will postpone the negative overview and start building correctional bullish bias to move towards 133.40 as the first positive target followed by touching the 135.50 resistance. The expected trading range for today is between 127.50 and 123.15.  |

|

#14

|

||||

|

||||

|

GBP/JPY is expected to trade with bearish bias as the key resistance at 127.35. The pair shows further downside potential after it failed to break above its key resistance at 127.35. The declining 50-period moving average is also playing a resistance role and suggests that the pair still has potential for a further drop. The relative strength index is below its neutrality level at 50 and lacks upward momentum. The British pound dropped to a low of 1.2081 to the U.S. dollar, the lowest intraday level since the "flash crash" on October 7, before paring some losses following Carney's comments. In his testimony to the House of Lords Economic Committee, Carney pointed out, "The balance of supply and demand in the exchange rate can shift, and we're not a targeter of the exchange rate, we're a targeter of inflation. But we're not indifferent to the exchange rate. As I've tried to make clear, that perception may well be mistaken, what we have to address as a committee, what we have to take into account as a committee is where sterling is and how persistent it likely is to be".

As long as 127.35 is not broken, look for further drop toward 126.55 and even 126.10 in extension. The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 126.55. A break below this target will move the pair further downwards to 126.10. The pivot point stands at 127.35. In case the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 127.70 and the second one at 127.95. Resistance levels: 127.70, 127.95, 128.15 Support levels: 126.55, 126.10, 125.25  |

|

#15

|

||||

|

||||

|

GBP/JPY is expected to trade mainly with a bullish bias. The pair has been supported by its rising 20-period moving average, and is looking for a higher top. Meanwhile, the 20-period moving average stays above the 50-period one, and the relative strength index is held up by a bullish trend line. As long as 141.50 is not broken down, further bounce is preferred with 144.50 and 145.20 as targets.

The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 144.50 and the second one at 145.20. In the alternative scenario, short positions are recommended with the first target at 140.00 if the price moves below its pivot point. A break of this target is likely to push the pair further downwards, and one may expect the second target at 139.25. The pivot point lies at 141.50.  |

|

#16

|

||||

|

||||

|

GBP/JPY is Under pressure. The pair is trading below its resistance at 144.75, which should limit the upside attempts. The downward momentum is further reinforced by its descending 50-period moving average, which maintains a downside bias. Besides, the relative strength index is below its neutrality area at 50, and lacks upward momentum. To sum up, as long as 144.75 is not surpassed, the pair is likely to drop to 143.30 and then to 142.70.

The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 143.30. A break below this target will move the pair further downwards to 142.70. The pivot point stands at 144.75. In case the price moves in the opposite direction and bounces back from the support level, it will go above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 145.15 and the second one at 145.70.  |

|

#17

|

||||

|

||||

|

GBP/JPY is expected to post some limited gains. The pair has been supported by a bullish trend line since December 20. The relative strength index has been backed by an ascending trend line since December 19 and is heading upward without any reversal signal. Therefore, as long as 144.90 is not broken below, the pair is expected to post further rebound to challenge 145.70 at first and then 146.05.

The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 145.70 and the second one at 146.05. In the alternative scenario, short positions are recommended with the first target at 144.50 if the price moves below its pivot point. A break of this target is likely to push the pair further downwards, and one may expect the second target at 144.15. The pivot point lies at 144.90. Resistance levels: 145.70, 146.05, 147.00 Support levels: 144.50, 144.15, 143.55  |

|

#18

|

||||

|

||||

|

GBP/JPY is expected to trade with bullish bias above 142.75. The pair is posting a pullback but stays above its horizontal support at 142.75. Even though a continuation of the consolidation cannot be ruled out, its extent should be limited. As long as 142.75 is not broken below, further bounce is expected with 143.90 as the next target.

The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 143.90 and the second one at 144.20. In the alternative scenario, short positions are recommended with the first target at 142.50 if the price moves below its pivot point. A break of this target is likely to push the pair further downwards, and one may expect the second target at 142.25. The pivot point lies at 142.75. Resistance levels: 143.90, 144.20, 145.15 Support levels: 142.50,142.25, 141.60  |

|

#19

|

||||

|

||||

|

GBP/JPY is expected to move further upside. The pair has continued its rebound since the low, which was hit on February 7, and is likely to continue its upleg. The 20-period moving average is currently playing a key support role, while the 50-period moving average is also rising and confirming a bullish bias. Meanwhile, the relative strength index is above its neutrality area at 50 and is positively oriented. As long as the level of 141.30 is not broken down, further bounce is preferred with 142.60 and 143.10 as targets.

