USD/CAD: in the last days of the month

11/28/2019

Today is a day off in the USA (Thanksgiving). US financial markets and banks will be closed, and on Friday, trading will end earlier. In this regard, trading volumes during the US trading session will be low.

Meanwhile, the US dollar remains positive. After the publication of a number of positive macro data from the United States on Wednesday, the DXY dollar index reached a local 6-week high near 98.37, while maintaining multi-month positive dynamics.

According to official data released on Wednesday, US GDP growth in the 3rd quarter was 2.1% (the initial estimate assumed US GDP growth in the 3rd quarter by 1.9%), mainly due to strong indicators of consumer spending. Rising wages, historically low unemployment and low interest rates in October supported consumer spending, which is about 2/3 of US GDP.

Speaking on Monday, Fed Chairman Jerome Powell said that "this growth period has been going on for 11 years and is the longest in US history, so overall economic conditions can be called favorable".

The US economy in the current conditions looks more stable compared to other major economies in the world, which will help maintain the demand for US assets and the dollar.

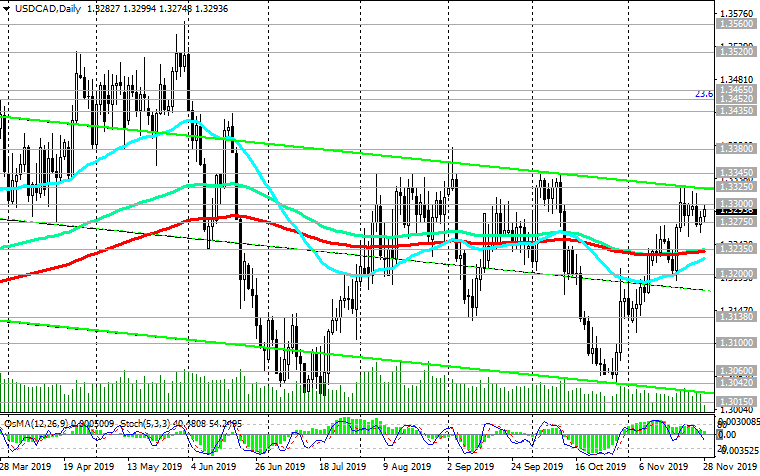

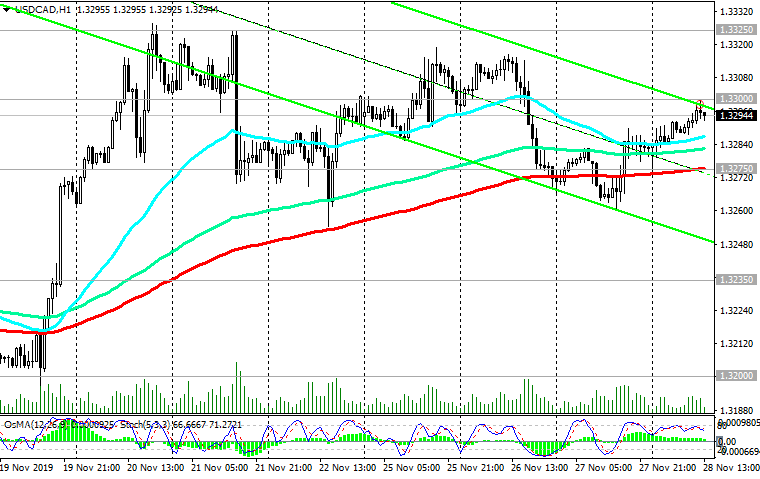

Meanwhile, USD / CAD has been growing since the opening of today's trading day. At the beginning of the European session, USD / CAD is trading above the short-term support level 1.3275 (EMA200 on the 1-hour chart) and the important support level 1.3235 (EMA200 on the daily chart), which speaks in favor of purchases of this currency pair.

Therefore, you should look for the opportunity to enter long positions, for example, when roll back (lower) to the support level of 1.3275. Above this level of support, long positions are preferred.

A breakdown of this level of support will be a signal for sales. In this case, the reduction targets will be the support levels 1.3200, 1.3138 (September lows), 1.3100, 1.3060, 1.3042.

Despite the optimism of Bank of Canada managers, many economists believe that the central bank should consider lowering interest rates to prevent the negative economic effects of ongoing trade conflicts.

The next meeting of the Bank of Canada will be held on December 4. If at this meeting, the Bank of Canada will signal its intention to lower the rate in the coming months, then the Canadian dollar may come under pressure, which may intensify amid falling oil prices.

Support Levels: 1.3275, 1.3235, 1.3200, 1.3138, 1.3100, 1.3060, 1.3042, 1.3015

Resistance Levels: 1.3300, 1.3325, 1.3345, 1.3380, 1.3400, 1.3452

Trading recommendations

Sell Stop 1.3250. Stop-Loss 1.3310. Take-Profit 1.3235, 1.3200, 1.3138, 1.3100, 1.3060, 1.3042, 1.3015

Buy Stop 1.3310. Stop-Loss 1.3250. Take-Profit 1.3325, 1.3345, 1.3380, 1.3400, 1.3452

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com