The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 142.60 and the second one at 143.10. In the alternative scenario, short positions are recommended with the first target at 140.50, if the price moves below its pivot points. A break of this target is likely to push the pair further downwards, and one may expect the second target at 139.90. The pivot point is at 141.30.  |

|

#20

|

||||

|

||||

|

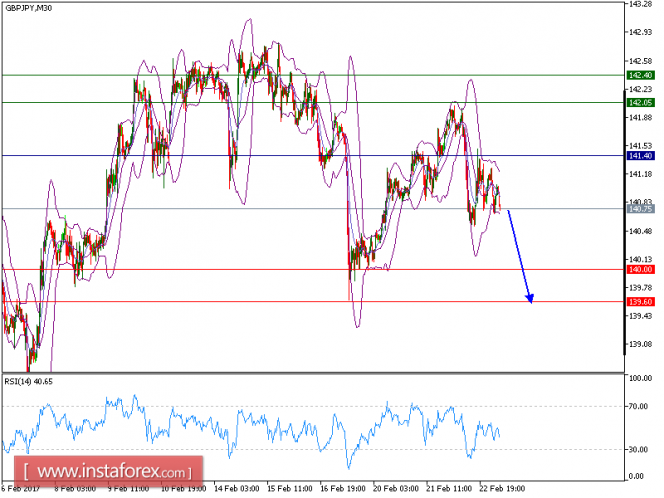

GBP/JPY is expected to trade with a bearish outlook as the key resistance is seen at 141.40. The pair is rebounding, having broken above the 20-period moving average. Nevertheless, the declining 50-period moving average is playing a resistance role. Additionally, 141.40 is playing a key resistance role, which should limit the upside potential. Even though a continuation of technical rebound cannot be ruled out, its extent should be limited.

The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 140.00. A break below this target will move the pair further downwards to 139.60. The pivot point stands at 141.40. If the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 142.05 and the second one at 142.40. Resistance levels: 142.05, 142.40, and 143.00 Support levels: 140.00,139.60, and 139.00  |

|

#21

|

||||

|

||||

|

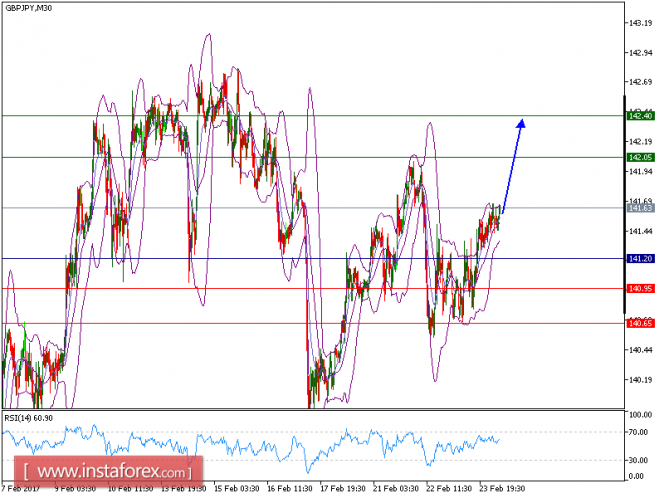

GBP/JPY is expected to move further upwards. The pair recorded a succession of higher tops and higher bottoms and is holding on the upside. The upward momentum is further reinforced by its rising 20-period and 50-period moving averages, which play support roles and maintain the upside bias. The relative strength index is above its neutrality level at 50 and calls for a further upside.

As long as 141.20 is support, look for a further advance toward 142.05 and even 142.40 in extension. The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 142.05 and the second one at 142.40. In the alternative scenario, short positions are recommended with the first target at 140.95, if the price moves below its pivot points. A break of this target is likely to push the pair further downwards, and one may expect the second target at 140.65. The pivot point is at 141.20.  |

|

#22

|

||||

|

||||

|

GBP/JPY is expected to trade with bullish bias above 138.65. The pair is rebounding on its 50-period moving average, as well as the horizontal support at 138.65. The 20-period moving average still stays above the 50-period one, and the relative strength index is around its neutrality area at 50 but lacks downward momentum. The intraday bias should remain positive.

The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 139.65 and the second one at 140.00. In the alternative scenario, short positions are recommended with the first target at 138.15, if the price moves below its pivot points. A break of this target may push the pair further downwards, and one may expect the second target at 137.00. The pivot point is at 138.65.  |

|

#23

|

||||

|

||||

|

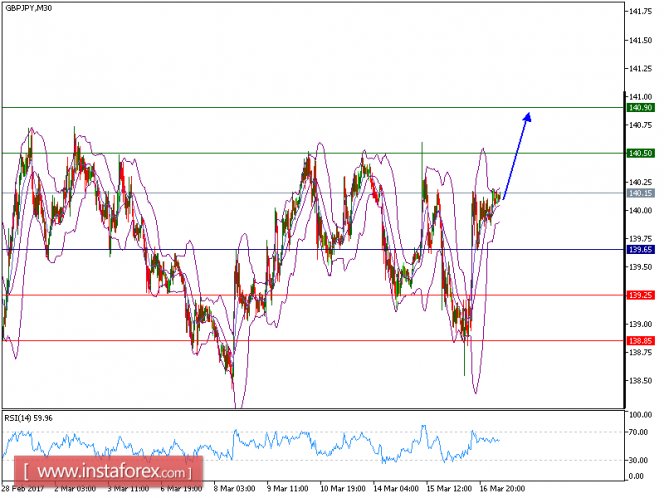

GBP/JPY is expected to continue the upside movement. The pair has broken above a negative trend line, as well as both 20-period and 50-period moving averages, and is expected to continue its technical rebound. Meanwhile the 20-period moving average has just crossed above the 50-period one, which is a bullish technical signal. And the relative strength index has been supported by a rising trend line and is above its neutrality area at 50. The intraday bias remains positive.

As long as 139.65 isn't broken, further bounce is likely with 140.50 and 140.90 as targets. The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 140.50 and the second one at 140.90. In the alternative scenario, short positions are recommended with the first target at 139.25 if the price moves below its pivot points. A break of this target may push the pair further downwards, and one may expect the second target at 138.85. The pivot point is at 139.65.  |

|

#24

|

||||

|

||||

|

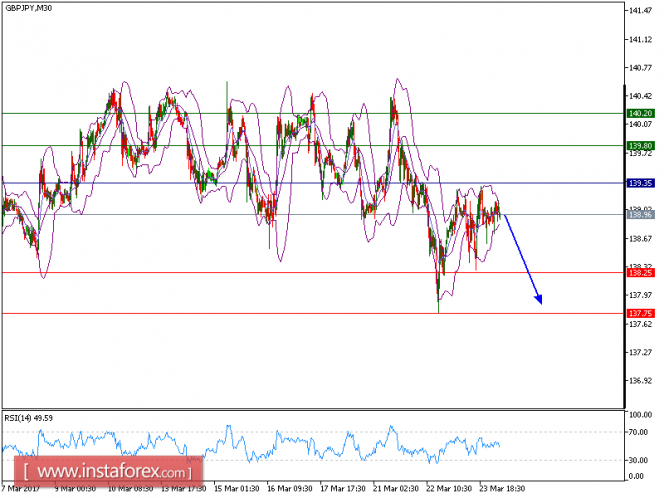

GBP/JPY is Under pressure. The pair has been capped by both descending 20-period and 50-period moving averages and remains on the downside. The technical configuration remains negative as the 20-period moving average is below the 50-period one, and the relative strength index is below its neutrality area at 50.

As long as 139.35 holds as the key resistance, expect a break below the nearest support at 138.25 at first. A break below 138.25 allows for the further drop to 137.75 as likely. The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 138.25. A break below this target will move the pair further downwards to 137.75. The pivot point stands at 139.35. If the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 139.80 and the second one at 140.20. Resistance levels: 139.80, 140.20, and 140.50 Support levels: 138.25,137.75, and 137.00  |

|

#25

|

||||

|

||||

|

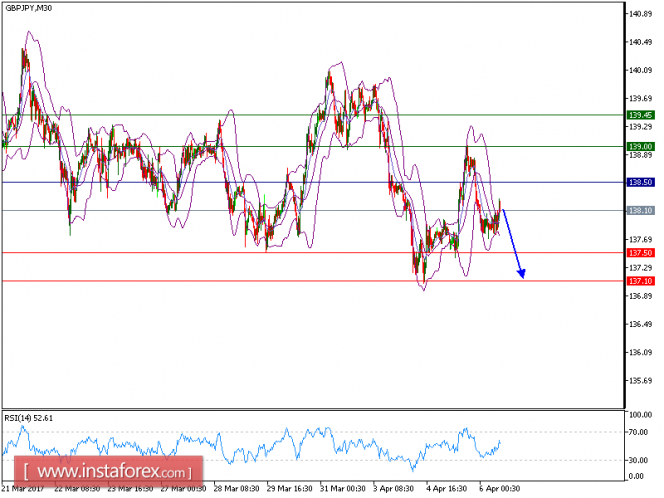

GBP/JPY is under pressure. The pair broke below its previous ascending trend line, and is likely to post new weaknesses. A bearish cross between the 20-period and 50-period moving averages has just been identified (a strong negative signal). Last but not least, the relative strength index is bearish and calls for further downside.

To sum up, as long as 138.50 is not surpassed, it is likely decline to 137.50 and 137.10 in extension. The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 137.50. A break below this target will move the pair further downwards to 137.10. The pivot point stands at 138.50. If the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 139.00 and the second one at 139.45. Resistance levels: 139.00, 139.45, and 140.15 Support levels: 137.50,137.10, and 136.70  |

|

#26

|

||||

|

||||

|

GBP/JPY is under pressure. The pair remains in consolidation and is likely to form a "bearish flag" pattern (not yet confirmed). The relative strength index lacks upward momentum. Besides, the 20-period and 50-period moving averages are mixed to bearish.

To sum up, as long as 137.15 holds on the upside, look for a new pullback to test 136.15 at first. A break below 136.15 would trigger a drop towards 135.70. The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 136.15. A break below this target will move the pair further downwards to 135.70. The pivot point stands at 137.15. If the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 137.75 and the second one at 138.15.  |

|

#27

|

||||

|

||||

|

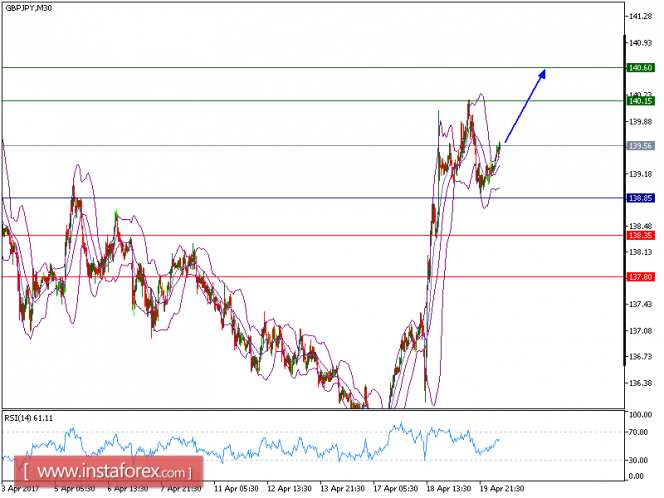

GBP/JPY is expected to trade in a higher range as the bias remains bullish. The pair is currently testing the support of its 50-period moving average, while the 20-period moving average is staying above the 50-period one. And the relative strength index is around its neutrality area at 50, showing a lack of momentum. The intraday bias remains positive.

As long as 138.85 is not broken down, a further bounce is preferred with 140.15 and 140.60 as targets. The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 140.15 and the second one at 140.60. In the alternative scenario, short positions are recommended with the first target at 138.35 if the price moves below its pivot points. A break of this target may push the pair further downwards, and one may expect the second target at 137.80. The pivot point is at 138.85.  |

|

#28

|

||||

|

||||

|

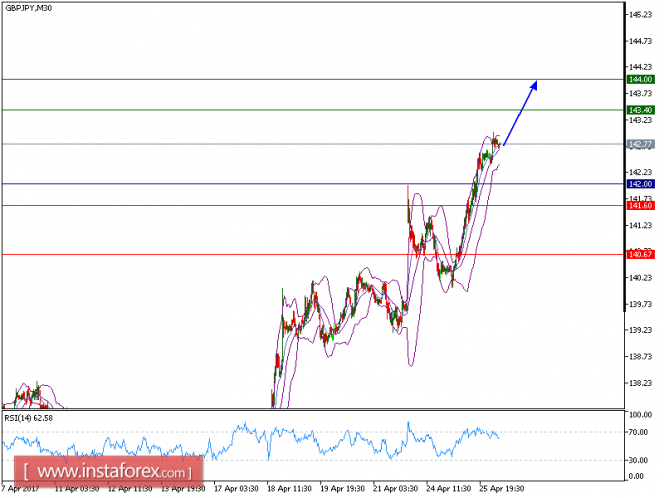

GBP/JPY is expected to prevail its upside movement. The pair remains above its horizontal support at 0.8480 and is currently testing the support of its 50-period moving average. The 20-period moving average is still above the 50-period one, which should confirm a bullish bias. In addition, the relative strength index is around its neutrality area at 50, showing a lack of momentum. Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

As long as 142.00 is not broken below, expect a break above 143.40 at first, which will allow for an upside acceleration to 144.00 as likely. The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 143.40 and the second one at 144.00. In the alternative scenario, short positions are recommended with the first target at 141.60 if the price moves below its pivot points. A break of this target may push the pair further downwards, and one may expect the second target at 140.65. The pivot point is at 142.00.  |

|

#29

|

||||

|

||||

|

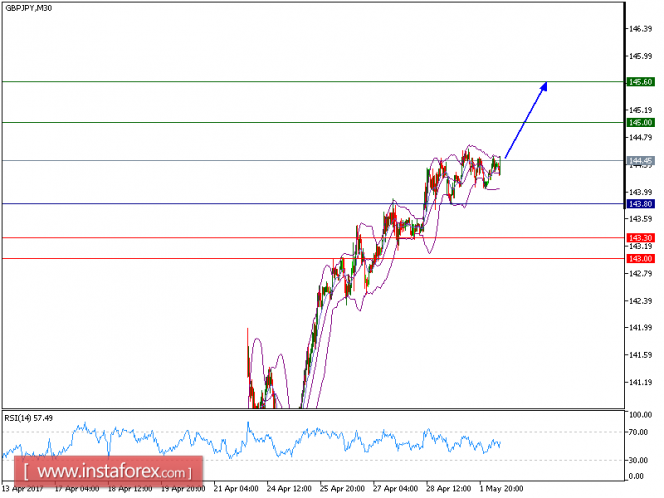

GBP/JPY is expected to continue its upwards movement. The pair has recorded higher tops and higher bottoms since April 28, which confirmed a positive outlook. The upward momentum is further reinforced by the rising 20-period and 50-period moving averages. The relative strength index is supported by the ascending trend line.

Hence, as long as 143.80 holds on the downside, expect a further rise to 145 and even to 145.60 in extension. The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 145.00 and the second one at 145.60. In the alternative scenario, short positions are recommended with the first target at 143.30 if the price moves below its pivot points. A break of this target may push the pair further downwards, and one may expect the second target at 143.00. The pivot point is at 143.80. Resistance levels: 145.00, 145.60, and 146.35 Support levels: 143.30,143.00, and 142.20  |

|

#30

|

||||

|

||||

|

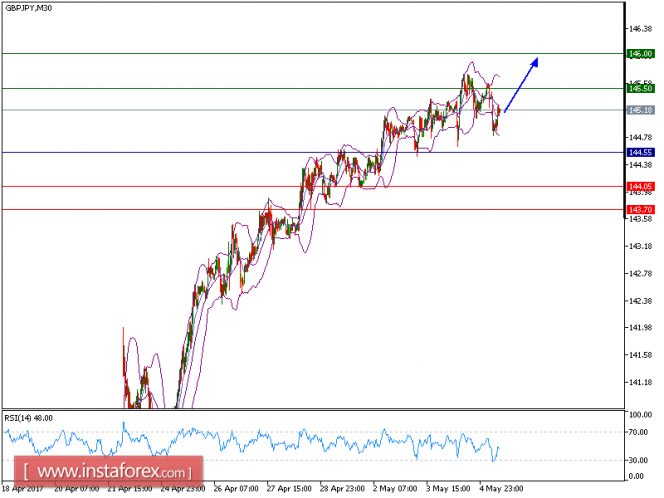

GBP/JPY is expected to advance further. The pair has broken above a triangle pattern, and is looking for a higher top. Both 20-period and 50-period moving averages are rising and should play support roles as well. In addition, the relative strength index is above its neutrality area at 50, showing upside momentum. Even though an intraday consolidation cannot be ruled out, its extent should be limited.

The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 145.50 and the second one at 146.00. In the alternative scenario, short positions are recommended with the first target at 144.05 if the price moves below its pivot points. A break of this target may push the pair further downwards, and one may expect the second target at 143.70. The pivot point is at 144.55.  |

|

#31

|

||||

|

||||

|

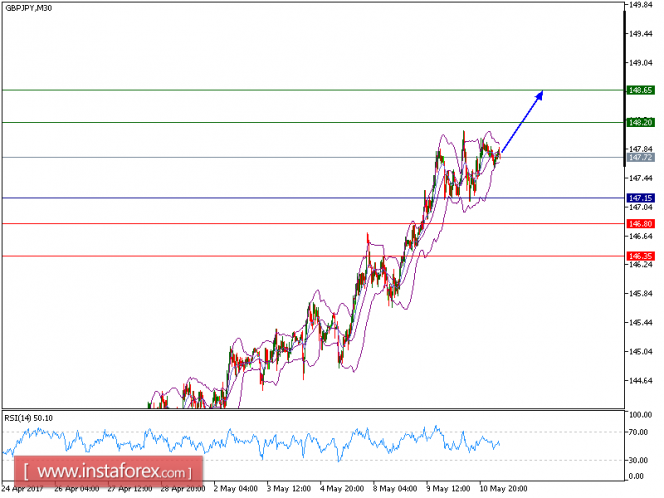

GBP/JPY is expected to continue its upside movement. The pair remains above the 20-period moving average which stays above the 50-period moving average. Besides, the relative strength index is still above its neutrality area at 50, and is positively oriented.

As long as 147.15 is not broken down, further advance is preferred with 148.20 and 148.65 as targets. The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 148.20 and the second one at 148.65. In the alternative scenario, short positions are recommended with the first target at 146.80 if the price moves below its pivot points. A break of this target may push the pair further downwards, and one may expect the second target at 146.35. The pivot point lies at 147.15.  |

|

#32

|

||||

|

||||

|

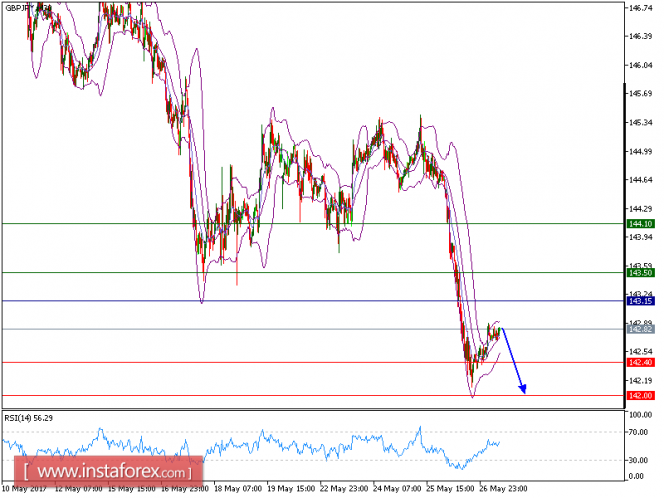

GBP/JPY is under pressure. The pair has been capped by its 20-period moving average, which remains below the 50-period moving average. The horizontal level at 147.15 should now play a key resistance role. In addition, the relative strength index is below its neutrality area at 50, and lacks upward momentum.

Therefore, as long as 147.15 holds as the key resistance, expect a break below the nearest support at 146.15 at first. A break below 146.15 allows for further drop to 145.70 as likely. The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 146.15. A break below this target will move the pair further downwards to 145.70. The pivot point stands at 147.15. If the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 147.55 and the second one at 148.  |

|

#33

|

||||

|

||||

|

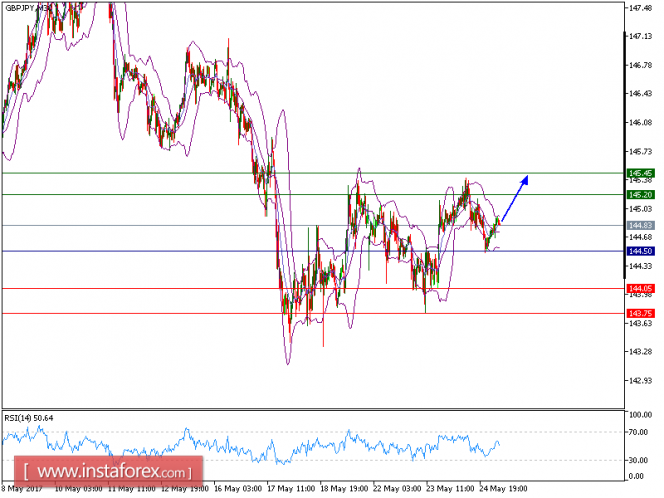

GBP/JPY is expected to trade with a bullish bias. The technical picture of the pair remains positive above a rising trend line, and is holding on the upside. The relative strength index is above a rising trend line and is above its neutrality level at 50. In addition, 144.50 is playing a key support role, which should limit the downside potential.

As long as this key level is not broken, look for a further advance towards 145.20 and even 145.45 in extension. The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 145.20 and the second one at 145.45. In the alternative scenario, the short position is recommended with the first target at 144.05 if the price moves below its pivot points. A break of this target may push the pair further downwards, and one may expect the second target at 143.75. The pivot point is at 144.50. Resistance levels: 145.20, 145.45, and 146.00 Support levels: 144.05,143.75, and 143.00  |

|

#34

|

||||

|

||||

|

GBP/JPY is under pressure. The pair is consolidating around its 20-period moving average, which remains below the descending 50-period moving average. The horizontal level at 143.15 should also play a key resistance role. In addition, the relative strength index is below its neutrality area at 50, and lacks upward momentum.

Therefore, as long as 143.15 holds as the key resistance, expect a break below the nearest support at 142.40 at first. The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 142.40. A break below this target will move the pair further downwards to 142.00. The pivot point stands at 143.15. If the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 143.50 and the second one at 144.10. Resistance levels: 143.50, 144.10, and 145.00 Support levels: 142.40,142.00, and 141.00  |

|

#35

|

||||

|

||||

|

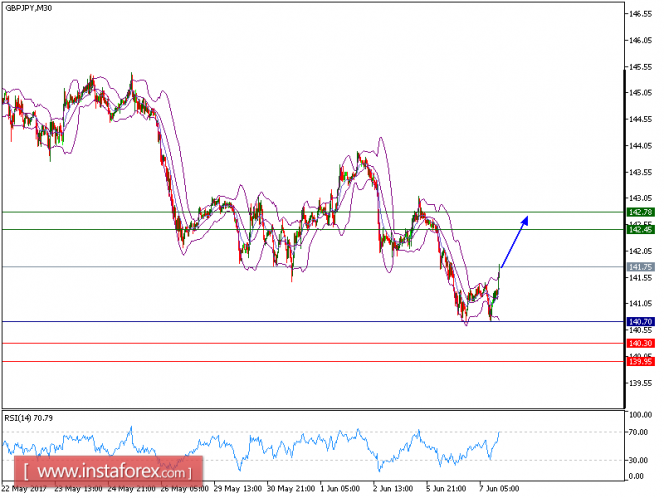

Yesterday, GBP/JPY moved lower as predicted. Today, the pair is making rebound from its support of 140.70 and expected to continue its rebound. The pair is expected to trade with a bullish bias above 140.70. The pair is trading above the rising 50-period moving average, which plays a support role and maintain the upside bias. The relative strength index is above its neutrality level at 50. The key support at 140.70 should limit the downside potential.

To conclude, as long as this key level is not broken, a rebound to 142.45 and even to 142.78 seems more likely to occur. At present, the pair is trading above its pivot point. It is likely to trade in a higher range as long as it remains above its pivot point. Therefore, long position is recommended with the first target at 142.45 and the second one at 142.78. In the alternative scenario, short position is recommended with the first target at 140.30 if the price moves below its pivot points. A break of this target is expected to push the pair further downwards, and one may expect the second target at 139.95. The pivot point lies at 140.70. Graph Explanation: The black line shows the pivot point, present price above pivot point indicates the bullish position and below pivot points indicates the short position. The red lines shows the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades. Strategy : BUY at dips, Stop Loss: 140.70, Take Profit: 142.45 Resistance levels: 142.45, 142.78, and 143.35 Support levels: 140.30,139.95, and 139.50  |

|

#36

|

||||

|

||||

|

Yesterday's GBP/JPY target has been hit as presicted. Today, the pair is expected to extend its upside movement. The pair posted a rebound and broke above the 20-period and 50-period moving averages. In addition, the bullish cross between 20-period and 50-period moving averages has been identified, which indicates a positive signal. The relative strength index is above its neutrality level at 50. Hence, as long as 141.70 is not broken, expect a further upside to 143.10 and even to 143.460 in extension.

Hence, as long as 141.70 is not broken, expect a further upside to 143.10 and even to 143.460 in extension. At present, the pair is trading above its pivot point. It is likely to trade in a higher range as long as it remains above its pivot point. Therefore, long position is recommended with the first target at 143.10 and the second one at 143.60. In the alternative scenario, short position is recommended with the first target at 141.40 if the price moves below its pivot points. A break of this target is expected to push the pair further downwards, and one may expect the second target at 140.70. The pivot point lies at 141.70. Graph Explanation: The black line shows the pivot point, present price above pivot point indicates the bullish position and below pivot points indicates the short position. The red lines shows the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades. Strategy : BUY at dips, Stop Loss: 141.70, Take Profit: 143.10 Resistance levels: 143.10, 143.60, and 143.95 Support levels: 141.40,140.70, and 140  |

|

#37

|

||||

|

||||

|

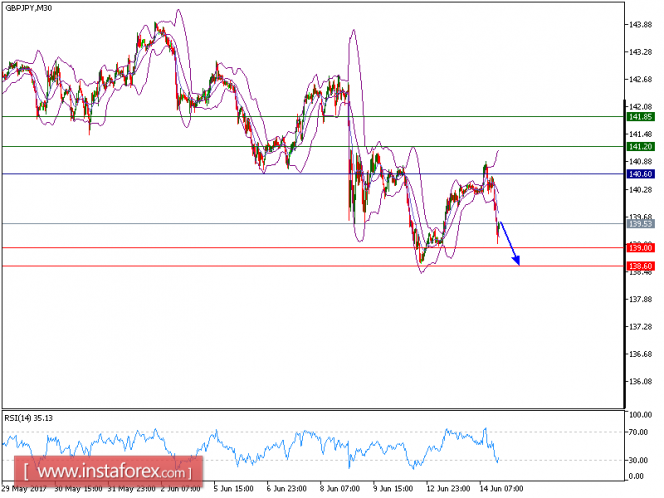

The yesterday take profit target for GBP/JPY has been hit. After hitting the mark of 140.80 (today's high), which was also our target moved downward, the pair went downwards. Therefore, the level played a resistance role. The pair is now expected to trade in a lower range below 140.60. The pair has clearly reversed downwards after its failure to break above the resistance at 140.80. The 20-period and 50-period moving averages are turning down and should continue to push the prices lower. Besides, the relative strength index is negative below its neutrality area at 50.

Chart Explanation: The black line shows the pivot point, present price above pivot point indicates the bullish position and below pivot points indicates the short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades. Strategy : SELL, Stop Loss: 140.60, Take Profit: 139 Resistance levels: 141.20, 141.85, and 142.15 Support levels: 139.00,138.60, and 138  |

|

#38

|

||||

|

||||

|

Overview

The GBP/JPY pair held higher above the support at 138.75. However, the ongoing formation of a barrier by the moving average 55 at 141.70 might support sideways fluctuations in the near-term period. Therefore, we recommend monitoring the price behavior and wait for surpassing one of the mentioned levels to detect the true targets in the upcoming period without suffering any sudden losses. Note that continuation of the negative pressure and an attempt to break the current support will confirm regaining the bearish bias with targets at 137.70 and then 135.05 levels. A breach of the moving average 55 will open the way for resuming the bullish trend with upward targets at 143.35 and 145.50 levels. The expected trading range for today is between 138.75 and 141.70.  |

|

#39

|

||||

|

||||

|

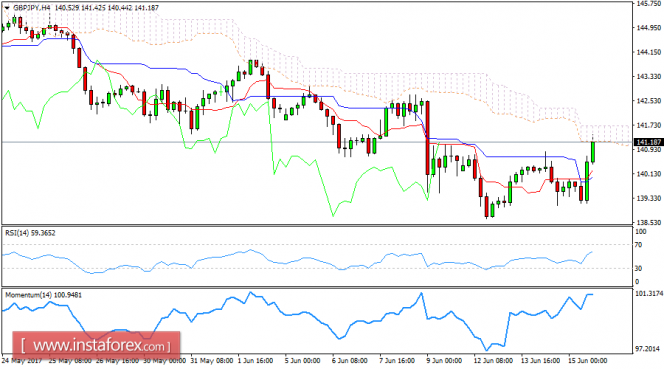

Our take profit target for GBP/JPY has been hit as predicted. The technical picture of the pair is positive as the prices are supported by the bullish trend line since June 15. The upward momentum is further reinforced by the rising 20-period and 50-period moving averages. The relative strength index shows upside momentum.

Hence, as long as 141.60 is support, expect a new advance to 142.75 and even to 143.35 in extension. Alternatively, if the price moves in the opposite direction as predicted, a short position is recommended below 141.60 with targets at 141.00 and 140.55. Chart Explanation: the black line shows the pivot point. The price above pivot point indicates the bullish position and when it is below pivot points, it indicates the short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.  |

|

#40

|

||||

|

||||

|

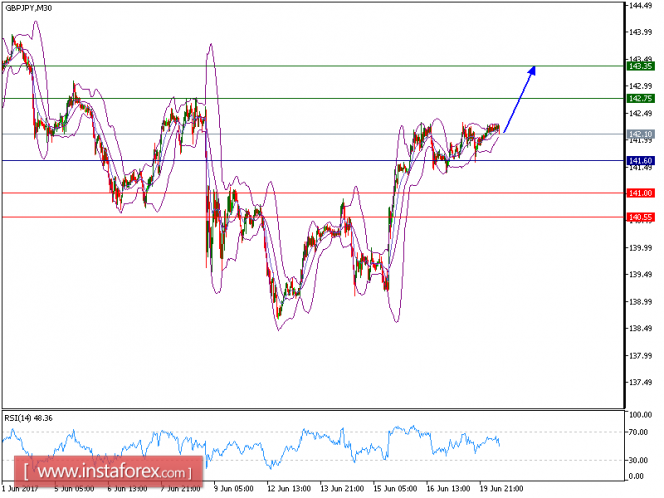

GBP/JPY is expected to trade with a bearish outlook. Despite the pair's bounce, it is still trading below the key resistance at 141.20, which should limit the upside potential. The relative strength index lacks upward momentum. Even though a continuation of technical rebound cannot be ruled out, its extent should be limited.

To conclude, below 141.20, look for a return to 140.30 and even to 139.80 in extension. Alternatively, if the price moves in the opposite direction as predicted, a long position is recommended above 141.20 with targets at 141.75 and 142.30. Chart Explanation: the black line shows the pivot point. The price above pivot point indicates the bullish position and when it is below pivot points, it indicates the short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades. Strategy: SELL, Stop Loss: 141.20, Take Profit: 140.30 and 139.80 Resistance levels: 141.75, 142.30, and 143.00 Support levels: 140.30,139.80, and 140.35  |

|

|

|

Similar Threads

Similar Threads

|

||||

| Thread | Thread Starter | Forum | Replies | Last Post |

| Daily technical analysis of GOLD By INSTAFOREX | InstaForex | Forex Analysis | 262 | 23-01-2018 14:15 |

| Daily technical analysis of EUR/NZD By INSTAFOREX | InstaForex | Forex Analysis | 319 | 19-01-2018 10:37 |

| Daily technical analysis of EUR/JPY By INSTAFOREX | InstaForex | Forex Analysis | 358 | 19-01-2018 10:34 |

| Daily technical analysis of USD/CAD By INSTAFOREX | InstaForex | Forex Analysis | 236 | 09-11-2017 22:58 |

| Daily Technical Analysis | dailyfxanalysis | Forex Analysis | 10 | 15-05-2013 10:27 |